Bitcoin vs Ethereum. As Shakespeare’s classic would say: ‘that is the question’. And, indeed, that is the question facing cryptocurrency investors who, considering the volatility that characterizes this market, have to decide which assets, given their track records, provide you with more guarantees.

But, after this initial confidence, doubts arise as to which cryptocurrency to opt for. To help you make this informed decision, we are going to take a closer look at the situation of two of the most important cryptocurrencies. Let’s get started.

Differences between Bitcoin vs Ethereum

First of all, before going into what sets these cryptocurrencies apart, it is worth noting that they are also linked by conditions that, within the framework of the crypto market, make them unique. Both fall into the category of the oldest cryptocurrencies.

Because of their track record, they tend to be less exposed to the fluctuations of newer cryptos. In this sense, we can consider that both of them, in a volatile market, can be characterized as representing moderately safe values.

As for the main feature of BTC, we have to note that it is the cryptocurrency that inaugurated the blockchain technology system. It was the first to implement a platform of decentralized, interconnected computers that make it possible to track the history of the assets on the market without being controlled by any central bank.

For its part, ETH, in addition to sharing the modus operandi created with blockchain, has other functionalities that are not part of the possibilities of BTC. We mean that ETH is not only used for monetary purposes. It can also be used for applications such as Smart Contracts and Decentralized Applications (Dapps).

Pros and cons of buying BTC

The first thing to keep in mind is that BTC is already an international currency, which provides security against crashes and counterfeiting and even attracts institutional investors. But there are more advantages, such as the agility of your transactions and the possibility of checking their real value at any time.

However, there are some disadvantages that you should also consider. For example, beware of the criminal uses of this cryptocurrency. Likewise, you cannot afford to expose your digital wallet to being hacked, which could cost you thousands of euros. To prevent this, I recommend that you use a cold wallet. Finally, don’t forget that, to use them effectively, you need an exchange that is as reliable as possible.

Pros and cons of buying ETH

For its part, the relative benefits of acquiring ETH are linked to the fact that it is already much more than a cryptocurrency. Therefore, apart from its use in the DeFi and NFT domains, it has become popular in virtual reality smart contracts. In addition, its system has proven to be more agile than that of BTC. We should also point out that the there is a genuinely high level community of developers working for ETH, which has even attracted institutional investors.

However, you should not invest in this cryptocurrency without first evaluating some of the disadvantages. Among them, we note that it is more volatile than BTC, which means you have to accept higher risk. Even so, it continues to be one of the most popular and secure cryptocurrencies today, since its market capitalization makes it one of the most outstanding today, and it has a longer history than most.

Bitcoin vs Ethereum: Which is the safer long-term option?

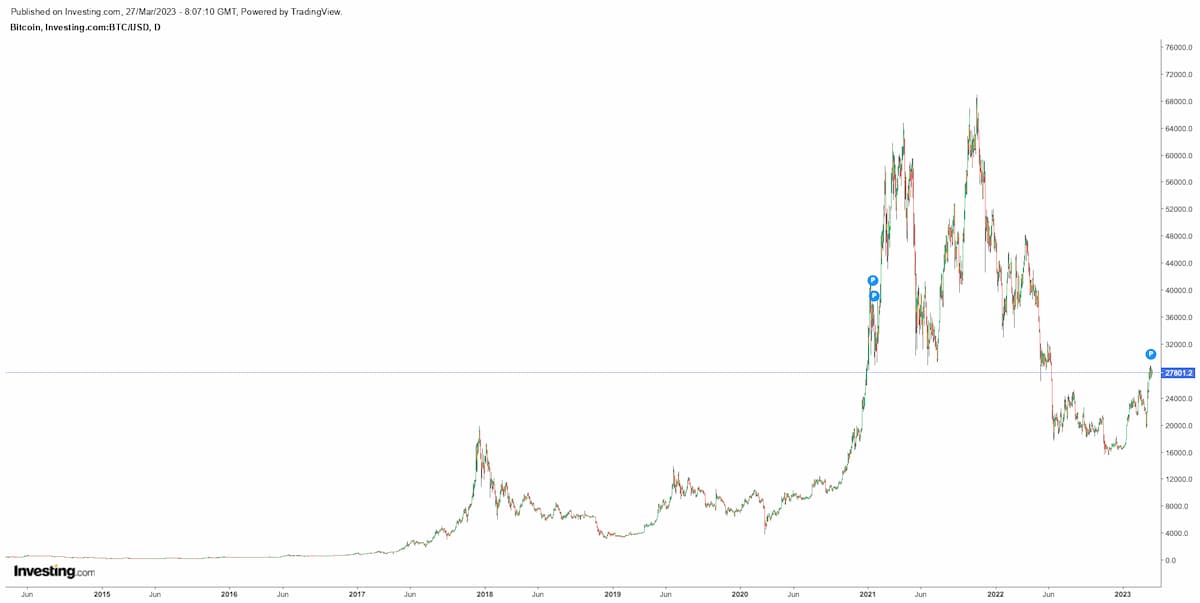

In view of the so-called cryptowinter that cryptocurrencies went through in 2022, most analysts agree that the normal thing to happen throughout 2023 is that both BTC and ETH will continue to fall a little further (to $14,000 in the case of the former), until they stabilize and rise again.

We must say, in the context of this scenario, that the starting price of BTC is around $17,000. With this in mind, there are some reasons to believe that ETH may behave as the safer option in the long run. Let’s analyze them.

The merger of ETH and its change of protocol suggested that it might rise in 2022, which did not happen in the end. However, these modifications have prepared this cryptocurrency to come out of the cryptowinter in better conditions than BTC.

Let’s keep in mind that it plummeted during 2022 and its price fell as low as $1266.35. Its greater security in comparison with BTC is based not only on the fact that it continues to create applications and added value, such as smart contracts, but also on the fact that, proportionally, it withstood the aforementioned crisis better.

Although BTC charts look more flattering than ETH charts, you should not set aside the expectations of fundamental trading analysis. Of course, if you are really going to invest in Ethereum, don’t forget to store them in a secure wallet for Ethereum.

Roughly how much should you invest?

The decision about the amount to invest in cryptocurrencies, such as BTC and Ethereum depends on factors such as your risk profile (conservative or more risky), knowledge of the industry, age and budget. If you are a beginner, we recommend that you first get your accounts in order before devoting a residual portion of your funds to these investments.

Once the significance of these variables has been made explicit, it is time to give a figure. And, in this sense, a sizeable number of financial analysts are in favor of allocating between 3% and 10% of your portfolio set aside for diversified risk investments to investing in the less volatile cryptocurrencies, which are the ones we are presenting here. We are going to explain it with a numerical example, which is the best way to understand these things. If you have 60% of your investments in assets considered volatile, consider that a maximum of 6% can be invested in the cryptocurrencies mentioned above.

Choosing between Bitcoin and Ethereum

When choosing between Bitcoin or Ethereum, you should note that the first of these cryptocurrencies has proven to be more attractive for long-term investments, i.e. to buy currencies and hold them, until you decide to sell them. ETH, on the other hand, is more sensitive to price swings which, for example, may result in its higher flexibility and faster transaction processing.

Broadly speaking, there is an idea that you can take into consideration when it comes to deciding on one cryptocurrency or another. When the bull market is strong, ETH performs better than BTC. On the other hand, when the market trend is reversed, it is the BTC price that will make a smaller drop.

If you still have doubts when faced with the question “should I buy in bitcoin now?” I highly recommend this post.

My personal advice

The key is that, on the one hand, you carefully follow the cryptocurrency and dollar rates to decide when to enter or exit the market. On the other hand, it is to combine, as far as possible, technical and fundamental analysis. And, as a last piece of advice, we recommend that you secure your investments by betting on Material Bitcoin cold wallet and Material Ethereum wallet the most secure cold wallets today for storing Bitcoin and Ethereum.

In short, Bitcoin or Ethereum is a distinction that, in a way, seeks to inject security into the volatile world of cryptocurrencies. Information is the key to making your investments profitable.

Which one would you invest in? Share it in comments 👇

0 Comments