The crypto market has had crazy growth over the past decade.

However, when governments change and other global issues arise, volatility hits, and prices can swing quickly.

Recent events have only amplified these concerns and impacted crypto’s volatility.

From increased regulatory pressures and fluctuations in market prices to major institutional investments, it’s normal to ask yourself, “Is crypto a bubble?”

Why Trust Material Bitcoin?

We don’t just sell wallets; we educate, protect, and guide.

- ✅ Expertise: Our team is made up of crypto security specialists and blockchain enthusiasts who have a passion for crypto.

- ✅ Authority: Trusted by thousands of long-term investors worldwide.

- ✅ Trust: Built from high-grade stainless steel, our wallets are fully offline, non-electronic, and immune to cyber threats.

- ✅ Transparency: We provide honest comparisons, product reviews, and resources to help you secure your crypto assets safely.

What Is a Financial Bubble? And Why Crypto Might Be Different

To fully understand the consequences of a crypto bubble, you first need to know what a financial bubble is.

A financial bubble happens when the price of an asset is much higher than its actual value.

This can happen from hype, speculation, and fear of missing out (FOMO).

Eventually, the bubble “bursts” when investors realize that the asset is overvalued.

Prices start to crash, and this usually triggers panic selling.

📉 Major Bubbles from the Past

📌 1: The Dot-Com Bubble (1995–2001)

In the late 90s, many investors poured money into Internet startups with little to no revenue. The assumption was that every company with “.com” in its name would become the next big thing. By 2000, the bubble burst. Stocks collapsed and wiped out trillions of dollars in market value.

📌2: The U.S. Housing Bubble (2006–2008)

Leading up to the 2008 financial crisis, housing prices were at all-time highs as banks offered risky loans to buyers. When the reality of unaffordable mortgages hit, the bubble burst. Unfortunately, this led to foreclosures and a financial crisis felt all over the U.S., Canada, and Europe.

Why Crypto Might Be Different

In many ways, crypto is following “classic bubble behavior.”

1️⃣ Quick price gains

2️⃣ Media hype

3️⃣ Investor speculation

But what makes crypto different from other asset classes is that it’s tied to a blockchain.

Let’s look at Ethereum; it enables DeFi, allowing people to lend, earn, and borrow without a traditional banking system.

Alternatively, Bitcoin has long been called “digital gold” and is being adopted by major institutions and governments.

What this does is give crypto a strong backing that other “bubbles” don’t have.

You also need to consider that crypto markets have a 24/7 globalized market, with liquidity available from millions of personal and institutional investors worldwide.

These unique market dynamics don’t follow the rules of traditional financial bubbles.

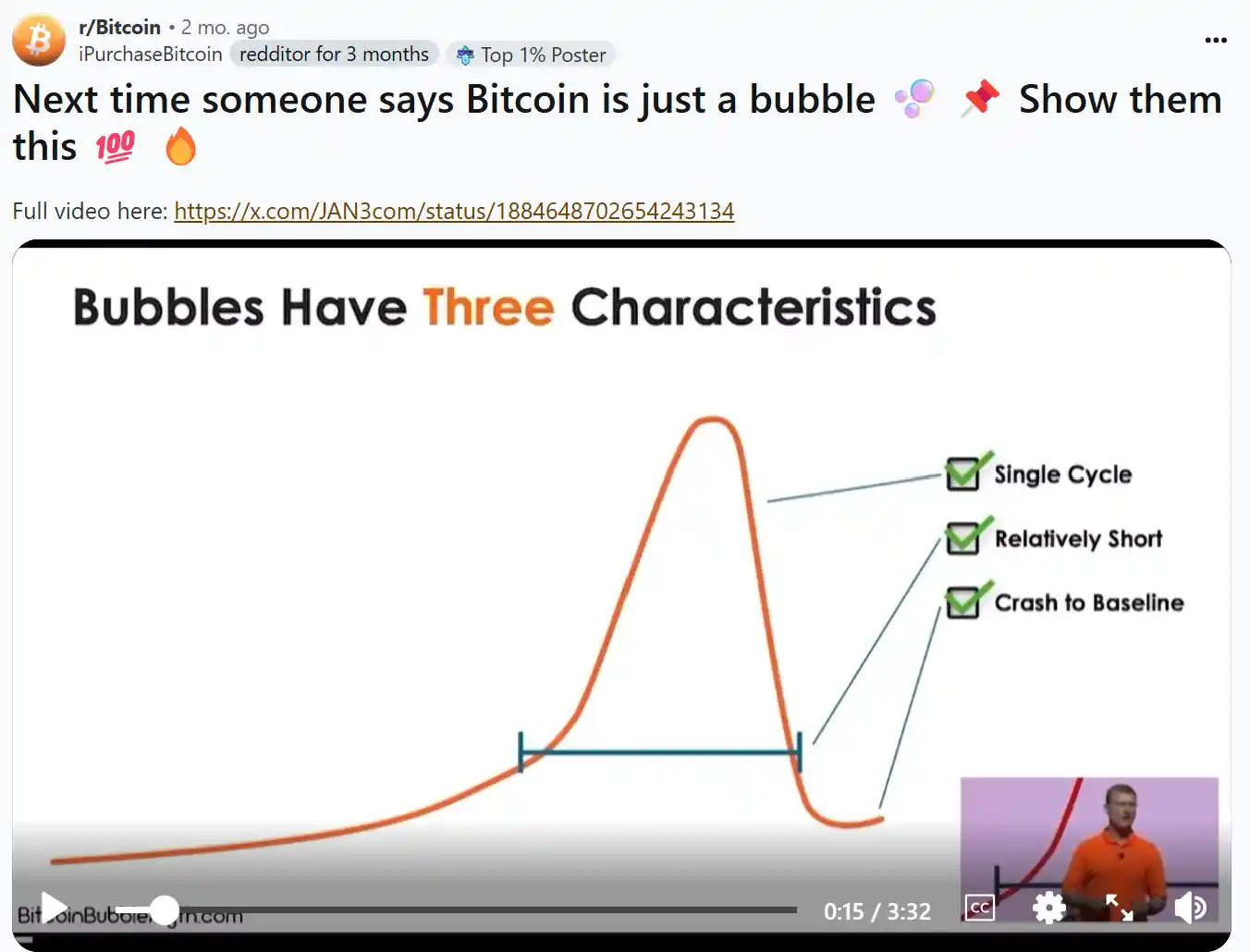

📢 Community Insight on Bitcoin

The next time someone says Bitcoin is a bubble, have them look at this 👇

The 5 Warning Signs That Suggest Crypto Could Be in a Bubble in 2025

Although we have pointed out the argument as to why crypto can’t be in a bubble, some analysts continue to raise 🚩red flags.

Here are five warning signs to look out for:

1️⃣ Rapid Price Increases Without Strong Fundamentals

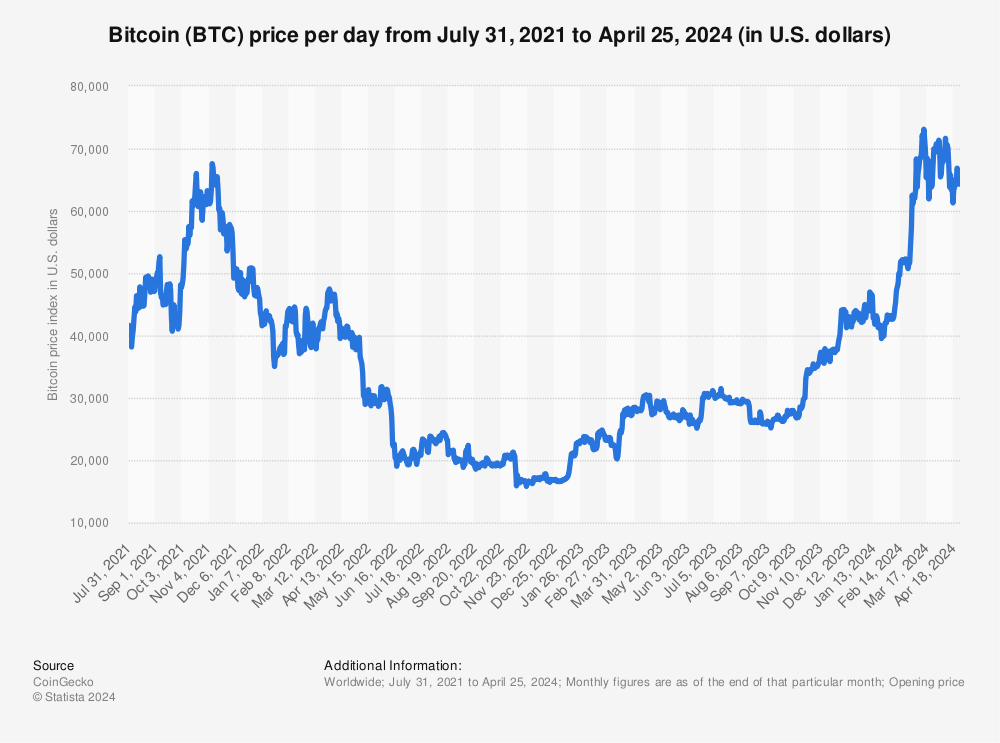

Bitcoin surged from around $24,000 in 2022 to over $80,000 by April 2025 (with plenty of highs and lows in between).

Find more statistics at Statista

Some of this growth is driven by demand and adoption, but other crypto coins and tokens that have little utility also had similar spikes but without the revenue, adoption, or tech backing it.

These are classic bubble indicators.

2️⃣ Massive Speculative Investments

Many retail investors are dumping money into crypto, hoping for quick profits.

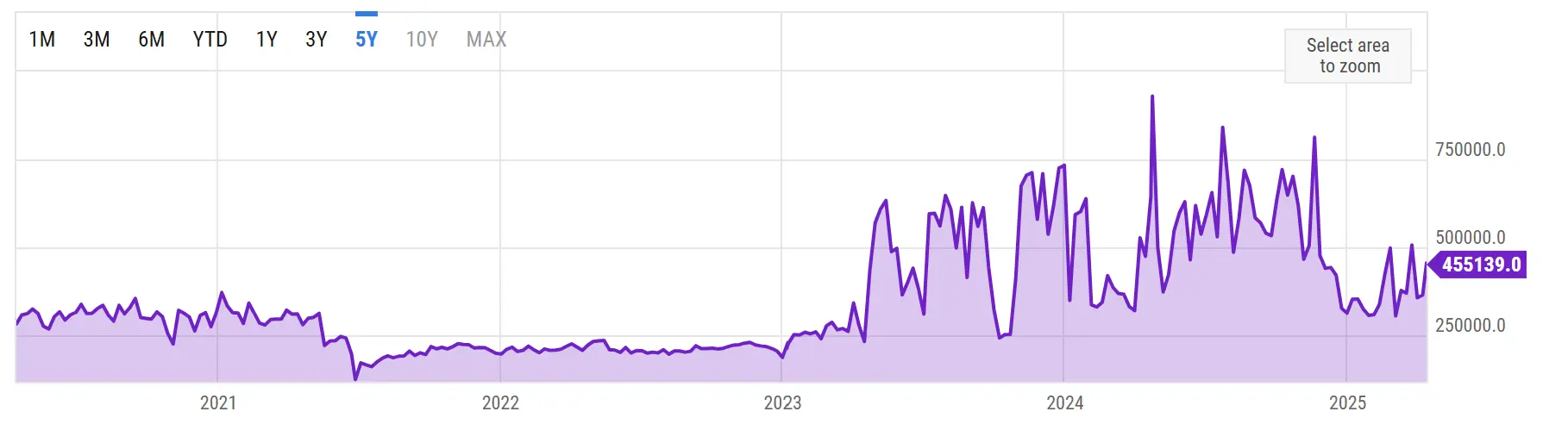

As of today, Bitcoin currently processes about 455,139 transactions per day.

This trend mirrors past bubbles, like the dot-com era, when people invested in internet stocks they didn’t fully understand.

This number shows how active the Bitcoin network is. Meaning that higher transactions show higher interest.

3️⃣ Celebrity Endorsements and Social Media

Crypto is everywhere.

From TikTok influencers promoting altcoins to major celebrities backing NFT or DeFi projects.

This hype can attract inexperienced investors and push prices higher, regardless of a project’s actual value.

Do we all remember how fast Dogecoin blew up after Elon Musk’s tweets?

4️⃣ Market Volatility

Bitcoin’s price jumped by 10% in one day multiple times this year…and went down just as fast.

Ethereum also fell 25% in a week in March 2025 after rumors of stronger regulations in Asia.

These wild swings make the market unstable and unpredictable.

Another sign that prices may be inflated beyond reason.

5️⃣ Prices and Real-World Usage

Some cryptocurrencies are valued in the billions, but their platforms have very few active users or real-world applications.

If tokens have little to no active daily users, this mimics past financial bubbles where prices were set high but without real usage.

Arguments Against the Bubble Theory: Why Crypto Might Be Here to Stay

Although some warn that crypto is a bubble in 2025, several key points suggest it may be evolving into a longer-lasting part of the global financial system.

| Key Argument | Details |

|---|---|

| Institutional Adoption | 83% of institutional investors plan to increase crypto exposure in 2025. Major banks like Goldman Sachs support blockchain systems. |

| Real-World Use Cases | Ethereum powers DeFi, games, and Visa’s cross-border payments. There’s even a UK school that accepts Bitcoin for tuition. |

| Regulatory Clarity | Ripple’s acquisition means improved U.S. regulation, making institutions more confident in crypto. |

| Stablecoins & CBDCs | The U.S. and the UK are advancing CBDCs and stablecoins, connecting traditional and crypto finance. |

| Tokenization of Assets | $50 billion in real-world assets have been tokenized, with an estimated $500 billion by the end of 2025, boosting liquidity. |

What Experts Are Saying About Crypto… And Do They Agree?

The crypto market is for anyone and everyone.

With that comes a lot of opinions of optimism and caution.

🐂Bullish Predictions

Anthony Scaramucci, an American financier and broadcaster who once was the White House Director of Communications, believes that Bitcoin could hit $200,000 in 2025.

He thinks this could happen due to rising institutional investment and a possible U.S. Bitcoin reserve.

Geoff Kendrick, the head of EM FX Research, West and Crypto Research, at Standard Chartered Bank, also thinks that Bitcoin will hit $200,000 by the end of 2025 and continue on a bull run.

🐻 Bearish Views

A bear market is defined by experiencing a 20% drop after reaching all-time highs.

In January 2025, the Fear and Greed Index, used to measure market emotions, dropped from 53 to 20 by February.

Reddit forums and experts on social media advised about the dropping numbers, causing panic sells.

However, an interesting point to be made is how many long-term holders took this as an opportunity to buy the dip and continue investing.

Learn More About Crypto Investing

Explore our top guides to get ahead in the world of crypto.

The Role of Blockchain Adoption and Global Regulation

Blockchain technology is being integrated into various sectors, and regulations are changing to adapt to this.

Major banks like JPMorgan and Citibank are using the blockchain for settlements and digital asset management.

Governments are even using the technology to organize and systematize their internal departments.

But, along with adoption and use, come rules and regulations…

The United States is becoming more crypto-friendly.

As President Trump is investing in a crypto reserve, the Department of Justice is also applying a crypto enforcement team, while the EU has the Crypto-Assets Regulation (MiCA).

Not to mention the global tax regulation that the Organisation for Economic Co-operation and Development (OECD) requires crypto service providers to report user info to tax authorities.

What Could Trigger a Crypto Crash in 2025?

With all the possible outcomes for the year, there are a few events that could affect the crypto market.

⚖️🚫 Tougher Regulations

- Sudden bans or restrictions by major governments.

🔓💻 Security Breaches

- A major hack on an exchange or wallet provider could trigger panic selling.

🌍📉 Global Recession

- Economic instability might lead investors to pull out of risky assets like crypto.

🕵️♂️💣 Big Scandals

- A high-profile fraud or collapse.

What Happens If the Crypto Bubble Bursts?

If the crypto bubble bursts, the first impact would be a large price drop and panic selling.

Many retail investors would lose, especially those who bought at peak prices.

But remember that these drops also lead to market consolidation.

This means the weaker projects don’t survive and disappear, but the stronger ones survive and usually come back stronger.

The key lesson?

If you survive a crypto bubble, you will come back smarter and stronger if you know how to manage your assets properly.

How to Protect Yourself

🔄 Diversify your portfolio

- Don’t put all your money into one coin. Spread your investment across different crypto assets and sectors to reduce the risk.

- But don’t buy into memecoins or tokens that you don’t understand. Beginners should stick to more reliable assets like Bitcoin and other altcoins at the beginning.

📊 Review your portfolio regularly

- Check your holdings and rebalance if needed.

- Take advantage of buying the dip and also utilize the DCA strategy for overall purchasing.

🔐 Store your crypto safely with cold storage

- Never leave large amounts of crypto on exchanges.

- Use a secure cold wallet like Material Bitcoin to protect your crypto from hacks and online threats.

Is Crypto a Bubble or Just Misunderstood?

Crypto in 2025 seems to be on the rise.

While prices might fluctuate, the growing adoption, regulations, and use suggest that it is more than just a bubble.

Although we don’t have a magic mirror to predict the future, the best way to manage your crypto is to stay informed, invest smartly, and secure your crypto in a reliable hardware wallet.

0 Comments