Ever since Bitcoin hit the market in 2009, crypto has been shaking up the financial world, which has led to the development of new coins and digital currencies. USDT, also known as Tether was introduced in 2014 as a stablecoin. This means that it is “stable” as a currency within the market since it is pegged to the American Dollar.

1 USDT = 1 US dollar.

This is what makes USDT so interesting, especially for new and unfamiliar investors who want to get into the world of crypto but are sacred: it’s seen as a “safer” way of investing in digital currency without the volatility of traditional cryptocurrencies such as Bitcoin.

In this post, we are going to delve into the world of Tether, getting into its development, how to use it, why traders love it and most importantly, how and where is the best place to store it.

What is USDT?

Since its inception in 2014, USDT has grown to be one of the most widely used stablecoins. Also known as Tether, it’s referred to as a stablecoin since it aims to maintain the same value as the US dollar. This is a key point to understand when you get into the world of trading because it gives you a 3-point advantage:

- You can use it to buy other cryptocurrencies without the need for a credit card or other centralized banking.

- If you are playing the crypto market and have made some gains and don’t want to lose out on it due to volatility, converting to USDT protects your earnings instantly.

- If you are looking to play the long game in investing, buying and storing your Tether as a long-term investment gives you peace of mind without the constant turbulence of other crypto. You might not gain as much as quickly, but it’s an investment strategy played by some.

History of Tether

Before we get into more details about USDT trading and investing, let’s go over how Tether came into conception.

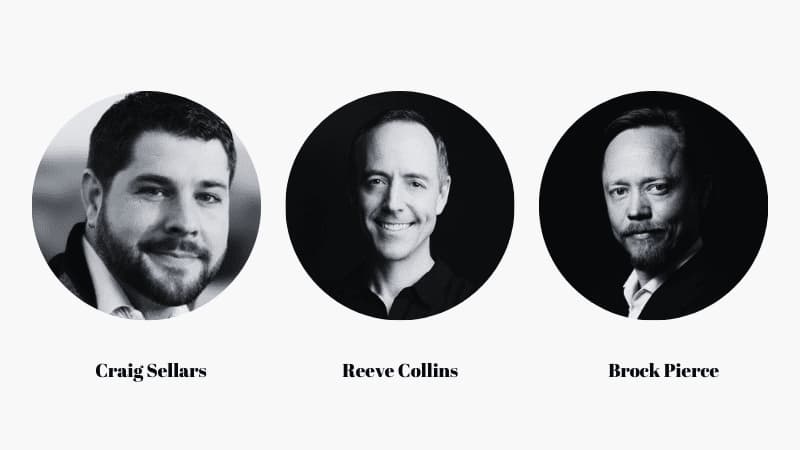

Founded by three partners, Reeve Collins, Craig Sellars, and Brock Pierce, Tether was created to work off of the BTC blockchain. But, as it grew and was later purchased by a company in Hong Kong, questions about its lack of KYC verification came up, and eventually, they separated ties from their banking partners.

This initially caused a problem for Tether, because it meant that the exchange of crypto to fiat currency (and visa versa) was no longer possible. Eventually, Tether found new banking partners in the Bahamas and Puerto Rico and started using other blockchains to get to where it is today.

How Do Traders Use USDT?

It is important to understand that in the world of investing, there are many different directions you can take. Some have the strategy to long-term invest, while others make their money by trading crypto and other assets daily. Traders often use USDT as a “buffer” against the sometimes crazy fluctuations of crypto. The stability of it appeals to traders who are looking to manage risks more effectively.

But, how does USDT help to manage risk?

Well, going back to the 3 points we mentioned above, traders can switch their investments to USDT quickly if the crypto market starts to fall. For example, a trader might have $25k worth of ETH that begins to plummet. This trader can pull out their phone, sign in to their exchange of choice, and instantly trade their Ether for USDT before it falls even further. Since USDT reflects USD, the plummeting price of crypto does not affect it. This method is the digital version of liquidity.

It also helps that trading pairs between certain crypto and stablecoins have been established. Exchanges between USDT/BTC, USDT/ETH, and USDT/LTC are common and most exchanges offer really low rates for trades between them. This saves not only time but also money since traders don’t need to lose out on conversion fees of cashing out BTC for fiat currency.

The Different Uses of USDT

Whether you are a seasoned crypto investor, someone who has been interested in a while but too scared to commit, or you are a traditional stock market holder who wants to expand into the digital world, USDT, and other stablecoins might be your best bet.

Here are the different ways that you can utilize USDT:

1. Stability: In terms of maintaining its value, the shifts are not as extreme as other cryptocurrencies. This results in investor confidence, protecting those who prefer a more conservative approach.

2. Trading: Gives a smoother and more predictable exchange between fiat currencies and other cryptos, with a significant risk reduction in terms of fluctuations and volatility.

3. Exchanging: USDT acts as the perfect “middleman” between the world of traditional finance and digital currency. Since there is a tangible asset pegged to Tether, it allows for easier exchange.

4. International Transfers: USDT is a useful alternative to traditional bank transfers that usually imply huge fees and slower transaction times. Perfect for someone who travels often.

Tether also is pegged to other currencies, making global trade between the blockchain that much easier. Tether Euro (EURT), Tether Yuan (CNHT), and Tether Gold (AUXT) is pegged to the price of gold.

5. Payments and Purchases: USDT is already accepted by many e-commerce sites, and also facilitates P2P trading.

How to Buy USDT

Buying USDT is fairly straightforward if you follow the correct steps across the different available platforms.

You can buy USDT on most exchanges, the more popular options available are Binance, Coinbase, and Kraken. All you need to do is create and verify your account, deposit funds (fiat money using credit cards, e-wallets, or other crypto), and finally, purchase the USDT.

Using peer-to-peer (P2P) platforms for buying USDT is another option, it has its advantages for those who do not want to give up KYC or use third-party services. Simply select your desired P2P marketplace, like Paxful, set up your account, and look for listings of sellers who are offering USDT for fiat funds or other cryptos as a trade. Complete the trade through the marketplace, but please be careful and do your research prior! Check seller profiles and ratings before sending money or crypto to anyone! Finally, you should receive the USDT and transfer it directly to the best Tether/USDT wallet available.

Storing Your Tether: The Material USDT Wallet

Storing your USDT safely is the most crucial part of owning any digital currency. A USDT cold wallet, like the Material USDT Wallet, gives you a secure place to hold your assets without any fear. The Material USDT Wallet is specifically designed for the storage of USDT and is user-friendly, easy to set up, and most importantly, its focus is on security.

The steel metal plate is virtually indestructible and has advanced security features to safeguard your assets for the long haul. Whether you are sending USDT or receiving it, the wallet is easy to navigate and offers free support to help you every step of the way.

We cannot stress enough how important it is to store your USDT and other crypto in a cold wallet, and for those looking for a reliable and secure option, the Material USDT Wallet is a great solution for storing your Tether assets.

FAQs

How to Buy USDT Using Bitcoin

- Log into your desired exchange that supports BTC/USDT trading pairs like Binance or Kraken. Deposit Bitcoin into your exchange wallet. Make a trade to convert your Bitcoin to USDT.

How to Buy USDT Using a Credit Card

- Platforms like Coinbase or Binance support purchases with credit cards. Register and complete any required identity verification, then add your credit card as a payment method and follow the steps to buy USDT.

How to Store USDT Safely

- Use cold wallets like the Material USDT Wallet for security.

Where Can I Use USDT?

- USDT is accepted on many platforms for trading and can be used for payments both online and in some stores.

0 Comments