KYC verification is necessary due to the growing concern for financial security, as it allows us to avoid, among other things, financial fraud and money laundering.

In addition, government regulations often require companies to carry out KYC verification to comply with their obligations for the prevention of money laundering and financing of terrorism.

Are you interested in learning more about KYC verification? This article explains it in detail.

What is KYC verification in cryptocurrencies?

KYC verification is a process that aims to know customers and verify their identity. It is a security measure used in the financial world and also in the field of cryptocurrencies to ensure compliance with regulations against money laundering and terrorist financing.

To carry out KYC verification, documents such as a passport or driver’s license may be required, as well as information about the user’s address and place of residence. This information is requested to confirm the user’s identity and ensure that the services are not being used improperly.

KYC verification is commonly used by cryptocurrency exchange platforms and other cryptocurrency-related financial services. These platforms are often subject to regulations similar to those of other financial institutions and, by performing KYC verification, can ensure compliance with their regulatory obligations and protect both themselves and their customers from the misuse of their services.

As we have mentioned, KYC verification is a process used in the financial world to confirm the identity of customers and ensure compliance with regulations against money laundering and terrorist financing.

Specifically, in the context of cryptocurrencies, KYC verification may include the verification of official identity documents such as a passport or driver’s license, as well as verification of the user’s address and place of residence.

The verification process usually begins when a user registers on a secure exchange or another cryptocurrency-related financial service. Upon registration, the user must provide certain personal information, such as their name, date of birth, address, and place of residence. They must also provide copies of official documents confirming their identity, such as a passport or driver’s license.

Once the user has provided this information, the platform begins processing it to carry out KYC verification. This may include verifying the information provided by the user against official databases such as the civil registry or vehicle registration. It may also include verifying the user’s address and place of residence through other sources such as utility bills or a credit check.

Once the platform has completed KYC verification, the user may be approved to use the platform’s services. In some cases, KYC verification may be an ongoing process, and the platform may request more information or documentation in the future to ensure continued compliance with regulatory obligations.

It is important to note that KYC verification is not a one-time process and can vary from one platform to another. Some platforms may require more or less information or documentation to carry out KYC verification, and the process may be more or less exhaustive depending on the specific platform.

Why is KYC important?

KYC verification is important because it is a process that companies use to know their customers and better understand their needs and preferences. This includes gathering information about the customer’s identity, address, and financial activities.

KYC verification is a compliance measure aimed at preventing money laundering and terrorist financing, among other things. When companies collect and verify this information about their customers, they can ensure that they are not involved in illegal activities and comply with applicable regulations and laws.

In addition, KYC verification can also help companies detect and prevent scams and other financial crimes. For example, if a person provides false information during the KYC verification process, the company can detect this and take steps to protect itself and its customers.

In summary, this process allows companies to know their customers, comply with laws and regulations, and protect themselves and their customers against fraud and money laundering.

Is KYC mandatory? When does it become effective?

KYC verification is a process widely used in the financial and business sectors in general. Although it is not mandatory in all cases, many companies and organizations use it as a compliance measure and to protect themselves and their clients against fraud and money laundering.

In some countries, the government may require certain companies and organizations to perform KYC verification as part of their anti-money laundering and counter-terrorism financing regulations. For example, in the United States, financial companies are required to perform KYC verification and report any suspicious money laundering activity to the competent authorities.

In general, KYC verification is a common practice in the financial and business sectors and is considered an essential measure to protect companies and their clients against fraud and money laundering. Although it is not mandatory in all cases, it is highly recommended for any company or organization that wishes to protect itself and comply with applicable laws and regulations.

That being said, the KYC process typically comes into effect when a company or organization establishes a business or financial relationship with a client. This usually includes opening a bank account, signing a loan agreement, or acquiring a financed product or service.

When a company establishes a business or financial relationship with a client, they usually ask them to provide information about their identity, address, and financial activities. This is done as part of the KYC verification process, which aims to get to know the client and better understand their needs and preferences.

In fact, in some cases, KYC verification may even begin before a business or financial relationship is established. For example, some companies may request information about a potential client’s identity before accepting a loan application or opening a bank account.

Which exchanges apply KYC?

As we have already mentioned, this type of verification is used throughout the financial and business sectors, which includes many cryptocurrency exchange platforms.

Generally, exchanges that apply KYC verification usually require their users to provide information about their identity, address, and financial activities. This is done as part of the KYC verification process, which aims to know the customer and better understand their needs and preferences.

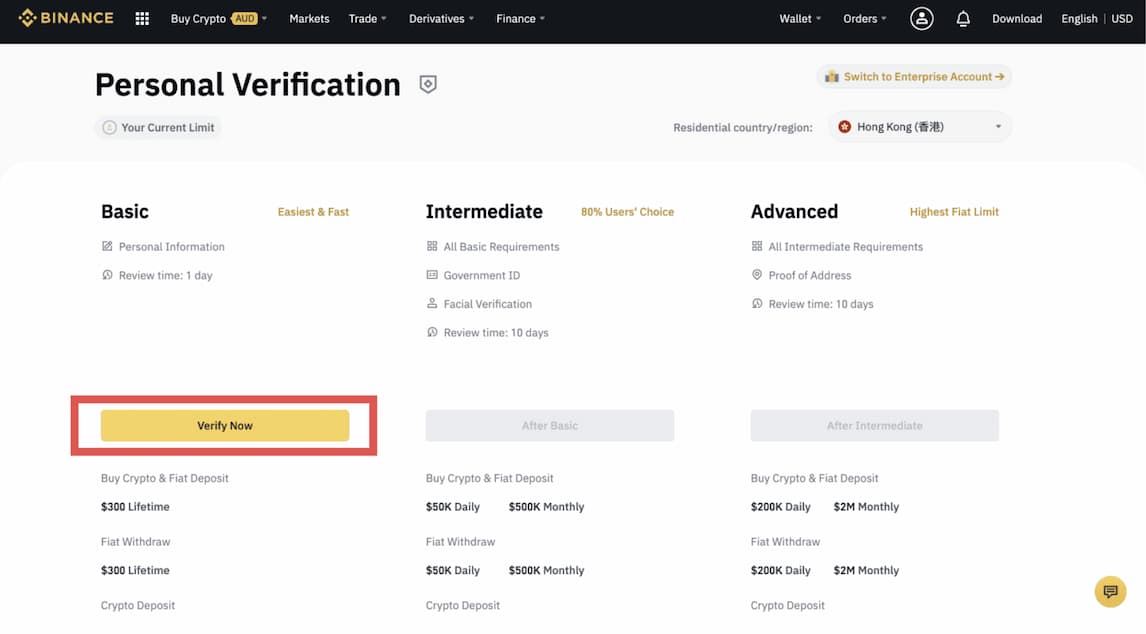

It is important to note that KYC verification can vary from one exchange platform to another, and some platforms may require a higher level of verification than others. Nonetheless, below are some exchanges that use KYC verification for their users:

- Coinbase

- Binance

- Kraken

- Bitstamp

- Gemini

- Bitfinex

- OKEx

It is also important to mention that some cryptocurrency exchange platforms do not apply KYC verification, which means they do not require their users to provide information about their identity. However, we should keep in mind that these platforms may be subject to less regulation and may present a higher risk of fraud or other illegal activities.

Don’t forget the risks of leaving your cryptos in the exchange.

Can you trade without KYC?

It is possible for some exchanges to allow trading without KYC verification. However, as mentioned in the previous section, these platforms are usually less regulated, so their users may be more exposed to fraud.

With that said, we recommend that all users of such platforms research the regulations and policies of each cryptocurrency exchange before starting trading to ensure compliance with all applicable laws and regulations. Additionally, it is important to note that KYC verification can help protect companies and their customers against fraud and money laundering, making it an important security and compliance measure.

What is MiCA law and how does it relate to KYC?

The European Union has approved the final text of the MiCA law, which will regulate the cryptocurrency market in the region from 2023.

The MiCA law, which contains over 100 articles, establishes the creation of a register of cryptocurrency exchanges operating in Europe, which must obtain a license to offer services in that region. It also requires these companies to create a database of their users.

However, it is important to note that this law still needs to be approved by the Committee on Economic and Monetary Affairs of the European Parliament before it is published and comes into effect.

Regarding the goals of this law, we must highlight that they are closely related to KYC and its objectives, which include protecting consumers and reducing the risk of money laundering and terrorist financing. It also establishes requirements for transparency and accountability of cryptocurrency companies, as well as a framework for supervision and oversight to ensure compliance with these regulations.

KYC and Crypto Anonymity

In the world of cryptocurrencies, KYC has become increasingly common. Many exchanges require their users to provide personal information, which can go against the anonymity that some people seek when using cryptocurrencies, and although anonymity is one of the main advantages of cryptocurrencies, KYC may be necessary to protect companies and consumers from illegal activities.

However, it is important to note that KYC does not completely eliminate anonymity in the world of cryptocurrencies. Although it reveals a user’s identity to a company, cryptocurrency transactions can still be conducted anonymously between different users. Additionally, some cryptocurrencies like Monero are specifically designed to provide a higher degree of anonymity.

Therefore, while it is true that KYC is an important process to protect companies and consumers from illegal activities, the reality is that it does not directly interfere with the anonymity that some users seek when using cryptocurrencies.

In summary…

KYC verification is an indispensable tool for all companies and users who want to avoid, as much as possible, the largest number of frauds and scams possible, and although it has been shown not to be an infallible method following cases like the FTX bankruptcy scam, the reality is that, to this day, it is one of the most important resources we have to protect ourselves from possible scams.

Still, as we always say, our money will always be safer in our hands than in the hands of others. Therefore, it is important for users to consider whether they want to reveal their identity to a company and what cryptocurrency they will use for their transactions based on their privacy and anonymity needs.

If you are concerned about security, store your cryptos in a safe place, our cold crypto wallets are the solution.

0 Comments