Learning to trade with cryptocurrencies is learning to trade with digital currencies, which is not the same as trading other financial assets such as stocks, ETFs, or commodities.

In this post, I’m going to show you exactly how you can learn to trade with cryptocurrencies, and not only that! I will provide you with a guide, a roadmap for beginners with the step-by-step process you should follow if you’re truly interested in the world of crypto trading.

Let’s dive in!

Basic Concepts for Cryptocurrency Trading

Here are some important basic concepts to differentiate and a few examples. They will help you get an idea of the type of trading you want to engage in and its level of difficulty.

What is cryptocurrency trading?

Cryptocurrency trading is an activity where individuals buy and sell different types of cryptocurrencies, such as Bitcoin, Ethereum, or any other digital currency. The main objective of trading is to profit from the price fluctuations of these cryptocurrencies.

An example

Imagine you buy Bitcoin at a low price and then sell it when its value increases. The difference between the buying and selling price is your profit. The price keeps changing; it’s an eternal roller coaster that fluctuates every less than a minute, even if it’s by small amounts. This is due to supply and demand, market news, or economic events.

You can even take advantage of those small changes. Let’s say you buy Bitcoin at $24,762.96 and sell it at $24,772.96. It seems like you’ve made a profit of $10, but it depends on your investment. However, if you invest $200,000 in that trade, the profit is calculated as the price difference multiplied by the invested amount. In this example, the profit would be:

Profit = Price difference x Invested amount Profit = $10 x $200,000 Profit = $2,000,000

Therefore, if you invest $200,000 in that trade and the price of Bitcoin changes as mentioned, you would make a profit of $2,000,000.

Types of cryptocurrency trading operations

There are different types of cryptocurrency trading. One of them is short-term trading, where traders aim to profit from small price fluctuations within short periods, such as minutes, hours, or days. On the other hand, long-term trading involves holding cryptocurrencies for longer periods, expecting their value to increase over time.

Here are some ways to trade with cryptocurrencies:

- Buying and selling cryptocurrencies: You can directly acquire cryptocurrencies on an exchange platform and sell them when the price increases. This form of trading involves physically owning the cryptocurrencies and storing them in a digital wallet.

- Trading on exchanges: Exchanges also allow you to engage in more active trading, where you can take advantage of price fluctuations to buy and sell cryptocurrencies with the goal of making short-term profits.

- Margin trading: Some exchanges offer margin trading, allowing you to trade with borrowed funds. This enables you to amplify your profits (and also your losses) based on the leverage used.

- Cryptocurrency futures: Futures contracts are agreements to buy or sell an asset, in this case, cryptocurrencies, at a predetermined price and date in the future. Cryptocurrency futures allow you to speculate on the future price of cryptocurrencies without physically owning them.

- CFDs (Contracts for Difference): CFDs are also used for cryptocurrency trading, allowing you to speculate on the price movement of cryptocurrencies without owning them physically. When trading with CFDs, you can benefit from both upward and downward price movements, and you have the flexibility to open long positions (betting on price increases) or short positions (betting on price decreases).

| Trading Method | Ease | Learning Requirement | Trading Experience |

|---|---|---|---|

| Buying and selling cryptocurrencies | Easy | Basic | No prior experience required |

| Trading on exchanges | Moderate | Moderate | Some prior experience recommended |

| Margin trading | Moderate to Difficult | Advanced | Prior experience required |

| Cryptocurrency futures | Difficult | Advanced | Prior experience required |

| CFDs (Contracts for Difference) | Moderate to Difficult | Moderate to Advanced | Some prior experience recommended |

- Easy: A relatively simple trading method to understand and implement. You don’t require deep technical or financial knowledge, and you can easily perform it.

- Moderate: Requires an intermediate level of knowledge and skills in trading. It may involve the use of exchanges and basic market analysis.

- Moderate to Difficult: More complex, requiring a higher level of knowledge and experience. It may involve the use of leverage and more advanced trading strategies, which entail higher risk.

- Difficult: Advanced and complex, extensive knowledge and experience in trading. You need to have a strong understanding of advanced financial and technical concepts.

Cryptocurrency Trading vs hodling Cryptocurrencies

When we talk about trading cryptocurrencies, we are referring to buying and selling them frequently with the aim of making short-term profits. It’s like buying collectible cards at a low price and selling them at a higher price to make more money. In this case, you would need to learn about how the cryptocurrency market works, analyze charts, and make quick decisions to take advantage of opportunities.

On the other hand, the term “hodling” is used to describe the strategy of holding cryptocurrencies for the long term without selling them. It’s like having a collection of cards and deciding to keep them without trading them for a long time, hoping that their value will increase over time. This strategy does not require as much technical knowledge or constant market analysis since the main focus is on holding the cryptocurrencies for an extended period and waiting for their value to rise.

Both strategies have their own advantages and challenges. Trading cryptocurrencies can offer quick profit opportunities, but it also involves more risks and will require more time and effort to learn and follow the market. On the other hand, hodling cryptocurrencies is more relaxed and less stressful, but it requires waiting longer to see a return on investment.

If you choose the latter strategy, I recommend purchasing a secure cold wallet and storing Bitcoin or Ethereum (currently the most secure cryptocurrencies). You can do this by buying one of our cold wallets, and once it arrives, you can store Bitcoin in it, which you can purchase from here. If you need personalized and completely free assistance, we are here to help.

Why a cold wallet?

When it comes to keeping your cryptocurrencies safe, prioritizing security is crucial. A common mistake is leaving your assets on an online exchange for extended periods. This practice can expose your funds to potential risks like hackers and theft.

Instead, consider using a cold wallet, also known as a hardware wallet. It’s like having a secure safe for your digital assets. Cold wallets keep your private keys offline, away from hackers and online vulnerabilities. I recommend ours, as it’s currently the most secure on the market, resistant to shocks, fire, and floods.

By storing your cryptocurrencies in a cold wallet, you have complete control and ownership of your funds. You reduce dependence on online exchanges and minimize the chances of losing your assets due to exchange-related issues or security breaches.

While online wallets provided by exchanges may be convenient for trading, they also come with higher risks. Always transfer your purchased cryptocurrencies to your secure cold wallet for long-term storage and peace of mind.

How to Learn to Trade Cryptocurrencies Step by Step

1.Educate Yourself

I can’t stress this enough. The majority of people who start trading cryptocurrencies or engaging in trading get scared because they don’t know how to manage their risks or diversify their investment portfolio. If you’re going to do trading, there are a series of concepts you must be aware of.

2. Create an account on an exchange

I recommend Bit2me for its user-friendliness and security. When registering, you will be asked for various details such as your ID, email verification, etc.

You can open an account directly from here.

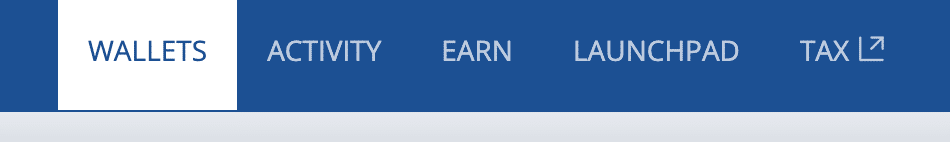

3. Choose the cryptocurrency to trade

From the “wallets” section in the main menu, you can access the complete list of cryptocurrencies. Depending on the exchange, you will have different options of cryptocurrencies available. It is common to have accounts on multiple exchanges to explore more possibilities.

4. Create a wallet

Once you choose a cryptocurrency, there may be exchanges where you need to create a wallet. It’s very simple and can be done in a couple of clicks.

5. Execute the buy order

Simply click on “buy,” choose the amount you want to invest, and select your preferred payment method.

6. Choose your trading strategy

It’s important to define a trading strategy that aligns with your goals and risk tolerance. You can opt for short-term strategies like day trading or longer-term strategies like swing trading. Research and familiarize yourself with different approaches to find the one that suits you best. In the recommended courses mentioned above, you can find detailed information.

7. Take risk management measures

Proper risk management is crucial to protect your capital. Set loss limits and use tools like stop-loss orders to automate the sale of your cryptocurrencies if the price falls below a predetermined level. Additionally, diversify your portfolio by investing in different cryptocurrencies and consider allocating only a portion of your available funds to trading.

8. Monitor and close your position

Once you have opened a position, it is essential to constantly monitor its performance. Use charts and technical analysis tools to make informed decisions about when to close your position. Remember that the cryptocurrency market is volatile, so it’s important to be prepared to adjust your strategies based on changing conditions.

Some tips for you

Here are some tips that, in my opinion, are key and can help you succeed if you manage to follow them:

Learn: Educate yourself about cryptocurrencies and trading. There are many online resources available to assist you.

Risk: Never invest more than you’re willing to lose. Manage your capital responsibly.

Practice: Use a demo account to practice before trading with real money.

Diversify: Don’t put all your eggs in one basket. Reduce risk by diversifying your investments.

Keep your cryptocurrencies safe: Use a cold wallet to prevent unnecessary hacks and theft.

Stay informed: Follow market news to make informed decisions.

I hope this comprehensive guide has helped you get started with cryptocurrency trading. If you have any doubts or questions about which path to take, feel free to leave a comment or reach out to us.

0 Comments