We all remember the major bull run of 2017, where fortunes were made overnight.

All news outlets were buzzing with headlines about the market soaring and tech investors becoming millionaires.

But what exactly is a bull run in crypto and why how does it happen?

More importantly, can you position your portfolio to take advantage of it?

With expert insight and historical data, our guide is here to help break down what a bull run crypto is.

What Is a Bull Run in Crypto?

A crypto bull run is a specific period when crypto prices rise significantly.

There are a few market indicators that can typically predict an upcoming bull run crypto:

1️⃣Increased market demand.

2️⃣Positive sentiments coming from the media and other influencers.

3️⃣Global adoption.

In the past, Bitcoin was the main cryptocurrency to boom, but now in 2025, new emerging cryptocurrencies and altcoins are skyrocketing.

Why Are Bull Runs So Important?

Bull Runs in Crypto is significant since it produces the most profit in the crypto market.

Past Bull Runs included:

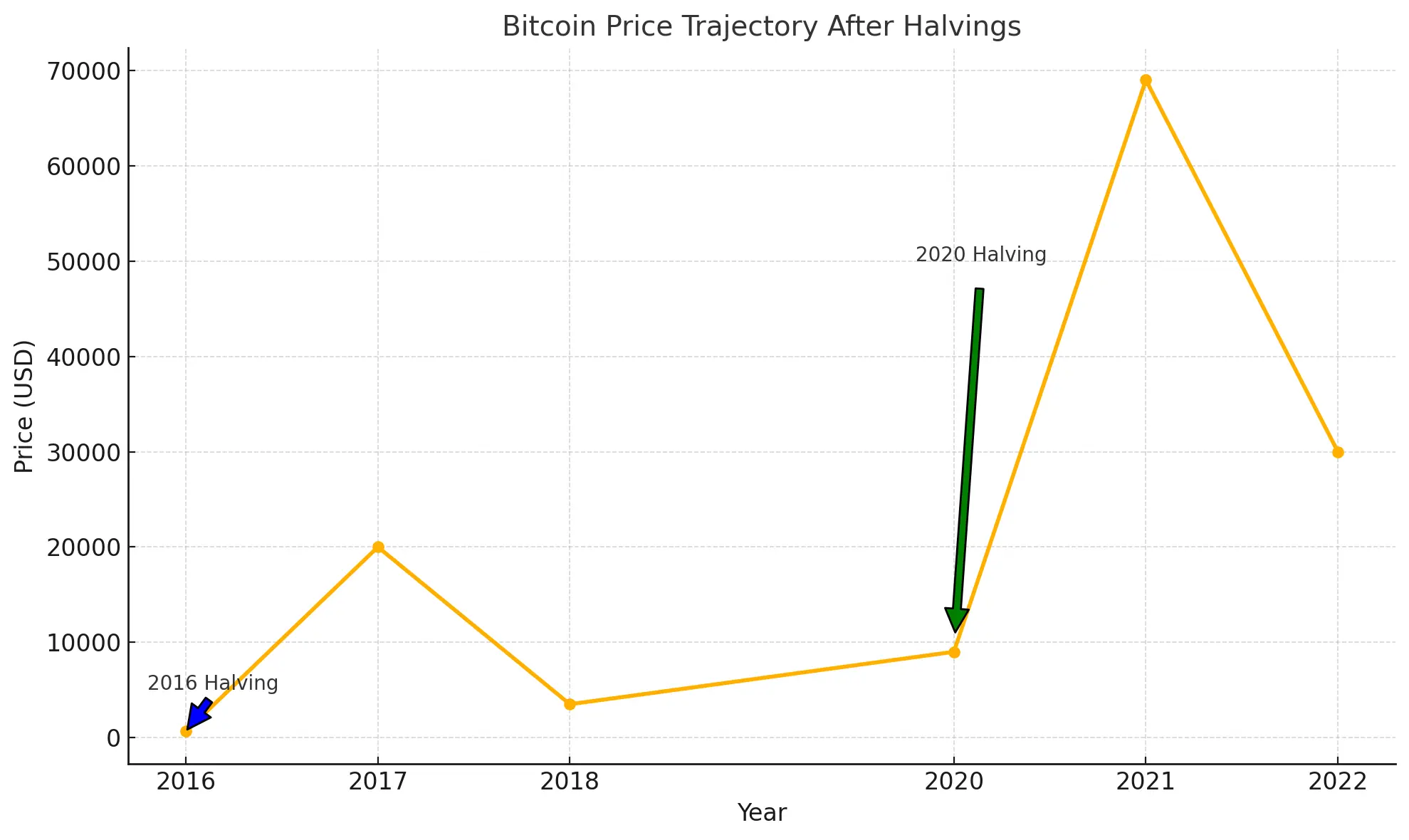

- 2017: This Bitcoin bull market grew BTC from under $1,000 in January to almost $20,000 by the end of the year. Ethereum jumped from $8 to over $700 in the same year.

- 2021: After Bitcoin halved in 2020, BTC prices exploded again. Bitcoin reached its highest value, over $69,000 in November 2021. Other altcoins like Solana grew over 11,000% in a year.

When you understand these cycles, you begin to see that there is a pattern – they are not random.

Things like increased adoption, advancements in tech, interest from private institutions, and economic trends all play a role in creating the momentum for a crypto bull run.

The advantage is once you learn how to see these trends coming, you can anticipate opportunities in the market and take advantage.

How a Bull Run Affects Crypto Prices

Are you still wondering how a bull run can push prices to rise?

Don’t worry, we have you covered.

It’s due to a combo of market dynamics and above all, investor psychology (you’d be surprised by how much this aspect plays into it).

1. Increased Demand and a Limited Supply:

For example, Bitcoin’s price boom in 2021 was partly brought on by Tesla’s $1.5 billion investment and its announcement of accepting Bitcoin as payment (later reversed). |

2. FOMO (Fear of Missing Out):

This happened in the 2017 bull run, where retail investors joined the market, driving up Bitcoin and altcoin prices. |

3. Media Hype

|

Pro Tip ➡️ Advanced traders and investors can take advantage of on-chain data and analysis.

On-chain analysis:

Examining blockchain metrics, including transaction volumes, movements of big holdings (known as whales), and wallet activity, can indicate growing interest, usually signaling an upcoming bull run.

When Is the Next Crypto Bull Run Expected?

Knowing the exact moment of a bull run in crypto is not an exact science, but as we mentioned before, there are a few indicators and historical patterns that can guide predictions for 2025.

Current Market Conditions

- Inflation is a major indicator that something is changing in the economic market. When inflation persists, many global economies and investors begin to look into alternative assets. This is where cryptocurrencies have stepped up, especially as a hedge against inflation.

- Institutional interest and regulations are also amping up for the next bull run. This is evident through newly elected U.S. president Trump‘s take on implementing Bitcoin into American holdings, claiming to be “crypto-friendly”. We also see how Bitcoin ETFs and other profitable cryptocurrencies are being regulated and adopted by government agencies.

- International market trends and positive sentiment around tech innovations, like in the DeFi space are all amping up confidence in the crypto market. The average person doesn’t seem to be as skeptical about buying Bitcoin or other tokens as they once were.

Historical Patterns

- The last Bitcoin halving event took place in April 2024. Historically speaking, this precedes a bull run crypto.

Bitcoin halving is when Bitcoin’s block reduces (halves) the reward it gives to miners. In turn, this causes a decrease in the supply rate.

- Typically, a Bitcoin halving event takes place every 4 years, and within 12 months post-halving there have been significant price booms. The 2016 halving made Bitcoin’s price rise from under $1,000 to about $20,000 by the end of 2017. And in 2020, BTC jumped from around $9,000 to a high of over $69,000 in November 2021.

- Increased adoption of cryptocurrencies in more businesses and individual investors has been on the upward trend. More payment platforms like PayPal, Venmo, and CashApp support crypto, and even countries like El Salvador have adopted Bitcoin into their legal framework. When this happened in 2020, it led to the last major bull run from Tesla and MicroStrategy investing large amounts in BTC.

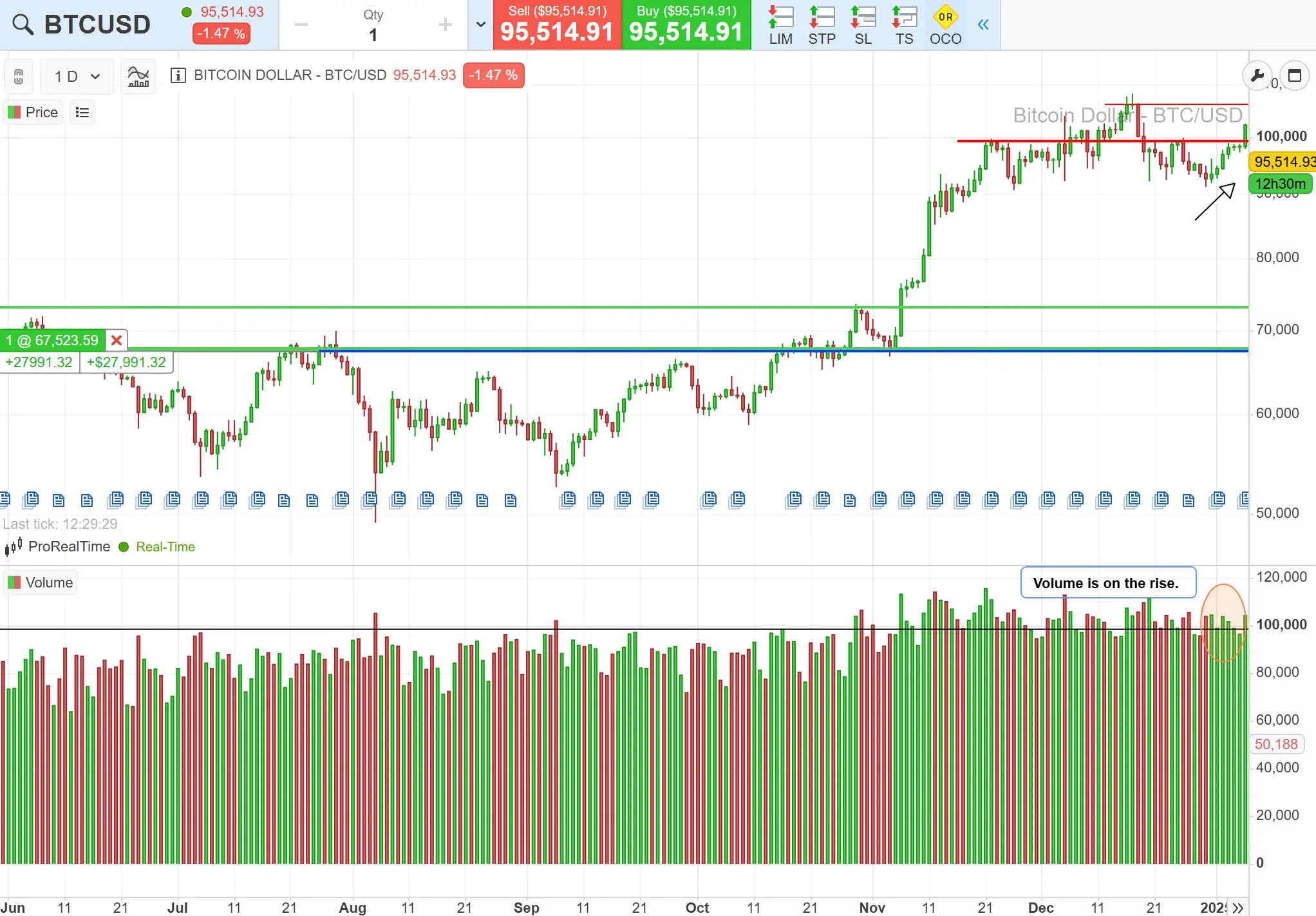

- Higher trading volumes and on-chain metrics are perhaps our biggest sign of growing interest in the market and an upcoming bull run. Wallet growth and blockchain transactions also are spiking at this time.

Preparing for a bull run means not only identifying opportunities but also securing your assets.

As crypto prices rise, so does the risk of hacks and other cyber attacks.

Protect yourself with secure cold storage, like Material Bitcoin Wallet. Unlike an online wallet or electronic hardware wallet, Material Bitcoin is designed to keep your private keys offline, never connecting to another device or online platform.

Regardless of a bull or bear market, safeguarding your crypto is the only sure thing in a volatile market.

Which Crypto Can Return 1000X in 2025?

In the past, previous 1000X performers included Ethereum and Solana.

For example, ETH came onto the market at around $0.30 and today it is worth over $3,000. That’s a 999,900% increase, by the way!

So, what does this mean?

High-Risk, High-Reward.

The attraction of 1000X returns in cryptocurrency usually comes from more unknown cryptos and altcoins.

Of course, Bitcoin and Ethereum dominate market share and stablecoins like Tether provide more stability, but smaller, emerging projects are the ones with the strongest growth potential.

Projects and Coins To Look Out For in 2025

1. Gaming Tokens and Blockchain Projects

- Gaming revenues are projected to surpass $312 billion globally by the end of 2025.

- Blockchain-based games are offering play-to-earn Bitcoin options on their platforms.

2. AI-Based Crypto

- Utilizing artificial intelligence in the blockchain has grown in 2024. Cryptos like SingularityNET (AGIX) are using blockchain technology to create a decentralized platform for AI creation and integration.

3. DeFi Projects and Layer 2

- Decentralized Finance platforms that turn real assets into digital tokens are on the up.

- While Layer 2 is becoming essential as more investors are turning to Ethereum in 2025.

Identifying Potential 1000X Projects Checklist

✅ Low Market Cap: Look for projects with a lower market cap for higher growth potential.

☑️ Special Use Case: Innovative projects that solve real-world problems are gaining traction.

✅ Strong Team: Research projects that have a transparent and experienced team.

Crypto Bull Run 2025: What’s Next?

The 2025 bull run could be triggered by global economics, new U.S. policies, clearer regulations, and the growing adoption of cryptocurrencies by businesses and individuals.

It’s a great time to make some returns but a bull run also comes with risks, like overpriced value, fast market corrections, and a boost in scams targeted towards the everyday investor.

To manage these risks, focus on diversifying your portfolio and securing your crypto with a reliable cold storage crypto wallet.

How to Prepare for the Potential Bull Run 2025

➡Techniques like DCA (Dollar-Cost Averaging) are a helpful way to regularly invest in crypto without feeling a large impact of possible market volatility.

➡Diversification is another must-do in any financial planning and investing. Spread your assets across different asset classes and a variety of crypto, tokens, and projects to help balance the risk and reward.

➡Use cold storage wallets to protect your assets from hacks by storing them offline in our Material Bitcoin wallet.

➡Use a HODL strategy during a bull run, regardless of timing. Keep in mind that prices will go up in a bull market and down in a bear market, but for the long term, storing your crypto has been proven to be the best technique for seeing returns.

Our Final Thoughts on a Bull Run 2025

The next bull run crypto could bring along some amazing opportunities for investors, but your preparation is key.

Knowing how to indicate market trends, and upcoming changes is one of the most useful tools you can have when investing.

Make sure to invest only what you’re comfortable with, indicating amounts you can afford and not buying or selling based on your emotions.

Above all, protect your crypto during a bull run with Material Bitcoin.

Don’t miss out on our expert insights and the latest news. Visit Material Bitcoin for all things crypto and secure storage solutions.

0 Comments