There is always speculation about what direction markets will take. With geopolitical issues affecting the world, upcoming U.S. elections, and new technologies coming onto the market, things can change quickly.

Whether you are new to crypto investing or an experienced user, knowing how to read Bitcoin bull market indicators can help you plan your financial strategies for 2025.

What Is a Bitcoin Bull Market?

A Bitcoin bull market is a period during which the price of Bitcoin continuously rises.

This creates a “positive” market, typically leading to higher demand and a larger adoption of crypto.

During these phases, most investors a more actively purchasing Bitcoin, including new investors.

The general consensus with professional investors and traders is that prices will continue to rise during this period.

Historical Patterns of Bitcoin Bull Markets

Bitcoin has gone through several important bull markets since its introduction in 2008. Here are the most notable Bitcoin bull markets recorded:

2013 Bull Market

In 2013, Bitcoin experienced its first major bull run. Prices were at around $13 and shot up to $750 by the end of the year. This is approximately a 5669% increase in Bitcoin price from January to December!

This bull run was brought on by media attention, adoption from tech influencers, and the rise of bigger Bitcoin exchanges, including Mt. Gox.

2017 Bull Market

This was an explosive year and can arguably be when Bitcoin became a household name.

In 2017, Bitcoin started the year at around $1,000 and skyrocketed to nearly $20,000 by December.

This brought on a lot of media attention with tech-loving Bitcoin owners becoming overnight successes!

However, it all came to a dramatic crash in early 2018, when prices dropped to around $3,000.

This began the cold “crypto winter“.

2020-2021 Bull Market

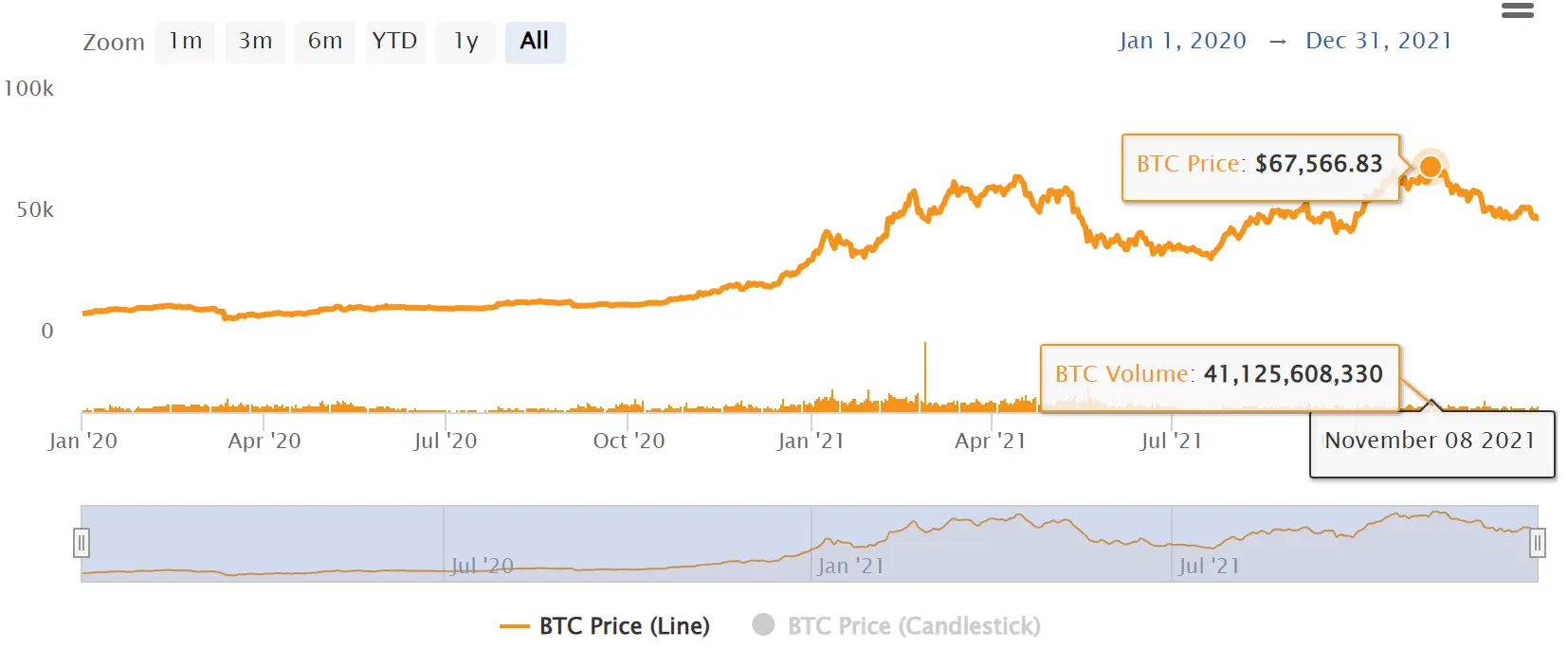

The most recent Bitcoin bull market began in late 2020. Large companies like MicroStrategy and Tesla added Bitcoin to their portfolio, pushing the price from around $7,000 at the start of the year to an all-time high of over $67,000 in November 2021.

COVID-19 played a role in this bull run as fear of global price rises pushed many people to invest in Bitcoin as a hedge against inflation.

What Can Indicate a Bitcoin Bull Market?

There are several signs and indications that point to the start of a Bitcoin bull market. These indicators are a big help for investors who are looking for a good time to buy Bitcoin.

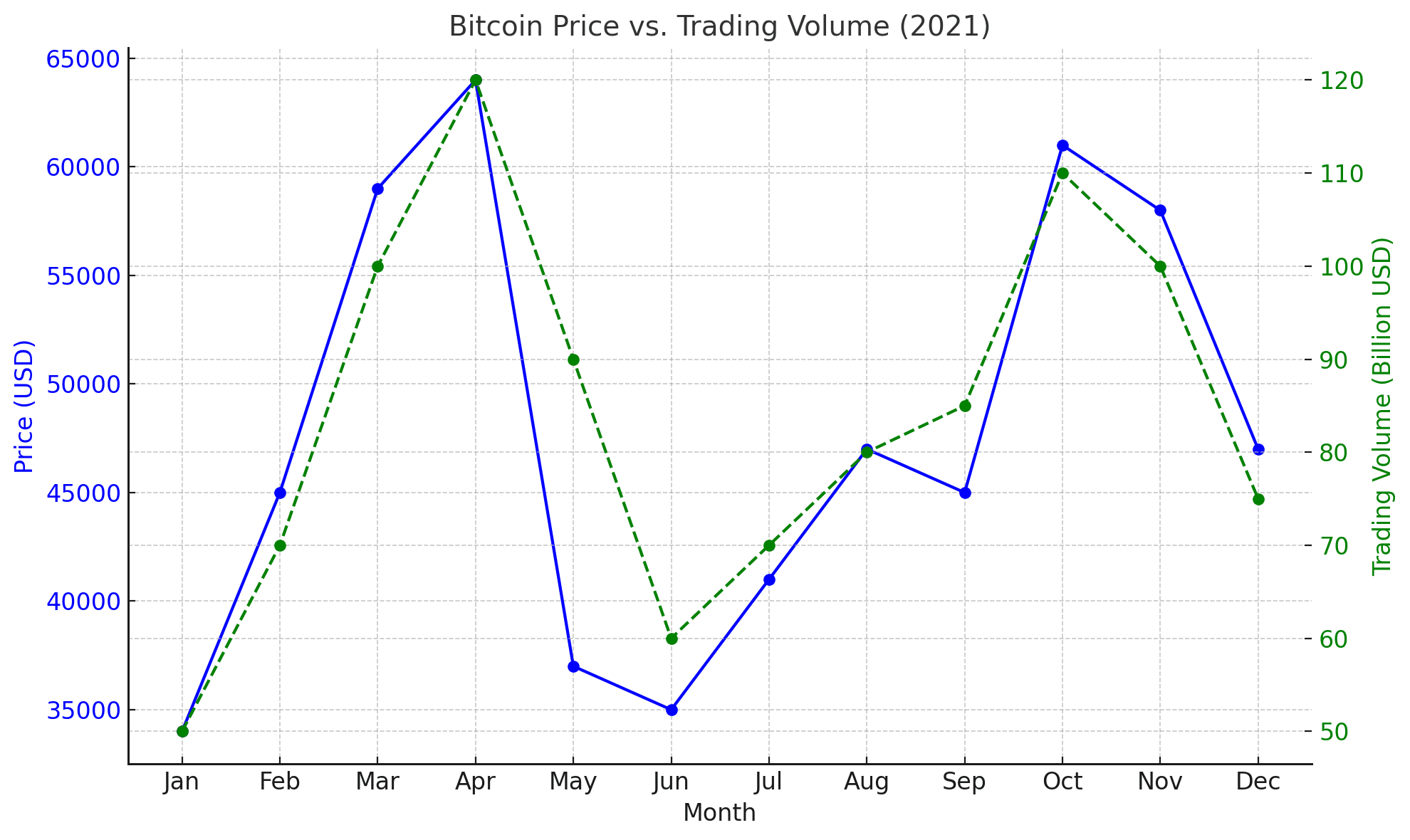

1️⃣Increased Trading Volume

One of the clearest signs of a Bitcoin bull market is when there is a big increase in trading volume. As more traders enter the market across the major crypto exchanges, this results in pushing Bitcoin prices even higher.

Did You Know?

During the 2020-2021 Bitcoin bull market run, major exchanges like Coinbase and Binance reported record-high volumes of trading activity.

2️⃣Rising Price Trends and Moving Averages

Another important technical indicator of a bull market is the sustained rise in Bitcoin’s price.

The 50-day and 200-day moving averages are commonly used by traders to predict the long-term trend.

When the 50-day moving average crosses above the 200-day moving average, it forms a “golden cross” which is indicative of a bull market.

This crossover was a tell-a-tale sign of the 2020-2021 bull run that caused BTC to boom within 9 months.

As of mid-2024, Bitcoin’s price continues to trend above these moving averages. This means that there is room to grow, suggesting a price rise is on the horizon.

3️⃣Bitcoin Halving Events

Bitcoin halving is when the block rewards for miners get halved. This happens approximately every 4 years, with the last event taking place in April of 2024.

Halving events are sure signs of driving an upcoming bull market simply because they create more scarcity of Bitcoin by reducing the rate at which BTC enters circulation.

This typically causes a desire for more Bitcoin and therefore, increases demand.

4️⃣Increased Institutional Adoption

When larger institutions begin to take notice, it becomes one of the strongest signals of a Bitcoin bull market.

We saw this happen in 2021 when TESLA invested $1.5 billion worth of BTC.

Additionally, the approval of Bitcoin ETFs within the U.S. and Canada makes this crypto asset even more accessible, leading to a spike in trading volume.

Major Factors Influencing the 2024-2025 Bitcoin Bull Market

Several key factors are shaping the current momentum for a Bitcoin bull market. Let’s break down the major influences behind this boost:

| Macroeconomics |

|

| Technological and Network Developments |

|

| Institutional Participation |

|

How Long Will the Bull Market Last?

If history is any indication, then Bitcoin bull markets usually last between 1 to 2 years.

They are normally triggered by halving events that reduce Bitcoin supply, along with other factors that we mentioned before.

The 2024-2025 bull market seems to be following this pattern, as many experts are predicting a price surge to continue with the remaining months of 2024 and well into 2025.

Famous Bitcoin analyst and Ark Invest Management’s CEO and Chief Investment Officer, Cathie Wood has predicted Bitcoin to rise by 5,837% by the end of 2030. That would bring the value of each Bitcoin to $3.8 million!

Bitcoin Price Predictions for 2024-2025

When it comes to Bitcoin price predictions for the next year, a majority of experts are predicting a bullish market.

Many analysts think that Bitcoin could surpass $100,000 by 2025.

Himanshu Maradiya, founder and chairman of the CIFDAQ Blockchain Ecosystem, said:

“Although predicting that Bitcoin will reach $1,000,000 by 2025 might sound overly optimistic, several factors make it possible. The growing adoption of Bitcoin, the approval of BTC ETFs in various countries, the weakening of traditional fiat currencies due to hyperinflation, and increasing profitability for Bitcoin miners are key drivers that could significantly boost its value.”

This has caught the attention of more traditional investors and long-term holders who are buying up more Bitcoin and storing them in some of the best hardware wallets available, rather than keeping them on exchanges for daily trading.

On the flip side, some analysts see a bearish side of the market. For example, some experts suggest that stronger regulations could hinder Bitcoin’s growth rather than increase it.

Regardless, one obvious indicator is that the price of BTC is on the rise.

Risks and Considerations to Take When in a Bull Market

While a Bitcoin bull market can provide exciting opportunities for digital investors, it does come with risks. Here are a few things to consider when buying Bitcoin in a bull market run:

➡️Bitcoin Volatility

- Bitcoin is historically known for its strong price swings, even during bull markets.

- Prices can drop quickly.

➡️Emotional Investors

- Any sudden changes in market news or regulations can lead to panic selling, even during a bull run.

➡️Regulatory Risks

- Changes in government regulations can quickly impact Bitcoin’s price.

So Should I Buy Bitcoin Now?

As the 2024 Bitcoin bull market unfolds, leading the way into 2025, it’s clear that the potential for gains is high.

Although there are risks involved when investing in any asset, all indications are pointing to a prosperous year ahead.

However, it’s essential to have a secure and reliable storage solution for your crypto.

With Material Bitcoin, you can easily buy and store your Bitcoin with no worries or time-consuming setup.

Your Bitcoin investments stay safe during both the highs and lows of the market.

FAQs

How do I know when the bull market is over?

- Bull markets typically end when prices stop rising consistently, and trading volumes decrease.

Should I buy Bitcoin during a bull market?

- Buying during a bull market can be profitable, but it’s important to stay cautious and avoid buying into hype. Consider a dollar-cost averaging strategy to reduce larger risks.

What are the best strategies for investing in a bull market?

- Diversifying your portfolio, setting realistic goals, and not over-leveraging are key strategies to reduce risk.

0 Comments