In late May 2024, the U.S. Securities and Exchange Commission (SEC) approved the first spot of Ethereum Exchange-Traded Funds (ETFs).

This was a major game changer for investors and the crypto market. In short, it means that Ethereum is officially a regulated investment.

The new Ethereum ETFs began trading on July 23, 2024, meaning you can now invest in Ethereum without needing to own the asset directly.

In this post, we’ll explore what is an Ethereum ETF, what it means that the SEC approved it, industry input and reactions, and how this can benefit you and your investment portfolio.

What is an Ethereum ETF?

An Ethereum ETF (Exchange-Traded Fund) is a type of investment fund that is traded on stock exchanges.

It’s similar to individual stocks in the sense of how it can be traded but ETFs give you the chance to invest in multiple companies and commodities at once.

Ethereum is the second-largest cryptocurrency, after Bitcoin, making it a valuable player in the market and ideal to include in your investment portfolio.

How Ethereum ETFs Work

Ethereum ETFs function by tracking the price of ETHER. This is done by the ETF fund holding actual Ethereum to help mimic the price movements of the cryptocurrency.

If you have a share of Ethereum ETF, you will notice that prices rise and fall along with the current price of ETHER.

As these are spot ETFs and not futures ETFs that were recently approved, it means that they follow the current market value of Ethereum.

You can buy and sell shares of Ethereum ETFs through traditional brokerage accounts.

Benefits of Investing in Ethereum ETF

- Beginner-friendly. Ideal for new crypto investors who want to start growing their crypto portfolio.

- No need for advanced technical knowledge. You don’t understand the blockchain? No problem!

- It’s in a regulated space with strict SEC standards.

- Portfolio diversification.

- Potential for high returns as Ethereum’s market cap hit $350 billion in August 2024.

The Significance of SEC Approval: What Does it Mean?

The approval of Ethereum ETFs by the SEC is a major evolution for crypto and American investors for several reasons:

1️⃣Regulatory Approval: This demonstrates the larger acceptance of cryptocurrencies in the mainstream world of finance. Bitcoin ETFs were approved earlier this year and now with Ethereum ETFs, it shows the growth and strength of digital currency.

2️⃣Accessibility: It’s now possible for investors to buy Ethereum in a regulated manner. This might go against the initial idea of crypto, but this means that retailers and institutions are more likely to accept Bitcoin and Ethereum.

3️⃣Market Impact: Spot Ethereum ETFs are expected to gain large momentum and most likely increase the price of Ethereum. This will enhance the overall market liquidity of ETH and the Ethereum blockchain.

Major players in the crypto community have widely welcomed and are thrilled with the SEC’s change of heart and decision, while others also worry about the possible impact this can have on decentralized finance.

Many experts in the industry, including James Seyffart, Eric Balchunas, and Adam Cochran were quick to show their excitement, support, and insights about the approval.

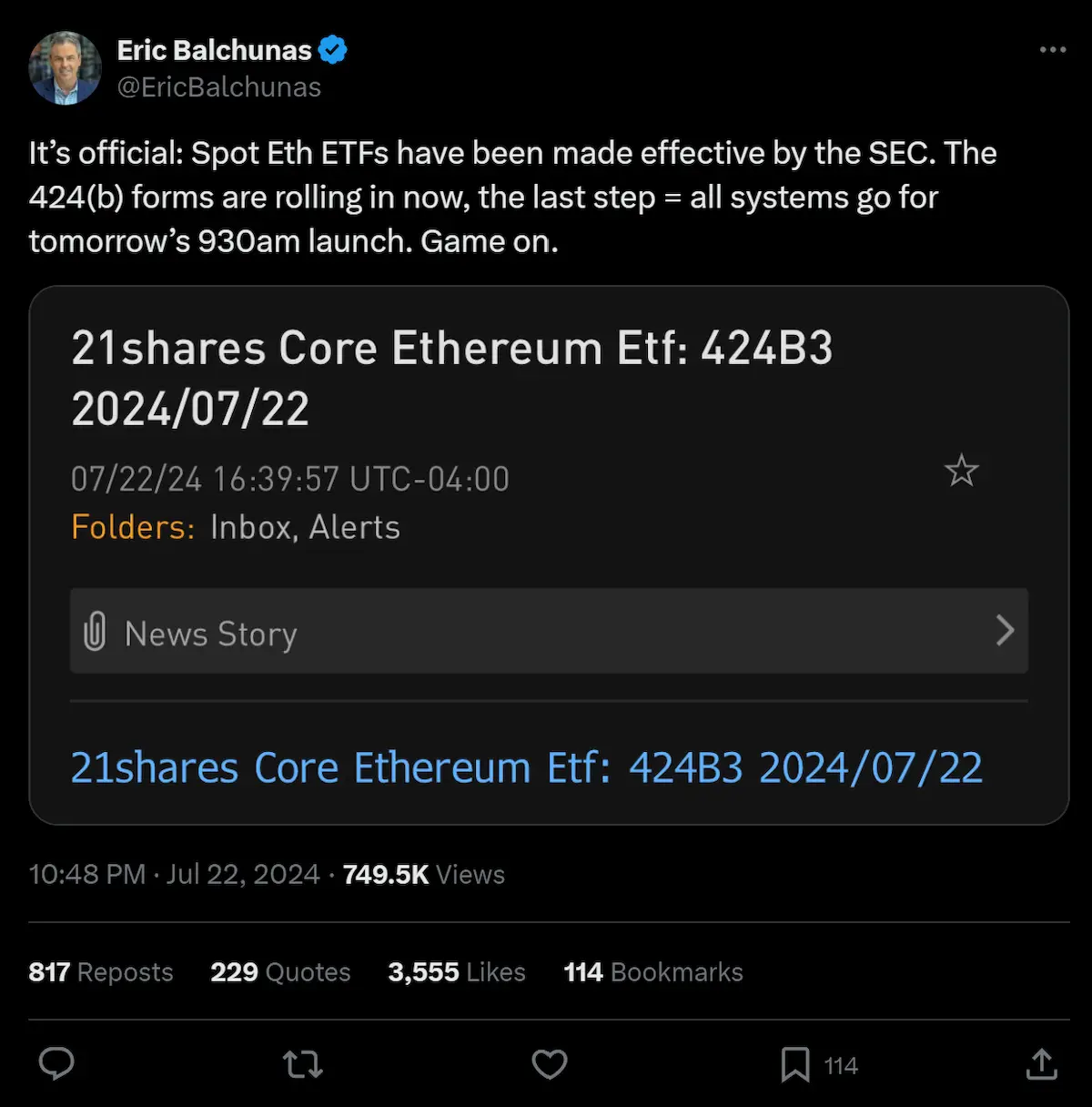

➡️Eric Balchunas, who is a Senior ETF Analyst at Bloomberg, expressed how this decision is a milestone for crypto and highlights the work needed to be done before launching the ETFs on July 24.

➡️Adam Cochran, one of the founders and a partner at Cinneamhain Ventures, brought up the point of the larger regulatory implications that this approval brings on. He states that this decision could set a precedent classifying all other digital assets as commodities.

How SEC Approval of Ethereum ETFs Can Benefit You

As Ethereum ETFs begin to trade, they offer multiple advantages for investors:

Firstly, it provides diversification opportunities by adding one of the leading cryptocurrencies to your portfolio. Investing in spot ETFs gives you the chance to capitalize on the growth of Ether and the Ethereum blockchain without the direct risk and responsibility associated with buying, owning, and managing the digital currency directly. It’s a great way to build a crypto portfolio.

Secondly, when you invest in Ethereum through an ETF, you are simplifying the process of ownership. This makes it especially appealing to new investors of crypto who are unfamiliar with exchanges, storage options, and regulations.

Lastly, since ETFs work on a regulated platform, some investors find it more secure. Having a regulatory structure gives the “guarantee” that everything functions within the SEC’s standards and offers crypto protection that is not provided in the traditional crypto market.

Investing in crypto doesn’t need to be scary or unsafe. Storing your Ethereum in a cold crypto wallet, like Material Ether provides the highest security and crypto protection for your digital assets.

Ethereum ETFs: From Launch to Now

Since its launch in July 2024, Ethereum ETFs have seen a lot of movement. The first few weeks proved the volatility of crypto and how quickly any investment asset can fluctuate.

Early on, Ethereum ETFs had a large inflow as it gained attention. For example, BlackRock’s iShares Ethereum Trust (ETHA) had large inflows of $900 million worth within the first few weeks.

In the first week of August alone, ETHA had inflows of $89.6 million in one day!

But, since then the the Grayscale Ethereum Trust (ETHE), which moved to an ETF format, saw big numbers of outflows. Almost $2 billion worth just at the beginning of August.

This is a peculiar contrast with other ETFs since many of them continued to experience positive inflows. For example, Fidelity’s Ethereum Fund (FETH) added over $6 million of inflows in one day!

Future Predictions for Ethereum ETFs

The success of Ethereum ETFs is unknown but one thing is for sure: they are helping to pave the way for cryptocurrencies to be part of traditional finance structures.

Whether you believe that this is a positive or negative thing in terms of decentralized finance and self-ownership, it is showing to drive up the prices of crypto.

🔊Breaking News: Nasdaq has asked the SEC for approval to add Ethereum ETF options, which marks a big push towards a global acceptance of digital assets.

The Impact of SEC Approval of Ethereum ETFs

The SEC’s approval of the first Ethereum ETFs has changed the crypto market. It enhances accessibility for Ethereum investments and shows a leap toward the acceptance of digital finance in the US.

As trading of these ETFs begins, it’s important to watch their performance and see how this will impact other cryptocurrencies.

0 Comments