New emerging cryptocurrencies are designed in a completely different way to distinguish themselves from more established coins like Bitcoin and Ethereum.

Many of them are creating innovative ideas and are focusing on decentralization and specific niches. Most of them emphasize the concept of community-driven governance – allowing holders to mandate how the project develops.

Emerging cryptos offer investors a fresh potential for growth and development, but they also come with risk.

The trick here is to get in early with the hopes that it will take off in popularity. In this post, we are going to review the top 10 best emerging cryptos of September 2024 to watch out for.

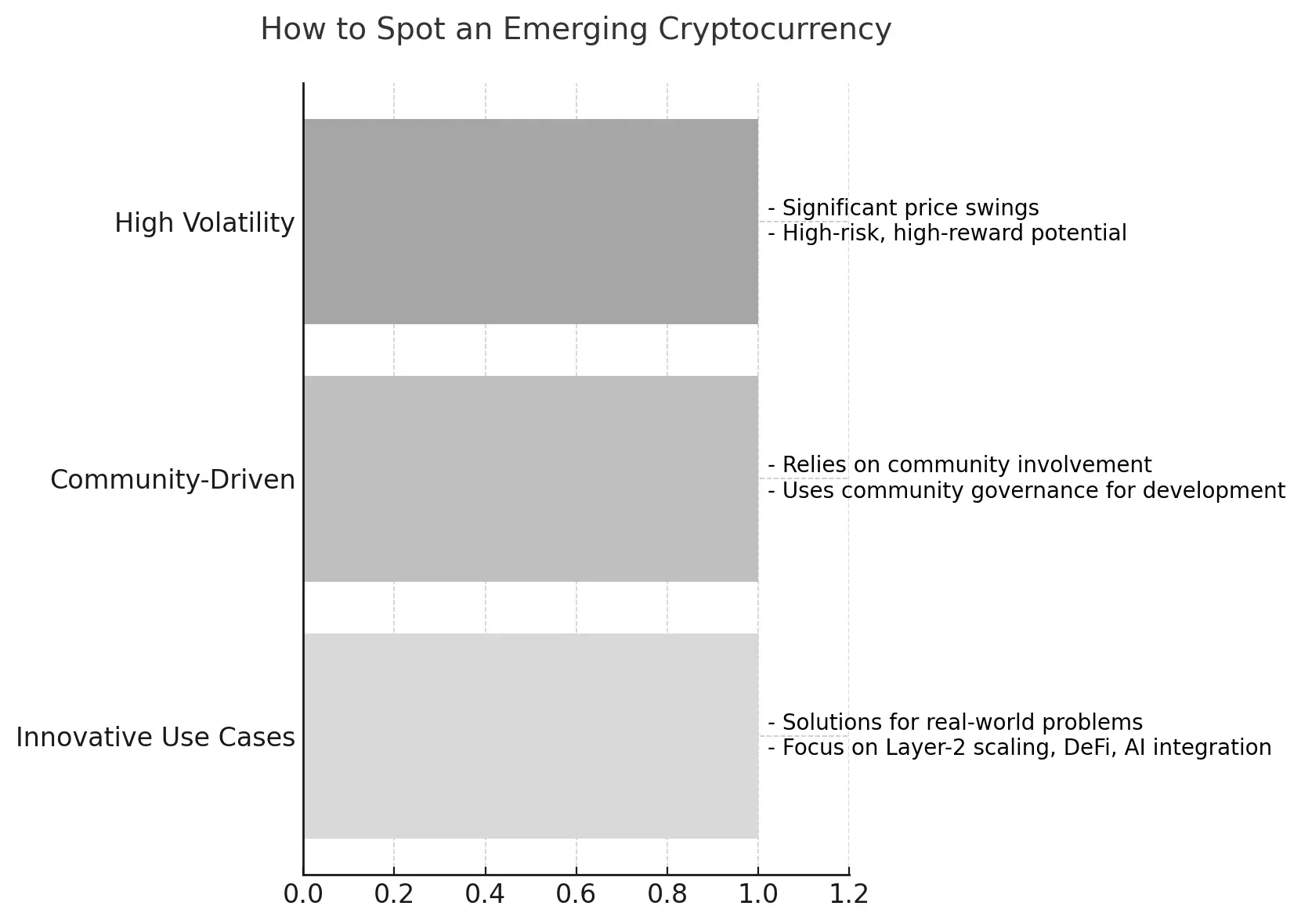

How to Spot an Emerging Cryptocurrency

There are tens of thousands of available cryptos to invest in. However, some key characteristics will help you identify emerging cryptocurrencies that are worth looking into further.

1️⃣Innovative Use

Most emerging cryptocurrencies begin by providing solutions for real problems. For example, Layer-2 scaling, which is used by Pepe Unchained (PEPU) is specifically built to lower the congestion and costs on the Ethereum blockchain. This makes it faster, cheaper, and more efficient. Another example is Renzo Protocol (REZ), which focuses on the DeFi space to offer liquid staking. This gives you the ability to earn rewards. Other new cryptocurrencies focus on AI integration to aid in automating tasks for businesses.

These types of innovative solutions that are completely separate from the commodity aspect of crypto like Bitcoin, are what sets these new cryptocurrencies apart.

2️⃣Community-Driven

Another characteristic of many emerging cryptos is their need for community involvement. Memereum (MEM) is known as a “meme crypto” and relies on its community to promote its success. While LayerZero (ZRO) uses community governance to create its protocols on the decentralized network.

3️⃣High Volatility

Nothing in this life comes without risk. The most telling sign of an emerging cryptocurrency is its significant price volatility. Many new coins experience dramatic swings and shifts daily. This can be a lucrative opportunity for some investors who are comfortable with high risk.

Market Trends That Are Driving the Emergence of New Cryptos

Layer-2 Solutions:

- Investors want faster, more efficient networks with lower transaction costs.

- These technologies help to lower congestion on major blockchains like Ethereum, making them highly attractive to users who want fast and cost-effective transactions.

DeFi and Staking:

- People want higher returns on their investments, and DeFi projects are making that possible.

- The accessibility and profitability of these platforms are getting the attention of both new and experienced crypto investors who want to earn more from their crypto.

Decentralization and Privacy:

- As centralized control and data privacy issues are on the rise, investors want projects focused on decentralization.

- Privacy-conscious users see these new platforms as important solutions as crypto is becoming more and more centralized and regulated.

Top 10 Emerging Cryptocurrencies to Watch For

1. Pepe Unchained (PEPU)

Established in 2023, Pepe Unchained was developed as a Layer-2 solution to address Ethereum’s congestion. It is a community-driven project, gaining traction during its presale and raising over $13 million in September 2024. The Cryptocurrency still has not set an official launch date for sale but this is one crypto we have our eyes on.

💪Strengths: Fast Layer-2 blockchain with low fees and staking rewards.

👎Weaknesses: Highly speculative and driven by community hype. This can cause unpredictable price swings.

2. MemeBet Token (MEMEBET)

In pre-sale as of September 2024, MemeBet aims to create a decentralized, no-KYC casino platform on Telegram. It’s marketed towards the privacy-focused, meme-enthusiastic audience, who wants gaming options with their crypto.

💪Strengths: No-KYC, highly private and anonymous.

👎Weaknesses: Extremely niche, limited to gaming and meme coin enthusiasts.

3. Ether.fi (ETHFI)

Ether.fi launched in March 2024 and focuses on decentralized staking for Ethereum. The main goal is to allow users to maintain control of their private keys. In September 2024, it has only gained momentum and is an emerging crypto to keep your eye on.

💪Strengths: Decentralized ETH staking with liquid staking options.

👎Weaknesses: Another niche-based market, appealing to Ethereum staking.

4. Renzo Protocol (REZ)

Renzo Protocol was built to simplify the complex world of liquid staking, specifically integrating with EigenLayer. This makes it easier for beginners who want to stake and restake their existing crypto on multiple networks.

💪Strengths: User-friendly liquid restaking with DeFi integration.

👎Weaknesses: Relies solely on the Ethereum and other DeFi ecosystems.

5. LayerZero (ZRO)

Launched in June 2024, LayerZero was designed to improve blockchain interoperability. This is a technology that allows different blockchains to “talk” to each other and share data. It was quickly adopted on the Ethereum, BNB, and Solana networks.

💪Strengths: Advanced blockchain interoperability, has already facilitated millions of transactions.

👎Weaknesses: Its use is very technical and more difficult for less-experienced users.

6. Sei (SEI)

Sei was initially introduced in early 2024 and is a high-performance blockchain. It focuses on scalability and fast transaction speeds. It’s meant for gaming and decentralized trading.

💪Strengths: Highly scalable with fast transaction speeds.

👎Weaknesses: There is a lot of competition in this sector.

7. WORLDWIDE WEBB (WWW)

WORLDWIDE WEBB was created to decentralize the internet. Its main goal is to allow users to control their data. It aims to build a censorship-free, decentralized web infrastructure.

💪Strengths: Great option for those who hold privacy high on their list.

👎Weaknesses: Success depends on the adoption of decentralized web services, which may take time.

8. Memereum (MEM)

Another meme-based token, Memereum has integrated DeFi functions into its system like staking and liquidity pooling. It offers insurance coverage for valuable assets like crypto.

💪Strengths: Uses DeFi for yield farming and staking.

👎Weaknesses: Its value is highly volatile, relying on social media trends and community hype.

9. Poodlana (POOD)

Poodlana is a fast, low-cost payment solution. It is meant to facilitate payment in areas with limited banking options.

💪Strengths: Fast, and low-cost transactions helping regions without the needed infrastructure.

👎Weaknesses: Saturated market.

10. Mega Dice (MDC)

Mega Dice is a decentralized gaming and casino platform. It focuses on offering fair gaming experiences with instant payouts via smart contracts.

💪Strengths: Prides itself on transparency and instant payouts.

👎Weaknesses: Limited appeal to the online gaming and gambling niche.

How to Identify Promising Emerging Cryptocurrencies

Check the Project’s Utility: Understand whether the cryptocurrency solves a real-world problem or has a unique use case.

Evaluate the Team and Partnerships: Strong partnerships and an intelligent team are indicators of success.

Analyze Market Trends: Look for alignment with growing market trends like DeFi, scalability, and privacy.

How To Maximize Returns with Emerging Cryptos

There are three main strategies to help get the most out of investing in emerging cryptos: Diversification, staying updated and informed, and learning about staking and yield farming.

Diversification➡️ One of the smartest strategies in investing, you must balance new, high-risk coins with more established cryptocurrencies like Bitcoin, Ethereum, and Tether. While emerging cryptos are exciting and can provide the chance to make a quick return, the safety of investing in stable assets will help to protect the fluctuations of new coins and tokens.

Stay Updated➡️ To maximize your return potential, stay up to date on the newest developments in the crypto and blockchain world. Pay attention to community updates, tech upgrades, and new product releases for the best profitable cryptocurrencies.

This is ideal for those with a strong interest in the world of crypto and not recommended for those seeking a stable long-term investment.

Staking and Yield Farming➡️ Another way to increase your returns is by participating in staking programs or yield farming. Many emerging crypto offer this option to help you boost your earnings. It’s a smart tool used by these crypto developers to keep you invested for longer, reducing short-term trading, but on the flip side, you have the potential to earn more.

Protecting Your Cryptocurrency Investments

One of the most important steps in protecting your cryptocurrency investments is securing them in a cold hardware wallet.

Unlike hot wallets, which are connected to the internet and vulnerable to hacking, cold wallets are offline devices that store your private keys securely.

For your long-term HODLING investments like BTC, ETH, and USDT, use cold crypto wallets like Material for secure protection.

How to Approach Investments in New Cryptocurrencies

While investing in emerging cryptocurrencies can provide high potential returns, it also carries risks.

It’s crucial to research thoroughly, stay updated with market trends, and only invest what you can afford to lose.

Emerging cryptos are exciting because they represent the cutting edge of blockchain technology, but caution and strategy are key to your success.

0 Comments