Imagine this scenario: You have BTC investments, Bitcoin is crashing, the news is full of negative headlines and social media is in panic mode.

What do you do?

Is it time to sell? Or rather, is this the perfect time to buy?

On the other hand, when Bitcoin prices are rising, should you jump on this pump too, or be cautious?

This is where knowing how to use the Fear and Greed Index is vital.

It’s a simple but useful tool that tracks overall market sentiment.

It’s meant to help you decide whether to buy, sell, or HODL your crypto.

Your Crypto Security Partner

At Material Bitcoin, we specialize in helping you learn about the crypto market.

Whether you’re protecting your Bitcoin in our cold storage wallet or looking for expert insights, we provide the tools and knowledge you need to make informed decisions.

In this guide, we’ll explore the Fear and Greed Index, explain how it works, and show you how to use it to your advantage.

What Is the Fear and Greed Index?

The Fear and Greed Index is a well-known and used market indicator.

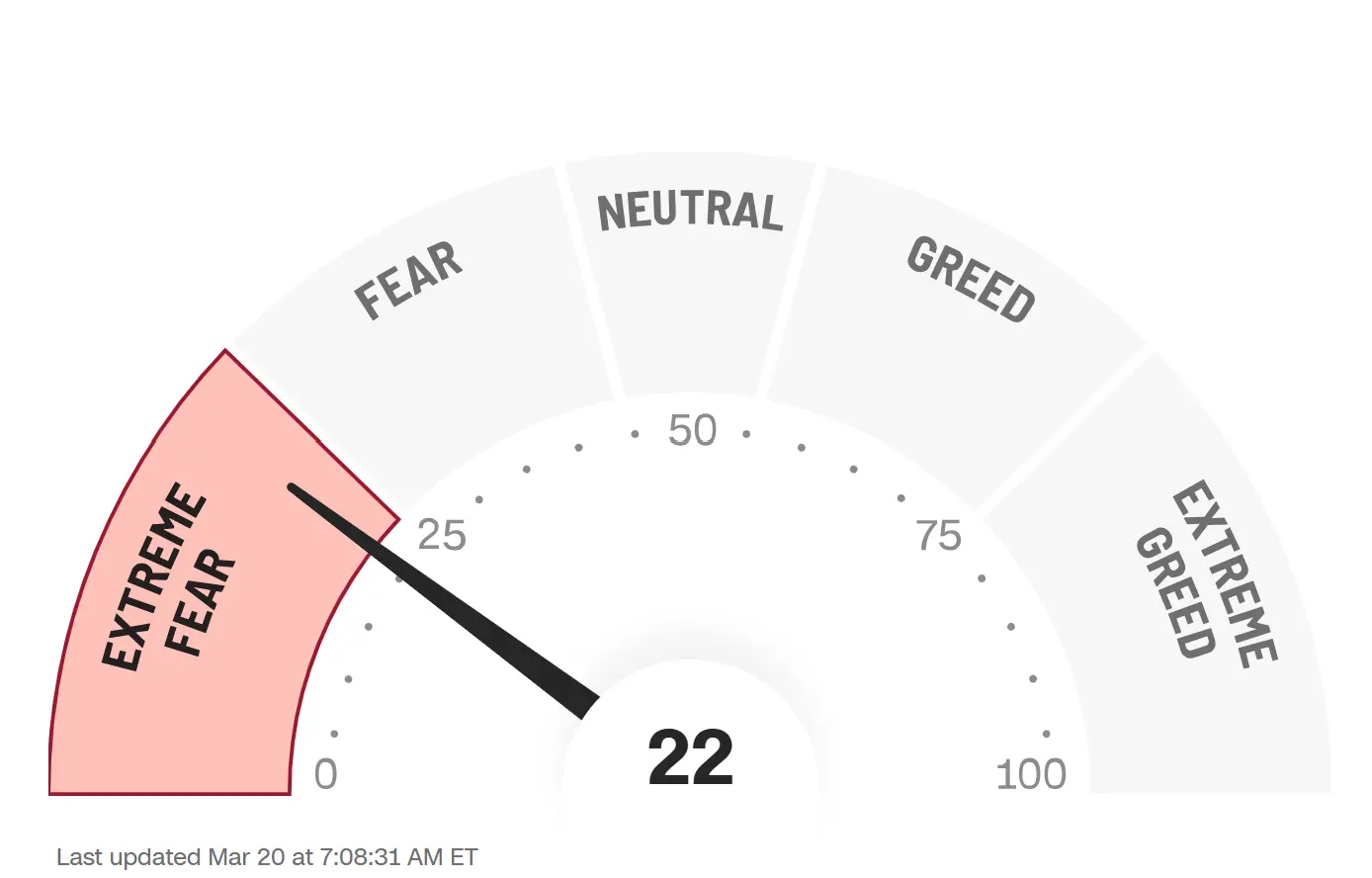

It assigns a numerical “value” to the emotional state of investors, ranging from extreme fear to extreme greed.

This is a crucial tool to understand and use to your advantage as crypto markets are heavily influenced by investor sentiment.

Traditional Assets vs Cryptocurrency

Stocks typically base their evaluations on fundamental earning reports and economic indicators.

Bitcoin and other crypto have larger influences driven by speculation, hype, and emotion.

How Does the Fear and Greed Index Work?

This index is calculated using multiple data sources that demonstrate investor emotions.

Each section influences the final score, which ranges from 0 (extreme fear) to 100 (extreme greed).

Let’s examine this example:

In March 2020, during the COVID-19 crash, the index hit 10 (Extreme Fear). Bitcoin was at $6,000. Buying at this moment turned out to be an amazing opportunity.

Later, in November 2021, Bitcoin hit $60,000. The index was at 90 (Extreme Greed), just before a major plummet.

@squidmandryk Fear and greed index allows you to turn market emotion into strategy – fear can fuel bargains, greed signals caution #crypto #cryptocurrency #fearandgreed #index #web3 #bitcoin ♬ original sound – squidmandryk

Recent Fear and Greed Index Sentiments

📊 Data sourced from CoinMarketCap Fear & Greed Index.

Why Is the Fear and Greed Index Useful?

1. Helps Identify Market Trends

- If the index stays in extreme greed for too long, this usually means that a correction in the market is coming.

2. Avoids Emotional Investing

- Many people panic sell during fear and FOMO buy during greed. Using the index will help traders step back and analyze rationally before making crazy buying or selling decisions.

3. Useful for Timing Entries & Exits

- Using the Fear and Greed index along with other strategies, like Buying the Dip and DCA can improve how you buy Bitcoin and when.

@mullzer_ What is the crypto fear & greed index & why is it important? #Crypto #Index #FOMC #Trading #Fearandgreed ♬ You Can Do It – Instrumental – Ice Cube

How the Fear and Greed Index Works: What Do the Scores Mean?

The Fear and Greed Index assigns a score between 0 and 100.

The scale is divided into five key zones:

How to Use the Fear and Greed Index to Your Advantage

This is a useful tool, but knowing how to use the fear and greed index correctly is key.

While this index doesn’t predict the exact market movement, it is a great way to help you understand the overall “feeling” of the market and what other investors are doing.

Buy During Extreme Fear (0-24)

Historically speaking, when the index falls below 25, Bitcoin has often been “cheap”, meaning that it’s a good time to buy.

This might seem contradictory when market-wide panic is causing so many people to oversell, pushing prices lower than their fair value.

But, this is something to take advantage of!

When the index is in Extreme Fear, most experts recommend buying Bitcoin and other strong cryptocurrencies rather than selling in panic.

@financiallyvictoria 🤔 Want to know how investors are feeling and what they are doing with their money? Meet the Fear and Greed Index 🤗 She’s the mood ring of the stock market. It’s a great indicator to check on but NOT something to base your investment decisions off of. Keep calm and invest on! #investingforbeginners #investing101 #investingtips #financialliteracy ♬ original sound – Smarter Than A Finance Bro

Be Cautious During Extreme Greed (75-100)

When the index reaches above 75, FOMO (fear of missing out) hits many investors.

Retail investors rush into the market and by default, they push prices up quickly and unsustainably.

This is usually a good time to sell (if you are an active trader).

Your takeaway is to avoid impulse purchasing that is driven by hype and keep an eye out for potential corrections.

What is a Retail Investor?

A retail investor is a non-professional investor who uses their own money to buy stocks, crypto, or other assets, typically using personal accounts instead of institutions or hedge funds.

Strategies for Using the Fear and Greed Index When Buying Crypto

As the crypto market is so volatile, understanding different investing strategies and putting them to use can improve your crypto portfolio and lower your emotional bias.

Buying the Dip vs. The Fear and Greed Index

One of the most common crypto investment strategies is Buying the Dip.

But not every price drop is a big enough dip to put large amounts of money into.

The Fear and Greed Index can help you to confirm whether a price drop is temporary or an indicator of a bear market.

Dollar-Cost Averaging (DCA) Strategy and the Fear & Greed Index

Instead of trying to time the market, Dollar-Cost Averaging (DCA) is a method where you invest a fixed amount on a pre-determined schedule.

It can range from weekly, bi-weekly, or monthly purchases of crypto.

This strategy is meant to remove the stress of figuring out the “perfect” time to buy.

How to Use DCA with the Fear & Greed Index

💰 Stick to regular DCA investments, regardless of market conditions.

📉 When the index shows Extreme Fear (below 20), increase your DCA amounts to capitalize on lower prices.

⚠️ Avoid panic-buying during Extreme Greed (above 80).

Contrarian Investing: Going Against the General Public

Taking the contrarian approach means exactly what the name states: you make decisions opposite of the crowd.

When the Fear and Greed Index is at Extreme Fear, most people are selling out of panic.

You are not to sell!

When the index hits below 10 (Extreme Fear), accumulate Bitcoin and other altcoins.

Buying Crypto and Secure Cold Storage

If you’re investing in Bitcoin and other cryptocurrencies for the long haul, the Fear and Greed Index can be a very useful tool.

However, once you’ve purchased your crypto, where you store them is just as important as when you buy them.

Many HODLers prefer to store their Bitcoin in cold storage wallets.

Cold Wallets keep your crypto offline and away from hacking risks.

Why Use a Cold Wallet for Long-Term Crypto Storage?

Unlike hot wallets, which are connected to the internet and therefore vulnerable to hacks, cold wallets are completely offline.

Material Bitcoin

If you’re looking for the highest level of security, a metal cold wallet like Material Bitcoin is the most reliable way to protect your crypto.

📴🌐100% Offline: No electronic components, meaning zero hacking risk.

🔥💧Fireproof & Waterproof: Made from high-grade stainless steel.

🚫🔐Tamper-Resistant: Cannot be remotely accessed.

⏳🔗Long-Term Reliability: Material Bitcoin comes with a lifetime guarantee.

Using the Fear & Greed Index with Cold Storage

1️⃣ Use the Fear and Greed Index to identify strong buying opportunities during market downturns.

2️⃣ Accumulate Bitcoin and move it to a cold wallet like Material Bitcoin for long-term security.

3️⃣ Forget daily price swings, your assets are safe, and you can hold for future crypto bull runs.

If you’re serious about Bitcoin as a long-term investment, don’t just buy it, protect it.

Subscribe to our Newsletter to stay on top of all Bitcoin-related news and insights and receive a $10 off coupon to use towards your Material Bitcoin Wallet.

Join our newsletter to get a $10 coupon!

FAQ

What is the Fear and Greed Index?

- It’s a market sentiment tool that ranges from 0 (Extreme Fear) to 100 (Extreme Greed), to help investors decide when to buy, sell, or hold crypto.

How can it improve my Bitcoin investing?

- It helps to guide you on when to buy, such as in extreme fear, and when not to buy, like in Extreme greed.

What’s the best investment strategy?

- Being aware of all the different investment strategies is ideal. Try mixing elements of Buying the Dip and DCA along with the Fear and Greed Index to make rational yet profitable choices.

How should I store my Bitcoin long-term?

- Use a metal cold wallet like Material Bitcoin for maximum security.

0 Comments