Why Buy Tether or USDT

Why Buy Tether or USDT Why choose Tether (USDT) among all the cryptocurrencies at our disposal? Tether (USDT), known as a stablecoin tied to the value of the US dollar, offers an option that combines stability and growth potential.

Why consider Tether as a long-term investment?

Stability over volatility: Cryptocurrencies are known for their volatility, but USDT, anchored to the dollar, provides a more predictable investment. Protection against inflation: Backed by a fiat currency, USDT can act as a refuge during inflationary periods. Investing in Tether involves not only seeking short-term gains but also preserving capital over time. That’s why it’s part of the list of the top 5 cryptocurrencies for long-term investment.

How to buy Tether

I’ll talk about the different options you have when deciding where to buy Tether, some safer, others more private.

Buying Tether from a centralized exchange

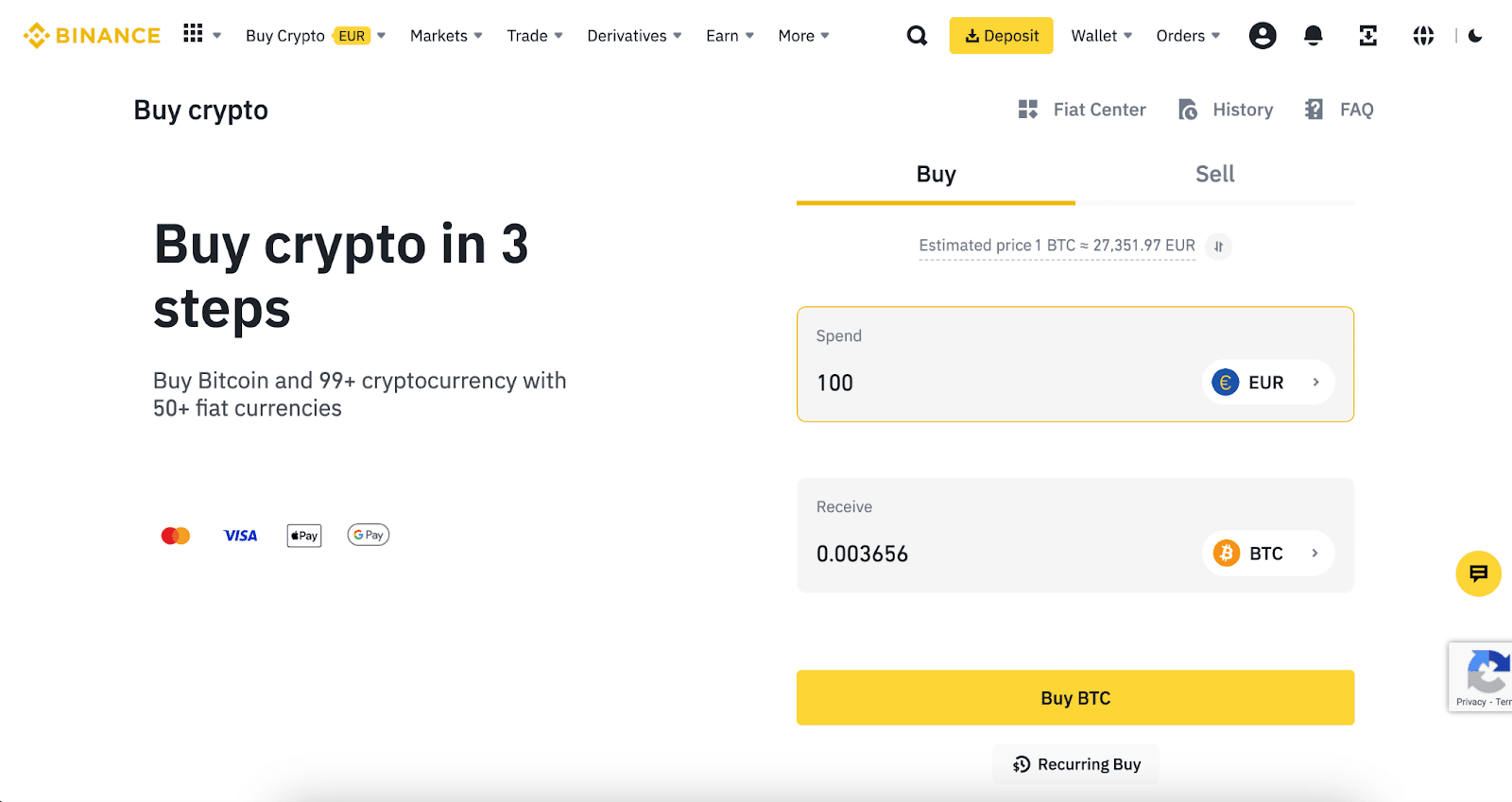

A centralized exchange (CEX) is a platform that acts as an intermediary in buying/selling. They are the most well-known (Binance, Coinbase, Bitvavo, etc.) and tend to be safer than non-centralized ones, as they are subject to more regulations and obligations in different countries.

Buying Tether from an exchange is much simpler than you might think. The most challenging part is choosing which exchange to use, as there are many fraudulent platforms.

Steps to buy Tether on a Centralized Exchange:

-

- Registration on an exchange: create an account on a trusted exchange and complete the verification process.

- Deposit funds: add funds to your account using secure methods like bank transfers or credit cards.

- Select Tether: look for the option to buy Tether on the platform.

- Make the purchase: determine the amount and confirm the transaction.

Importance of a Secure Exchange:

Security is paramount when buying cryptocurrencies. Choose exchanges with robust security measures, such as two-factor authentication (2FA) and cold storage of assets.

Buying Tether from a Decentralized Exchange

Decentralized exchanges (DEX) offer an alternative that emphasizes privacy and authenticity in transactions.

To give you an idea, these exchanges operate on blockchain networks and use smart contracts to facilitate transactions without relying on a central entity. This can make them more vulnerable to hacker attacks, for example. What is true is that they offer more privacy.

Steps to buy Tether on a Decentralized Exchange:

- Choose a reliable DEX: select a reputable decentralized exchange with good reviews. Like Uniswap or OKX DEX.

- Set up your wallet: create or import your wallet compatible with the selected DEX.

- Make the transaction: explore Tether options, choose the amount, and complete the transaction.

DEXs offer a more direct and private approach to acquiring Tether, but the choice between centralized and decentralized depends on your security and comfort preferences.

How to Sell Tether

Selling Tether involves following almost the same steps as buying. Choosing a reliable exchange is key, and security should be a priority throughout the process.

- Access your account: log in to your account on the selected exchange. If you don’t have an account yet, sign up (as in the case of buying).

- Transfer your USDT: go to the deposits or funds section in your account and select the option to deposit or transfer Tether. Use the deposit address provided by the exchange.

- Select the Exchange pair: once your USDT is on the exchange, select the desired exchange pair. If you plan to sell your Tether for Bitcoin, for example, look for the USDT/BTC pair.

- Make the sale: Place a sell order with the desired amount of Tether and confirm the transaction. You can opt for a market order for an immediate sale or a limit order to specify the price.

- Withdraw your funds: once you have sold your Tether, withdraw the funds to your linked bank account or your wallet.

Where to Store Tether Safely

It is crucial to store your USDT in a secure place, and for that, there are different ways to do it. Let’s see them.

Options to store Tether securely:

Hot wallets: virtual wallets connected to the internet and vulnerable to hacks and thefts. When you leave your cryptocurrencies on the exchange, you make them vulnerable to this type of danger, as you are using a hot wallet.

Cold wallets: physical wallets not connected to the internet and prevent this type of attacks. Anyway, whatever your need (hot or cold), I leave you an article for you to evaluate the best USDT wallets.

Why choose cold wallets:

- Protection against cyber attacks: being not connected to the internet, cold wallets are immune to online threats.

- Total control: you maintain total control of your private keys, minimizing dependence on third parties.

Dangers of leaving cryptocurrencies on the exchange:

- Vulnerability to cyber attacks: exchanges can be a target for attacks, jeopardizing your assets.

- Dependence on third parties: by leaving your cryptos on the exchange, you trust the platform’s security, as the control of your cryptos relies on it.

The best place to store USDT

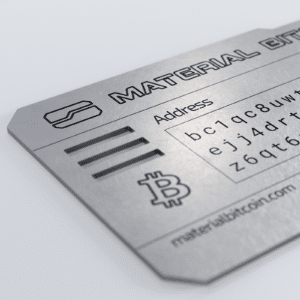

To give you an idea of a genuinely secure device to store USDT, I present you Material.

Material is a hyper-resistant steel device that stores your USDT completely offline, ensuring that nothing and no one can take them away from you. And when I say nothing, it’s because it’s also resistant to all kinds of physical dangers (fire, water, or impacts), setting it apart from the majority of devices.

You simply buy Tether, provide the address of your Material wallet to receive them, and store them securely for the long term, waiting for their value to increase over time.

It’s simple, right? Here it is, in case you’re interested.

Frequently Asked Questions about Buying and Selling Tether (USDT)

How to buy Tether with other cryptocurrencies?

Buying Tether with other cryptocurrencies is a common process on many exchanges. Regardless of the exchange, you should follow these steps:

- Select the exchange pair: on the exchange, choose the exchange pair corresponding to the cryptocurrency you want to exchange for Tether, for example, USDT/BTC to exchange for bitcoin.

- Perform the transaction: place an exchange order, either market or limit, according to your preferences. Confirm the transaction.

- Verify your balance: once the transaction is completed, verify your balance to ensure that you now have the desired amount of Tether.

How to buy Tether without registration?

Most reliable exchanges require some level of registration and verification due to regulations against money laundering and terrorism financing. However, you can explore peer-to-peer (P2P) exchange options where transactions can be conducted without exhaustive registration, as mentioned before, on decentralized exchanges.

How to buy USDT with Paypal?

Buying Tether with PayPal may not be a direct option on many exchanges, as the payment platform has restrictive policies on cryptocurrency transactions. Instead, you can consider buying Bitcoin with PayPal and then exchanging Bitcoin for Tether. For example, with the Bitvavo exchange, you can deposit directly using PayPal and buy cryptos with that deposit.

What is the fee for buying Tether?

The fees for buying Tether vary depending on various factors, including the exchange, the amount of USDT you are buying, your geographical location, the payment method used, and market conditions at that time. Check the fee structure of the chosen exchange for specific information.

Conclusion:

In conclusion, buying and selling Tether involves understanding the specific processes of exchanges, choosing secure methods, and knowing the best practices for cryptocurrency management. From choosing a secure exchange to selecting the safest storage method.

And that’s it! If you have any questions about buying Tether, leave them in the comments, and we’ll respond as soon as possible.

0 Comments