Bitcoin is the world’s largest and most well-known cryptocurrency.

Despite its volatility and recent regulatory changes, it will remain the main player in the crypto investing game.

As global events affect and shape the price of Bitcoin, many new and even experienced investors ask themselves: “Is it the right time to buy Bitcoin?“

In this post, we are going to look at the current state of BTC and the various factors that have impacted global economic markets. We will also examine the risks involved and compare Bitcoin to other investment classes.

Is it a Good Time to Invest in Bitcoin?

Undoubtedly, Bitcoin has had an impressive run from its start.

Although prices have fluctuated greatly from time to time, with some notable crashes throughout the years, the total BTC trend has been on the up.

Understanding Bitcoin’s Volatility

Bitcoin is still one of the most volatile assets in the financial market.

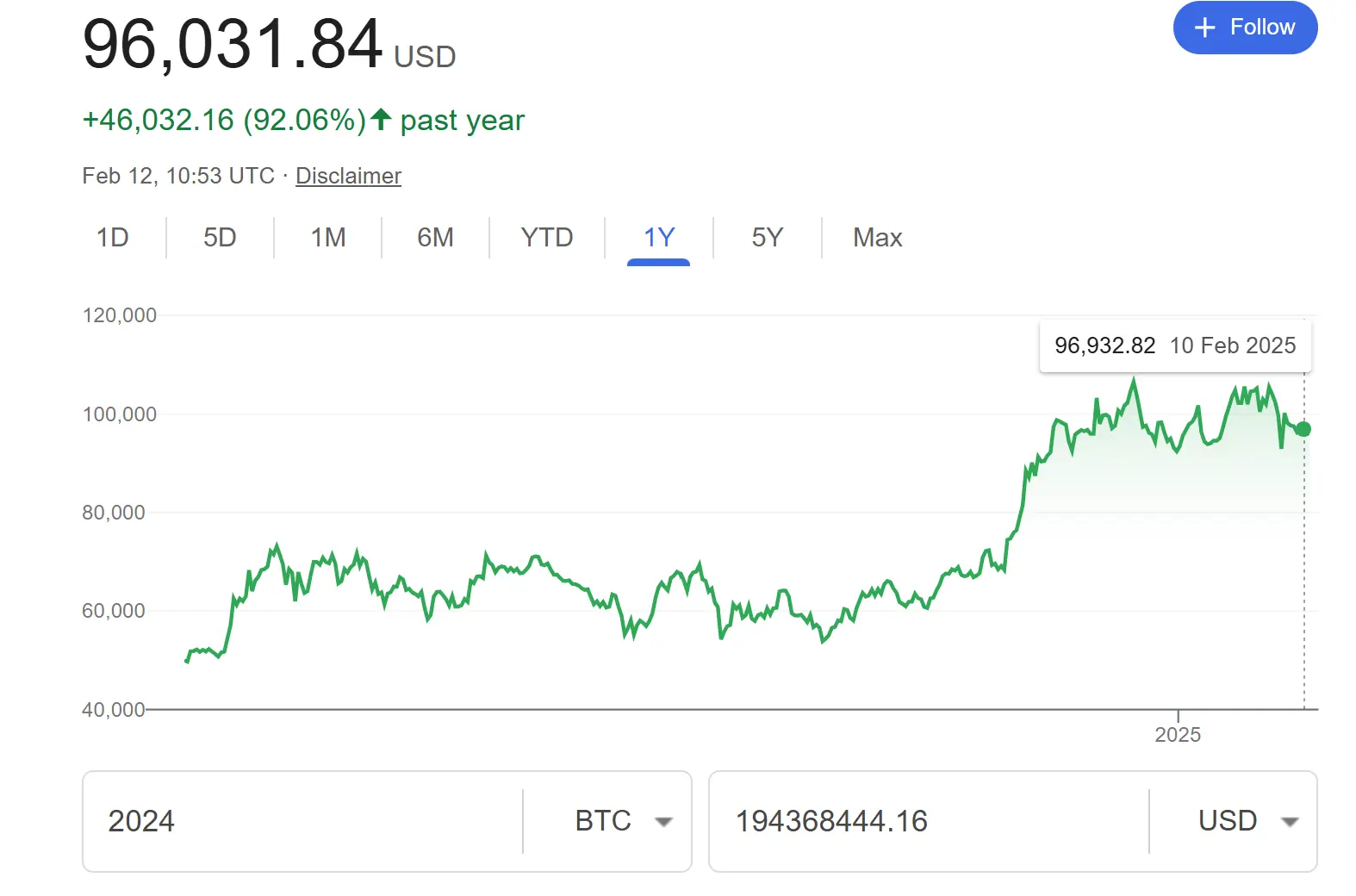

In 2024, its price had significant movement, rising to around $73,000 in March, then later dipping to the $50,000 mark.

But, by the end of the year, prices started skyrocketing, and early 2025 is holding onto these higher price points.

The average return from January 2024 to February 2025 is about 128.82%.

Not too shabby, if you ask me!

Bitcoin Monthly Prices

Bitcoin Price History

| Date | High (USD) | Close (USD) |

|---|---|---|

| February 2025 | $102,755.73 | $97,437.56 |

| January 2025 | $109,114.88 | $102,405.03 |

| December 2024 | $108,268.45 | $93,429.20 |

| November 2024 | $99,655.50 | $96,449.06 |

| October 2024 | $73,577.21 | $70,215.19 |

| September 2024 | $66,480.70 | $63,329.50 |

| August 2024 | $65,593.24 | $58,969.90 |

| July 2024 | $69,987.54 | $64,619.25 |

| June 2024 | $71,907.85 | $62,678.29 |

| May 2024 | $71,946.46 | $67,491.41 |

| April 2024 | $72,715.36 | $60,636.86 |

| March 2024 | $73,750.07 | $71,333.65 |

| February 2024 | $63,913.13 | $61,198.38 |

| January 2024 | $48,969.37 | $42,582.61 |

This volatility might seem scary, but actually, it offers good opportunities for both traders and long-term investors.

Factors Influencing Bitcoin’s Price Today

Different influences have impacted Bitcoin’s price changes. The main influences are regulatory developments and global institutional interest.

Last year, the SEC approved the first 11 Bitcoin spot ETFs in the United States, which boosted Bitcoin interest around the world.

Other influences, like policy regulations, tax implications and responsibilities as well as inflation rates and hedging against fiat currency have all added to the price changes in BTC.

Compare Bitcoin and Fiat Currency in real-time

The Impact of Economic Trends on Bitcoin

Many global issues have risen, contributing to fears and therefore price fluctuations.

For example, Bitcoin’s price movements have been closely linked to stock prices in the sense that investors and traders are treating crypto the same way they treat stocks.

This means that price movements trend similarly.

Aspects like supply and demand, geopolitics, and regulations all affect both traditional stocks and Bitcoin.

Influences Affecting Price: Traditional Stocks vs. Bitcoin

| Factor | Traditional Stocks | Bitcoin |

|---|---|---|

| Economic Reports | High Influence | Moderate Influence |

| Interest Rates | High Influence | Moderate Influence |

| Corporate Earnings | High Influence | No Influence |

| Government Regulations | Moderate Influence | High Influence |

| Global Events | Moderate Influence | Moderate Influence |

| Technological Development | Low Influence | High Influence |

| Market Sentiment | Moderate Influence | High Influence |

| Adoption & Usage | No Influence | High Influence |

| Halving Events | No Influence | High Influence |

Long-term vs. Short-term Investing

Bitcoin investors typically fall into two categories:

1️⃣Long-term holders (HODLers)

2️⃣Short-term traders

Each investing strategy has its own risks and objectives.

Long-Term Investing

In general, most experts will always suggest taking a long-term hold stance on investing in Bitcoin.

This strategy has proven to be profitable, as BTC has had impressive long-term growth regardless of its volatility.

❗Remember to always store your Bitcoin in a long-term cold wallet for protection.

🔥 Bitcoin Fact: Bitcoin has a limited supply of 21 million coins.

As it becomes more popular and adopted by global institutions, its appeal for long-term investing is ideal.

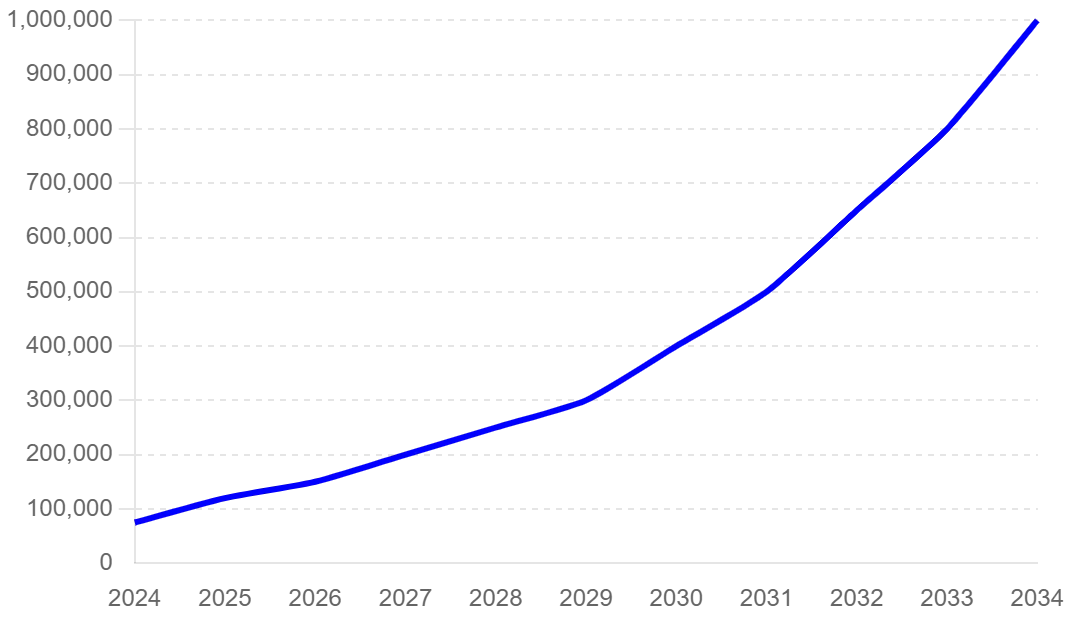

Some experts are predicting a bullish upcoming year, forecasting that Bitcoin will reach between $150,00 – $200,000 within the next year.

So, just how long should you hold onto Bitcoin?

Although all signs are pointing for you to invest in the long term, you need to clearly understand your risk tolerances and know not to panic when prices drop.

Throughout the long term (10-year minimum), prices will fluctuate.

If you are comfortable riding out the ups and downs and see the potential in the future of crypto, then it’s a great time to invest in Bitcoin as predictions are pointing for it to only grow in value.

Bitcoin Price Predictions (2024 – 2034)

Bitcoin for Short-Term Traders

The biggest question to ask yourself is if it’s worth the risk.

Yes, short-term trading in Bitcoin can be very profitable but comes with increased risks, especially for those who are not experienced experts.

Recently, Bitcoin’s prices have swung dramatically, providing good opportunities for day traders and swing traders to capitalize on these movements.

But, they require sophisticated tools and an expert understanding of technical analysis.

While there is a potential for making high and quick profits, the risk tolerance needed is extremely high and requires someone who can make fast, non-emotional decisions.

❗ Anyone who is going to take this on must understand that it will be a full-time job, monitoring the market and analyzing performance tools multiple times a day ❗

Comparing Bitcoin to Traditional Investments

When we look at traditional assets like gold, real estate, and stocks, Bitcoin has historically had a much higher return.

Gold is one of the most popular comparisons due to its function and ability to hedge against inflation. Bitcoin has commonly been called “digital gold” for that reason.

When deciding whether or not Bitcoin is safe, you always want to look at other investments and asset classes and compare their returns to your personal goals and risk tolerances.

As of publishing this article, financial institutions, and assets have had notable performances.

Asset Performance Overview:

🪙Bitcoin (BTC): Currently trading at $96,131, Bitcoin has experienced a slight decline from previous months but has grown 91.29% from one year ago.

💰Gold (per oz): Is currently priced at $2890.91, up by 45.81% from this time last year.

📈S&P 500: The S&P 500 is currently at 6040.53, up by 24.66% from last year.

It is clear that Bitcoin has made the largest impact and growth over the last 12 months and has proven to be a leading asset investment.

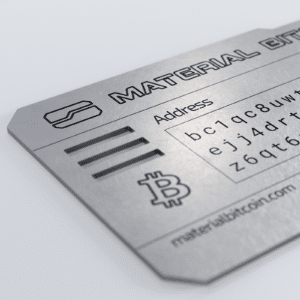

🔐 Material Bitcoin is the safest and easiest way to store and protect your Bitcoin investment.

✅ It is user-friendly and one of the best hardware wallets available.

❄️ It’s a 100% true cold wallet, keeping your private keys offline for maximum security.

What are the Risks of Buying Bitcoin Today?

Bitcoin has great potential, but it’s important to understand its risks.

Let’s break down the key factors to consider when evaluating whether it is a good time to buy Bitcoin or not.

There are three things you should consider…

1️⃣Just how volatile is Bitcoin and can you handle it?

2️⃣Can you handle Bitcoin market corrections?

3️⃣Is Bitcoin really a safe investment? – Says who?

As we’ve mentioned time and time again, Bitcoin is known for its volatility, so ways to help mitigate those risks are to:

➡️Diversify: Spread your money across different assets to reduce the impact of wild price swings or crashes.

➡️Dollar-Cost Averaging: Set up a fixed price amount to invest in Bitcoin regularly. This helps to reduce the impact of sudden price swings.

When big regulatory news or global economic events occur, it’s common for price corrections to hit.

We’ve seen this happen time and time again.

Some of these changes are brought on by a shift in U.S. Federal Reserve policies.

On the other hand, many in the U.S. and around the world say regardless of these price changes and corrections, BTC always recovers.

Therefore, the debate about Bitcoin being a good and safe investment carries on.

When is the Best Time to Buy Bitcoin?

| Strategy | How To |

|---|---|

| Buying Bitcoin During Dips |

Risks: Prices may continue to fall further, so this strategy works best for investors who can tolerate volatility. |

| Using Dollar-Cost Averaging (DCA) |

This helps to reduce the impact of volatility and avoids the risk of investing a large sum at a market peak. |

| Major Events Impacting Bitcoin’s Price (Halving, ETFs) |

Tip: Investors monitor these events closely for potential buying opportunities.

|

What Experts Say About Bitcoin For The Future

Leading financial experts have been widely addressing Bitcoin and other cryptocurrencies in terms of their performance for 2025 and beyond.

Some key takeaways come from the CEO of ARK Invest, Cathie Wood who keeps a strong bullish view on Bitcoin. She predicts that BTC will surpass the $1 million mark by the end of 2030.

While Fidelity Investment Group has gone as far as to predict that Bitcoin could reach $1 billion by 2050. Keep in mind that these projections are speculative and discussions among the investment community, and it is an interesting topic to follow.

Watch the full video of Greg Foss (one of Canada’s leaders in Bitcoin and hedge investing) explaining Fidelity’s predictions.

Is It a Good Time to Buy Bitcoin vs. Other Cryptocurrencies?

Bitcoin is the most influential cryptocurrency, as it continues to lead the market in terms of capitalization and adoption.

As Ethereum has moved to full PoS (proof-of-stake), it has significantly changed its market influence.

By introducing staking, ETH now gives holders the ability to earn yield which has undoubtedly increased its price performance compared to BTC.

Top Altcoins To Be On The Lookout For

In 2025, a few altcoins are showing growth and could be your chance to invest.

Bitcoin vs. Other Cryptocurrencies: 2025 Performance

| Cryptocurrency | Price | Market Cap (Billion) |

|---|---|---|

| BTC | $96,172 | $1,800 |

| ETH | $2,619 | $314 |

| SOL | $196.37 | $65 |

| AVAX | $24.98 | $8.9 |

| FET | $0.7408 | $0.55 |

| AGIX | $0.3536 | $0.4 |

When assessing your investments, you must think about many factors. Consider technology advancements, market adoption, your personal risk tolerances, and global influences (elections, geopolitics, tariffs, etc).

FAQs

Should I invest in Bitcoin right now?

- Yes, as Bitcoin has proven to have long-term potential, it’s a good investment to include in your portfolio. Using DCA is a great strategy to combat when to buy BTC.

What major events should I watch for Bitcoin price changes?

- Bitcoin halvings, ETF launches, and regulatory updates are major events that can impact its price.

Is Bitcoin a safe investment compared to other cryptocurrencies?

- Bitcoin is the most established crypto on the market, making it a more secure choice.

How much of my portfolio should be in Bitcoin?

- It depends on your risk tolerance. Generally, most experts suggest investing about 5% into BTC.

Will Bitcoin’s price go back up?

- While Bitcoin’s price fluctuates, its long-term trend has been upward. Experts believe it will only continue to rise in value over the next decade.

0 Comments