Bitcoin has become a household name and is the largest and most “successful” cryptocurrency to date.

From volatile dips to all-time highs, it’s easy to see why Bitcoin has become an intriguing digital asset. More and more people around the globe are taking notice and are more easily convinced to buy Bitcoin than they were 10 years ago.

But, is it safe to invest in Bitcoin?

In this post, we will break down the risks of investing in Bitcoin, what steps you can take to secure your crypto, and whether BTC is still a good choice for future investments.

The Risks of Bitcoin’s Market Volatility

Bitcoin is notorious for having crazy swing prices.

Compared to traditional commodities and investment assets like gold or stocks, the value of Bitcoin can change dramatically in a very short period.

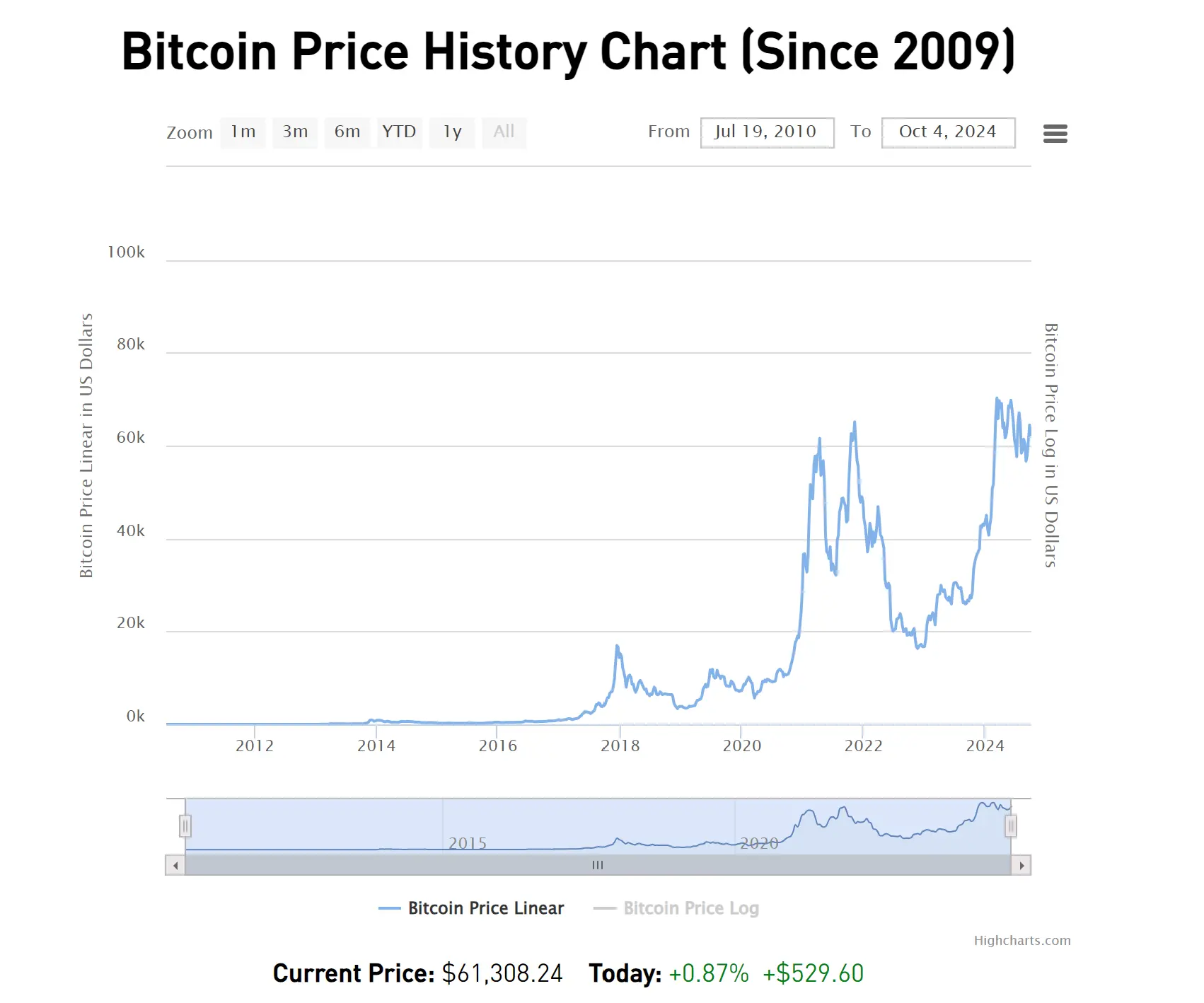

Most people will recall the Bitcoin boom in 2017, when the value reached an all-time high (up to that point) of almost $20,000 almost overnight, before dropping to only about $3,000 in 2018.

This incident did two things for Bitcoin:

1️⃣Put it on the global map and gain recognition.

2️⃣Scare investors to question whether or not it is safe to invest in Bitcoin.

Jump ahead to 2021 and Bitcoin was at another high, valued at around $64,000 but then later plummeted to $30,000 a few months later.

These types of examples scare a majority of investors who are not well-versed in investment strategies or understand how markets can work.

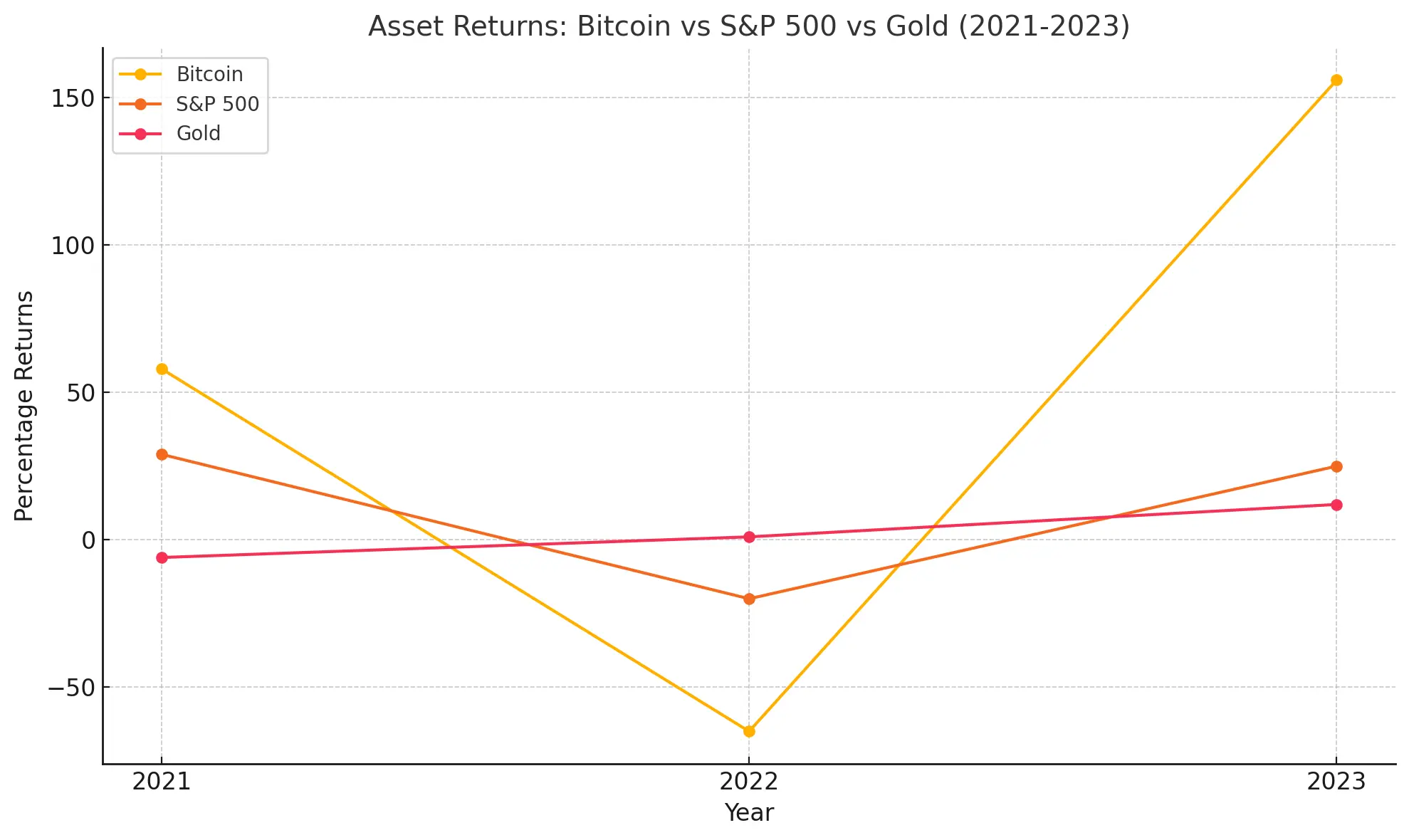

Compared to the S&P 500 and Gold, Bitcoin Returns are immense.

So? What is driving these crazy Bitcoin prices and dips?

Speculation & Predictions: From leading experts and investors, Bitcoin’s prices can be influenced by predictions from analysis.

Media Hype: News coverage and public interest can cause significant price movements. This includes social media influence like we saw happen with Elon Musk.

Endorsements: High-profile figures promoting or mentioning Bitcoin can cause sudden price spikes or drops.

For example, in 2021 Tesla announced that they bought $1.5 billion worth of Bitcoin. This bumped BTC by 20% in a single day!

Government Involvement and Regulations: Upcoming U.S. elections and new SEC regulations can impact the price of Bitcoin for the good or the bad.

Is Bitcoin a Safe Long-Term Investment?

Despite being volatile, Bitcoin has a proven track record of being a great long-term investment for holding.

Over the past 10 years, Bitcoin’s long-term growth has outshined any other asset, including stocks and gold.

Did You Know?

On average, Bitcoin has returned 671% per year.

Someone who bought Bitcoin at the beginning of 2017 for around $1,000 would have seen their investment multiply dramatically to over $60,000 today.

In comparison, short-term traders or emotional investors who have not revised their risk tolerances might have sold during the crashes of 2018 and 2021.

Knowing how long to hold Bitcoin can be tricky for some who especially have a low-risk tolerance. But remember to look at the historical data to make educated predictions about future returns.

Nothing is ever guaranteed, but compared to all other investment classes, Bitcoin continues to surpass all of them.

What Are The Risks of Investing in Bitcoin?

Like any other asset that you put money into, there are always certain risks as nothing is ever guaranteed.

Here is a look at some of the biggest risks in crypto and what you can do to protect yourself.

How Safe is Bitcoin from Hackers?

Bitcoin’s security is built on the technology of the blockchain, which is designed to be secure.

As Bitcoin is decentralized by nature, it means that no single “entity” controls the network. This system is what keeps Bitcoin itself from being hacked or manipulated.

However, the platforms that you and I might use to buy, sell, and store Bitcoin can be vulnerable.

A famous example is the 2014 hacking of the MT. Gox exchange that lost about 850,000 Bitcoins. This opened the eyes of many and forced exchanges to improve their security features.

Ways of Storing Your Bitcoin

Exchanges are very quick and useful for buying and selling Bitcoin and are convenient for frequent traders. However, storing your Bitcoin should never be left on an exchange but rather moved to a crypto wallet.

There are a variety of crypto wallets available. A self-custodial wallet vs custodial options are the starting point and from there you can move into software wallets, hardware wallets, and cold storage.

Software wallets are convenient, but they come with serious security risks.

Yes, they allow for easy access to your Bitcoin, but they are also prime targets for hackers and scammers.

The biggest risk of online wallets is that they are always connected to the internet, and this is what makes them vulnerable to phishing attacks, malware, and security breaches.

For safer storage, your best option is to use one of the best hardware wallets available, such as a cold storage hardware wallet.

Cold hardware wallets, like Material Bitcoin, keep your Bitcoin 100% offline as they never store your private keys on the internet. It is the best option for long-term Bitcoin holdings.

The Risk of Losing Private Keys and How to Avoid It

The biggest risk to your Bitcoin is losing your private keys. Your private key is like a password that gives you access to your Bitcoin and if you were to lose it, you would lose all access to your assets.

This is true when you use self-custodial wallets.

They are considered much safer options, as you have control of your private key but also come with a higher responsibility for safeguarding your private key.

A famous example is Stefan Thomas, a programmer who lost his password to his digital wallet holding 7,002 Bitcoins.

That would be worth $426,274,758 today.

To avoid these types of serious losses, using a cold wallet, along with a metal crypto wallet for seed phrase recovery, will always be your safest guarantee.

If a Cryptocurrency Exchange Fails

Crypto exchanges can be vulnerable to many issues, from hacking to poor management and even regulatory issues. When an exchange fails, users often lose access to their funds, sometimes permanently.

Recently, FTX, once one of the largest exchanges, collapsed and filed for bankruptcy. Users ended up losing billions in funds that were frozen.

This doesn’t mean that all exchanges will collapse, it is only a warning sign for you to never leave your assets on an exchange.

Remember to quickly move large amounts to a hardware wallet.

Security of Your Bitcoins

| Tips | |

|---|---|

Storing Your Bitcoin |

|

Crypto Best Practices |

|

Is Bitcoin Still a Good Investment Today?

Despite its volatility, Bitcoin continues to be a very valuable asset. Regardless of its drops historically, it has shown to always bounce back and grow immensely.

Looking towards 2025, experts are predicting that Bitcoin will only continue to grow as crypto adoption globally expands and more mainstream financial institutions and governments are taking notice.

Did You Know?

Standard Chartered (a British multinational bank) has predicted that BTC will rise to $120,000 by the end of 2024.

Should You Invest in Bitcoin?

Investing in Bitcoin can come with high rewards and significant risks.

This is why understanding the pros and cons can help you with your investment strategy:

| Pros | Cons |

|---|---|

|

|

Including Bitcoin as part of your investment strategy is a great way to diversify your investment portfolio.

You might already be invested in stocks, bonds, and real estate, and investing in Bitcoin is another valuable asset to add to your roster.

FAQs

Is Bitcoin Safer Than Fiat Money?

- Bitcoin is safer in terms of decentralization but fiat money offers more government oversight and insurance, like FDIC protection.

How Does Regulation Affect Bitcoin’s Security?

- Regulation improves Bitcoin’s security by protecting investors, however, it can vary from country to country. It is important to note that Bitcoin regulation does go against the fundamental value of cryptocurrency as it was built on decentralization.

What Happens if I Lose Access to My Bitcoin Wallet?

- Losing your private keys means losing access to your Bitcoin forever. Make sure to back up your wallet by using seed phrase recovery and store your private keys on a cold wallet.

0 Comments