Cryptocurrency has come a long way since Bitcoin was first launched in 2009.

In 2025, it’s become a global financial asset with millions of users and institutional backing.

If you are new to crypto, trying to understand it can be overwhelming.

Knowing where to start can be difficult, from colloquial jargon to crypto’s price volatility and the never-ending number of new crypto projects.

Here at Material Bitcoin, we pride ourselves on not only making the best hardware wallets available for protecting your Bitcoin but also being a resourceful source of all things crypto.

In our beginner’s guide to crypto investing, we’ll break down everything you need to know and how to get started with crypto investing and trading in 2025.

We’ll explain how blockchains work, highlight some of the 💰 best cryptocurrencies to invest in, and walk you through step-by-step how to make your first Bitcoin investment 🪙.

You’ll also learn about long-term investing versus short-term trading 📈 and how to store your crypto safely 🔐.

Finally, we’ll touch on legal and tax considerations ⚖️ and share helpful resources and tips to help answer the most frequent crypto doubts 📚.

What Is Cryptocurrency?

Cryptocurrency is a digital currency that is secured by cryptography.

It operates on decentralized networks based on blockchain technology.

Important Crypto Characteristics:

- 🏛️ Decentralization: No central authority controls the currency.

- 📖 Transparency: All transactions are recorded on a public ledger.

- 🔒 Immutability: Once recorded, transactions cannot be altered.

Why Crypto Investing Matters in 2025

Investing in crypto has gone beyond mere anonymous transactions.

To many, it is viewed as a valuable asset class, and many institutions are adopting crypto into their systems.

Cryptocurrency adoption continues to rise.

The number of global users is estimated to reach 861 million by the end of 2025.

At the same time, major financial institutions are adopting crypto and using it to their advantage.

For example, BlackRock’s iShares Bitcoin Trust (IBIT), which launched in January of 2024, blew up to over $50 billion in assets within 11 months.

Additionally, crypto is proving to be a real hedge against inflation, and today, with all the geopolitical instability, many are looking to Bitcoin as a “steady” currency.

Together, these points highlight why crypto is growing and why it might be a good time for you to buy Bitcoin.

Did You Know❓

As of today, there are 17,134 total cryptocurrencies in existence.

Crypto Basics You Need to Know

To really understand how crypto functions, you need to know about the fundamentals of the technology.

How Blockchain Technology Works

A blockchain is a decentralized ledger in which all transactions are securely recorded across multiple computers.

Transactions are linked together in blocks, each one “linked” to the one before, forming a chain.

The main idea of the chain is to ensure security.

This means that the recorded chain cannot be altered without modifying all the blocks.

There are two main ways that the blockchain validates transactions:

1️⃣ Proof of Work (PoW)

Miners compete to solve complex mathematical problems.

The first to solve the problem gets the right to add a new block to the chain and is paid with cryptocurrency.

Bitcoin uses this method.

2️⃣ Proof of Stake (PoS)

Validators are individually chosen based on the amount of cryptocurrency they hold and are willing to “stake” as collateral.

This is a more energy-efficient way of validating the blockchain than PoW, as it doesn’t require as many computers.

Ethereum transitioned to PoS in 2022 from PoW. This has helped with transaction processing times and fees.

Top Cryptocurrencies to Watch in 2025

By no means can we look into a magic ball and predict the future.

But based on Bitcoin monthly returns and professional 2025 bull run assumptions, here is a list of cryptocurrencies worth investing in, especially if you are just getting started on your crypto journey.

Before You Invest: How to Prepare for Buying Crypto

There are a few key things everyone should do before putting any money into crypto.

🔍 Financial Literacy: The Crypto Edition

Do not put any money into crypto if you don’t know the difference between fiat currency and cryptocurrency!

Know why inflation matters and how to read market cycles.

You don’t need to have a master’s degree in economics or cryptography, but using platforms like our Material Bitcoin blog and practicing with paper trading tools is a great way to start learning how to buy and manage your crypto properly.

Discover The Material Bitcoin Blog

Your trusted source for crypto news, expert insights, and secure cold storage guidance.

Whether you’re just getting started or looking to level up your strategy, we’ve got you covered.

Recommended Reads for Smarter Investing:

📊 Know Your Risk Tolerance

Crypto is known for its WILD price swings.

For example, Bitcoin dropped 15% in just 24 hours after the U.S. approved spot ETFs in 2024.

Can you handle that?

Take our quick risk assessment quiz to better understand your comfort level with volatility.

⚠️ Avoiding Common Mistakes

This beginner’s guide to investing in crypto wouldn’t be complete without a few warnings.

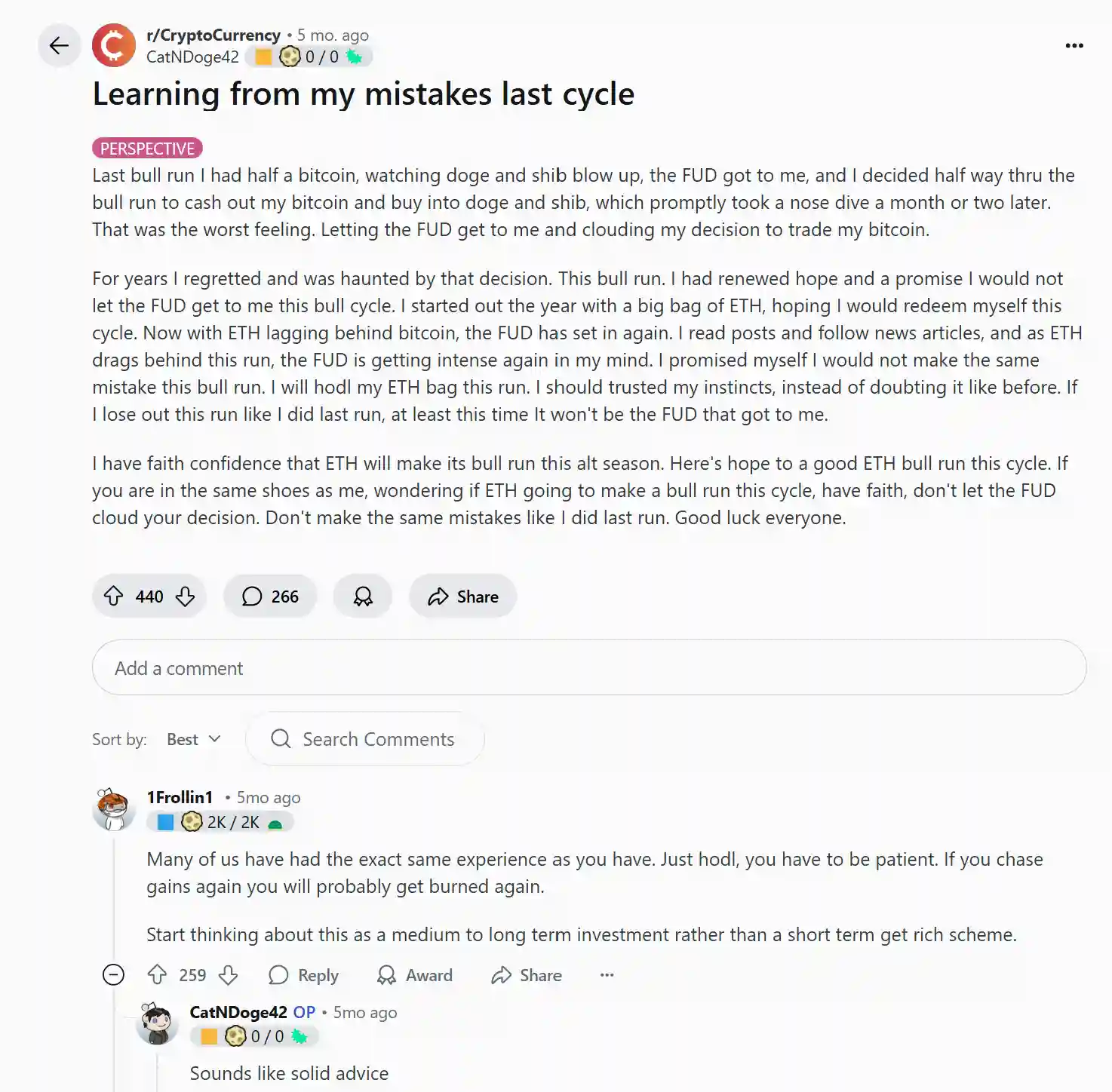

New investors often make costly mistakes like:

- Buying during hype (FOMO)

- Failing to secure seed phrases

- Overtrading without strategy

There are countless Reddit stories of users who lost everything due to scams or carelessness.

Don’t become one of them.

How to Start Investing in Crypto Step by Step

Getting started with crypto doesn’t have to be complicated.

Here’s our simple breakdown of what you can do.

1. Choose a Trusted Crypto Exchange

First, you need to select a reputable platform where you can safely buy and sell cryptocurrencies.

All these platforms are licensed, secure, and support fiat deposits.

⚠️ Warning:

Always move your crypto from your chosen exchange to a secure, cold crypto wallet like Material Bitcoin.

2. Create & Verify Your Account

Once you’ve picked your exchange, you’ll need to sign up and complete KYC (Know Your Customer) verification.

This usually involves uploading a valid government ID, taking a selfie or video verification, and confirming your residential address.

There are no KYC exchanges and private Bitcoin wallets available for those who prioritize anonymity and privacy.

We suggest these exchanges for advanced users who fully understand how to check and verify the blockchain.

3. Deposit Funds

You can fund your exchange account using bank transfers, credit or debit cards, and PayPal.

💡 Note:

Bank transfers can take 1–5 business days. Card and PayPal deposits are faster but typically come with higher fees.

4. Buy Your First Crypto

Now you’re ready to invest.

Most beginners start with Bitcoin (BTC) or Ethereum (ETH) because they’re the most established and widely supported.

Choose your coin, enter the amount you want to buy, and confirm the transaction.

Our suggestion is to start small and grow as you learn.

Just make sure to move your crypto to a cold wallet after buying on an exchange.

Investing vs Trading

When it comes to crypto, you can either invest for the long term or trade in the short term.

Each approach has its pros and cons.

Long-term investing, also known as HODLing, means buying and holding crypto like Bitcoin for a minimum of 10 years or more.

Short-term trading includes high-risk strategies like day trading or swing trading.

These methods rely on price charts and timing the market.

To do this, you’ll need to understand analysis tools, how to interpret the Bitcoin rainbow chart, and also look at Bitcoin technical analysis factors to make predictions.

Whichever you choose, our advice is to always build a diversified crypto portfolio.

📊 Approximately 8% of the US population trades cryptocurrency.

How to Store Your Crypto Safely

Now that you know how to buy crypto, keeping it safe is just as important.

There are two main types of crypto wallets:

Hot wallets are connected to the internet, making them very easy to access but also vulnerable to hacks.

Cold wallets store your crypto offline, providing safer protection for long-term storage.

Security tips

- Store your recovery phrase offline, never digitally.

- Use metal backups like Material DIY.

- Avoid phishing scams by never clicking links from unknown messages or emails.

❗Don’t Forget to Back Up Your Wallet

Always create a secure recovery seed phrase when setting up your wallet. Without it, your funds could be lost forever if your wallet is damaged or misplaced.

For maximum protection, store your seed phrase on a cold wallet backup like Material DIY, a durable, fireproof, waterproof steel plate built for long-term security.

Legal & Tax Essentials (Don’t Skip This)

Crypto is regulated differently depending on where you live, and it is YOUR responsibility to adhere to those regulations.

In the U.S., the SEC now requires centralized exchanges to register.

In the EU, MiCA is fully in effect, enforcing standardized rules for reporting crypto gains and holdings.

Canada and the UK treat crypto as taxable property with clear capital gains policies.

To report your crypto correctly, we suggest you track profits and losses like you would with stocks.

There are many tools to help you automate this process.

Crypto Taxesand

Bitcoin Legality Worldwide

Helpful Resources for New Investors

Learning is key to buying and holding crypto with confidence.

Here are some trusted resources to help you build your knowledge and stay informed:

Useful Crypto Learning Platforms

- Material Bitcoin Blog: Free with 3 new articles posted per week. Don’t forget to subscribe to our newsletter.

- Binance Academy: Free, beginner-friendly lessons on all things crypto

- Coin Bureau: In-depth explanations of major coins and market trends

Join our newsletter to get a $10 coupon!

Must-Follow YouTube Channels

- Coin Bureau

- Finematics

- BK Crypto Trader

- Tyler S

Crypto Communities to Join

Reddit: r/CryptoCurrency and r/BitcoinBeginners

✅ Final Tips for Crypto Success |

|

|---|---|

| 🔍Do your research | Investigate projects and coins before investing |

| 🔐Prioritize security | Use strong passwords, 2FA, and cold storage |

| 🧺 Diversify your portfolio | Avoid putting all your funds in one asset |

| 🕰️Be patient | Stick to long-term strategies despite volatility |

| 💸Start small | Try $20/month via Dollar Cost Averaging (DCA) |

| 📆Stay consistent | Avoid emotional buying/selling |

| 📚Keep learning | Follow crypto news on Material Bitcoin’s blog, X, Reddit, YouTube |

| 🧭Review your strategy | Adjust your plan based on goals and risk tolerance |

FAQs

What’s the best crypto to start with in 2025?

- Start with well-established options like Bitcoin (BTC) or Ethereum (ETH). They both have strong track records.

Is crypto still safe in 2025?

- Yes, but only if you follow security best practices. Use trusted platforms and store long-term holdings in a hardware wallet.

Should I use a hardware wallet?

- Absolutely! For long-term storage, hardware wallets like Material Bitcoin offer the highest level of security.

How much should I invest in crypto as a beginner?

- Start small; even $20–$50 is enough to begin. Only invest what you can afford to lose.

Can I lose all my money in crypto?

- Yes, especially if you invest blindly or fall for scams. That’s why research, security, and risk management are so important before you begin.

0 Comments