Bitcoin has taken many unexpected twists and turns since its introduction in 2009. Starting from nothing and facing a lot of skepticism from top investors and bankers, Bitcoin has grown from pennies to over $60,000.

It has completely transformed the concept of digital finance and investment assets, making it a top commodity in many professional investment portfolios.

Bitcoins’ unbelieve rise over the past decade has shocked and impressed individual investors and institutions, causing governments to take notice and include BTC in their country’s investment plans and future.

But, as Bitcoin continues to grow, it’s important to also understand that it can be extremely volatile.

This means that you as an investor need to have a clear understanding of when to buy, hold, or when to sell Bitcoin investments.

In this post, we will break down the key signs and factors to consider when asking yourself “Should I sell my Bitcoins?”

Whether you are new to crypto or have been holding since the start, understanding and identifying these key signs will help you make well-informed decisions to help maximize your BTC returns.

5 Key Factors to Consider When Deciding “Should I Sell My Bitcoins?”

1️⃣Your Personal Investment Goals

First and foremost, deciding when to sell Bitcoin needs to align with your personal investment objectives. These goals should be decided before investing in any asset but as things change in our lives, you can adjust your goals to fit your new future objectives.

Ask yourself: Are you looking to retire early? Do you want to buy a house? Or do you want to continue to grow your wealth in the long term?

If you have reached a particular investment goal, like doubling your initial investment it might be an indicator to sell a part of your BTC holdings. On the other hand, investors who have kept their BTC for the long haul have surpassed those goals.

Regardless of your strategy, make sure to revisit your wants and needs and they can change over time.

2️⃣Tax Implications

When you sell your Bitcoins, you don’t just hit “sell” and receive the money for your use instantly. With new rules and regulations being implemented by many government agencies globally, you need to consider your tax implications and responsibilities.

In the US, selling Bitcoin is taxable, for example, the IRS treats Bitcoin as property which means you need to declare and pay capital gains tax when you sell. There are some tax breaks for long-term holders who can benefit from a lower capital gains tax rate, but it depends on the number of years you have held the cryptocurrency and what your personal tax bracket is.

If you fail to file the appropriate taxes for cryptocurrencies, you can face major legal consequences later on.

3️⃣Technical Analysis

Using technical analysis tools to help you decide when is a good time to sell your Bitcoins can be very useful. Many traders use them to make informed decisions for buying and selling themselves.

When you analyze Bitcoin price charts, historical trends, and trading volumes, you can notice patterns and identify market trends, like whether we are entering a bullish or bearish market.

4️⃣Market Predictions and Trends

Staying up-to-date on Bitcoin monthly returns and market trends can also help to guide your decision to sell Bitcoins.

This step also involves reading the news on digital investments and knowing about regulations, and the adoption of international markets which can indicate rises and falls in Bitcoin prices.

5️⃣Network Activity and On-Chain Metrics

This step requires a bit more knowledge about the blockchain and how the Bitcoin network functions itself.

Considering the activity on the current BTC network, like active addresses and transaction volume can give important insights into the current health of Bitcoin and in which direction it is headed.

When it comes to securing your Bitcoin for the long term, Material Bitcoin has the best cold hardware wallet solution.

Not like a hot wallet, which is connected to the internet and vulnerable to hacking, Material Bitcoin makes sure that your assets stay offline and secure.

For example, when there is a higher volume of active addresses, that means that more people are using BTC and it suggests growing adoption of the cryptocurrency. This usually means that we are headed into a bullish market.

On the flip side, less activity can be a sign of weaning interest and a dip in the market.

Material Bitcoin for Long-Term Storage

When it comes to securing your Bitcoin for the long term, Material Bitcoin has the best cold hardware wallet solution.

Not like a hot wallet, which is connected to the internet and vulnerable to hacking, Material Bitcoin makes sure that your assets stay offline and secure.

Bitcoin Trends and Predictions Right Now

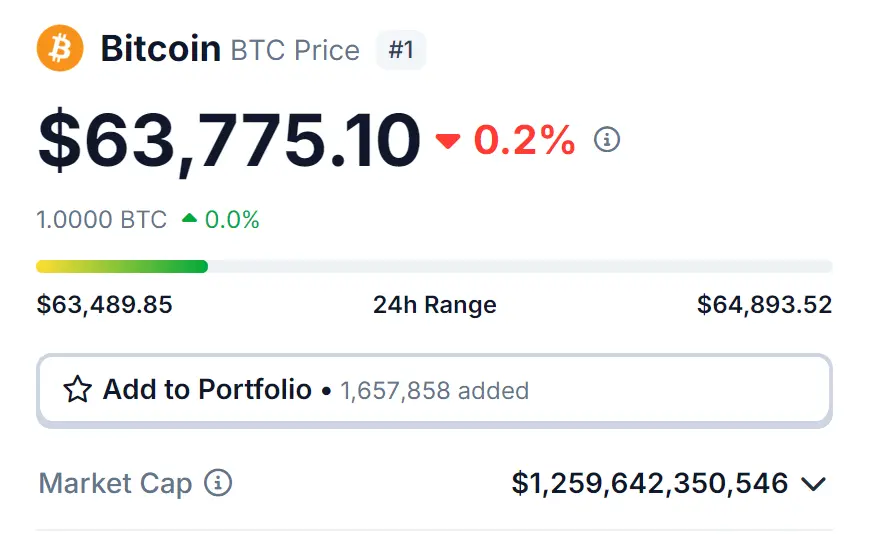

Currently, Bitcoin is one of the main focus points in digital currency and is included in many famous crypto portfolios.

Bitcoin is known to be a volatile asset and some of the main factors for its price movements include:

Institutional Adoption

There has been a major shift even in recent years that has seen many institutions adopt Bitcoin, for example, Fidelity Digital Assets has stated that 81% of institutional investors see cryptocurrencies as a good investment. This is up from only 45% in 2020.

These types of big shifts in ideology add to the market capitalization of Bitcoin making it worth about $1.26 trillion as of August 2024.

Halving Events

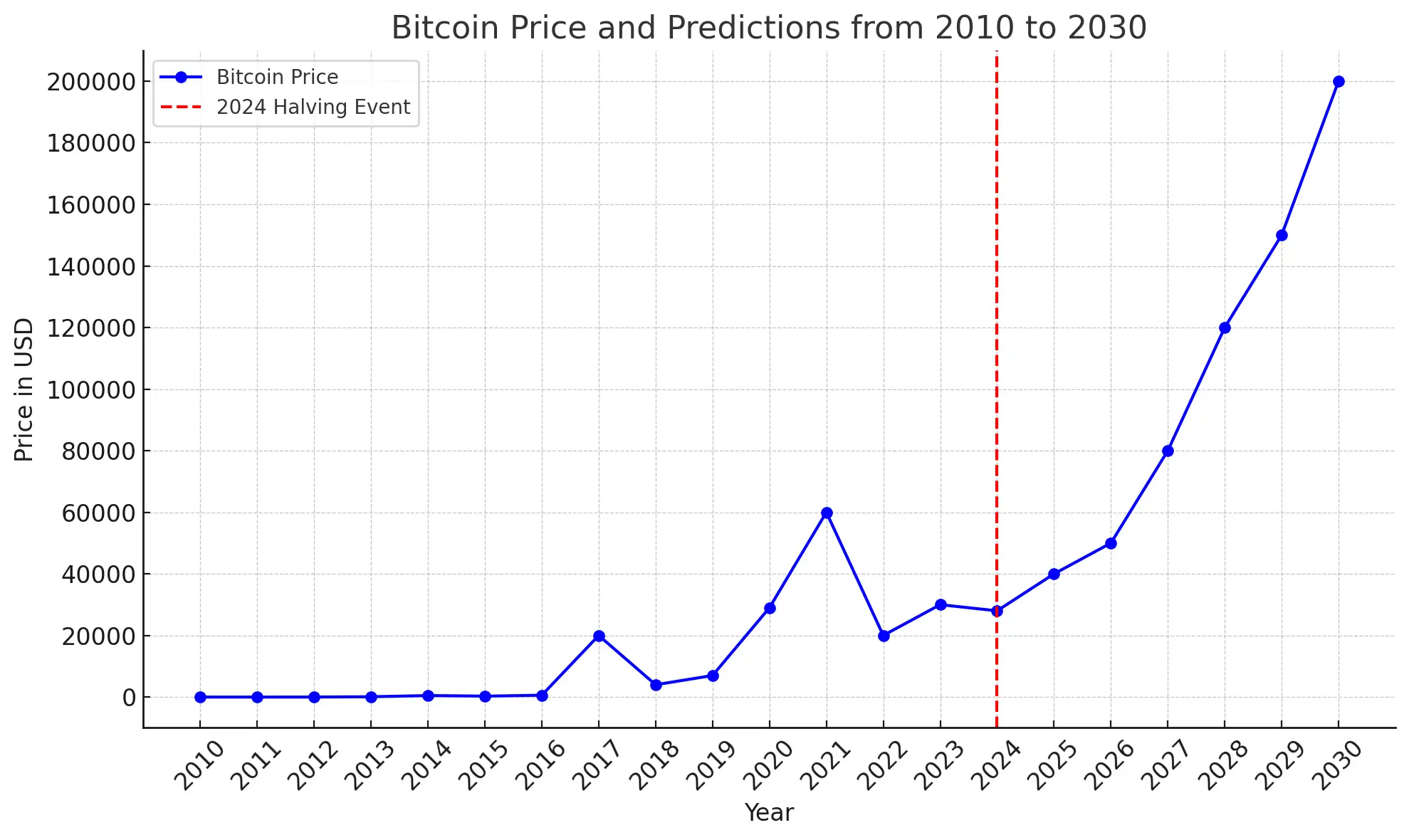

Historically speaking, Bitcoin halving events—which reduce the reward for mining new blocks by half—have indicated a significant price increase.

In 2020, after a BTC halving, Bitcoin’s price went up from about $9,000 to about $30,000 in just one year. Another halving occurred in the spring of 2024.

Regulatory Issues

These pose a risk to many Bitcoin investors. New SEC regulations and taxation requirements often indicate a dip in the market. But as you can see, future predictions indicate nothing but growth.

How to Sell Your Bitcoins

After carefully reviewing your personal goals, tax obligations, market trends, and predictions, you have concluded that you want to sell your Bitcoin.

Here are some different strategies you can apply to sell your Bitcoins but also set up for future sale indicators:

➡️Stop-Loss Orders

This will automatically sell you BTC once the price drops to a certain level that you have predetermined. This is a common strategy used when there is a market downturn to help keep you from losing too much of your investment.

➡️Dollar-Cost Averaging

This method is used to buy and also to sell your crypto. It involves selling your BTC in regular intervals, no matter the price. This method is to smooth out the market’s volatility. Sometimes you will sell high and sometimes you will sell low, but in the end, it should help to average your losses and returns.

➡️Gradual Sales

This method sells your BTC strategically at certain times to capitalize on the best prices. You need to keep track of the market while selling portions of your crypto.

➡️Target Profit Sales

When you purchase Bitcoin initially, you have predetermined a goal. Once you reach that target, you sell. For example, you purchased BTC at $10,000 and set the sale target for $50,000. Once Bitcoin reaches that amount, you sell all or a portion of your holdings.

➡️Rebalance Your Portfolio

Like with any other asset, if Bitcoin represents too much of your current investment portfolio, then maybe it is time to sell a portion of it. This must align with your goals but also represent “smart” decisions based on performance and market trends. If an asset is doing well and you believe in its future, it is ok to readjust your objectives.

➡️Using Options Contracts

Using options contracts can be another avenue for selling your Bitcoin at a specific price within a certain timeframe. This gives you the ability to sell BTC at a predetermined price and date. This is the complete opposite of futures contracts and should only be used by advanced crypto investors.

By considering these factors and strategies, you can make more informed decisions about when to sell your Bitcoin, helping you achieve your financial goals while minimizing risk.

Related FAQs

Is it worth keeping my Bitcoin?

- Depending on your goals and risk tolerances, yes, it is believed that holding on to Bitcoin long-term is the best investment strategy.

Should I cash out my Bitcoin?

- Consider cashing out your BTC if you’ve met your goals, or don’t believe in the future of crypto.

Is Bitcoin a buy, hold, or sell?

- This depends on current market trends and conditions but generally speaking, Bitcoin is thought to be a good hold asset.

How can I manage the tax implications of selling Bitcoin?

- Stay up-to-date with new rules and regulations. Don’t be afraid to consult with a tax professional who can help you with the specific regulations in your jurisdiction.

0 Comments