MU.S. elections always play a big role in shaping global financial markets. From stocks to commodities, real estate to crypto, big market investors also closely monitor presidential elections.

The 2024 U.S. presidential election is no exception, especially as crypto regulations are becoming a hot political topic on the campaign trail.

After initially being skeptical of cryptocurrency, Trump has stated that he plans to make America the “crypto capital of the planet“, while Harris’s stance isn’t so clear…yet.

Whether you are new to digital investing or fully invested, you’ll want to know what to expect in 2024 and beyond when it comes to the U.S. election’s cryptocurrency impact.

How Do U.S. Elections Influence the Cryptocurrency Market?

U.S. elections impact more than just politics. They also have a major influence on the financial market, including decentralized crypto.

What makes this point interesting, is that any impact of change doesn’t happen only at the time of the newly elected president, but can have a significant influence on the crypto market months ahead.

As crypto is already a volatile asset, election cycles can cause even wilder price swings. As soon as a candidate speaks out about regulations, changes in tax policies, or takes a direct stance with or against crypto, it will dramatically affect the market and therefore cause traders and emotional investors to make dramatic choices.

Understanding these influences is a key way for all crypto investors to understand the possible new changes ahead.

Market Volatility Expected During Election Cycles

Cryptocurrencies have come a long way from their beginning but one thing that has stayed consistent is their speculative nature.

No one could have ever predicted where Bitcoin and Ethereum have ended up today, nor can we imagine how crypto will finally be utilized globally. This is no different during uncertain times, like an election, which can only drive volatility.

Since crypto doesn’t function like stocks (in the sense that they are tied to the performance of a particular company) this means that when uncertainty is high, traders and investors can react instinctively to news and cause drastic price swings.

Historical Cases of U.S. Elections and Their Effects on Bitcoin and Altcoins

As the cryptocurrency market is still relatively young compared to traditional markets, it is more sensitive to big global changes.

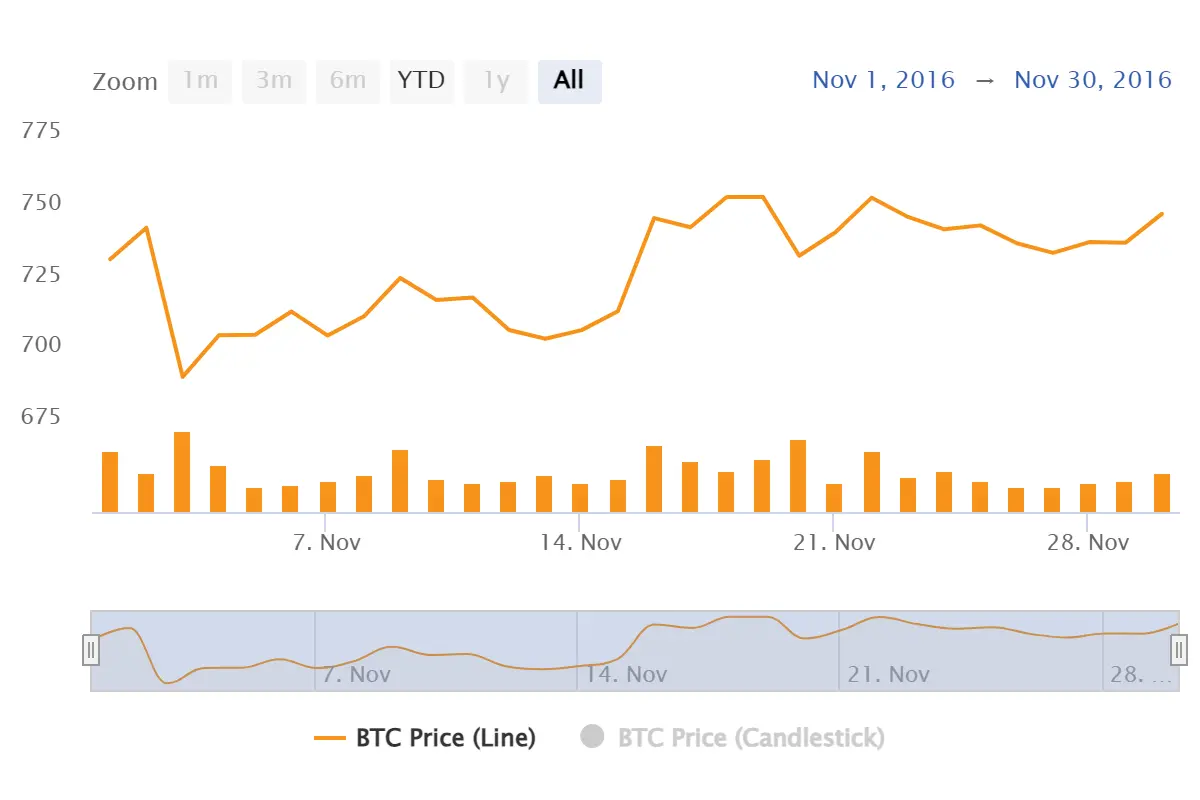

Looking at the 2016 elections, Bitcoin dipped on the evening of November 8, 2016, to $709.85 only to rise once the president was elected on November 9, 2016, to $723.27.

In the 2020 U.S. elections, Bitcoin saw major price changes because investors and traders had to speculate on outcomes that would affect regulations and global adaptation. This in turn affects inflation, which also impacts commodities and crypto.

Both of these examples clearly show how uncertainty can cause a dip while a result or confirmation will swing a price upwards. This has nothing to do with the political party or person elected, but rather that the uncertainty and unknown are now over.

Altcoins like Ethereum and Litecoin also followed similar movements in both of these election cycles.

As we approach the 2024 elections in November, similar patterns of volatility are expected, potentially providing both risks and opportunities for investors.

Depending on how you want to look at it, of course.

Crypto Policies of the Leading Candidates

Approaching the 2024 U.S. Presidential elections, we are left with two front runners.

Kamala Harris represents the Democratic party, and former president, Donald Trump represents the Republican party.

Kamala Harris

The current Vice President under the Biden administration, Harris has maintained a cautious yet what seems to be evolving stance on cryptocurrencies.

The issue here is that she really has not been vocal about her exact stance.

Previously, the Biden administration took a skeptical approach to crypto, especially concerned with consumer protection, financial stability, and the potential for fraudulent activities. Kamala Harris, as part of the administration, has supported Biden’s stance.

President Biden’s Executive Order on Ensuring Responsible Development of Digital Assets, signed in March 2022, outlines the approach to regulating the cryptocurrency market. This emphasizes the need for federal agencies to address risks associated with digital assets while exploring the potential benefits of a U.S. central bank digital currency (CBDC).

What does this mean for Harris?

Her policies would likely continue to reflect this cautious approach, focusing on consumer protection and anti-money laundering (AML). But, this is all speculation as there is no firm stance within her current campaign.

Donald Trump

Trump has been openly critical of digital assets, famously referring to Bitcoin as a “scam” and expressing concerns that cryptocurrencies could undermine the U.S. dollar. During his time as president, his administration did not go after major cryptocurrency regulations, and he seemed more focused on fiat USD.

However, Trump’s views on crypto have suddenly changed. In recent statements, he has spoken about the growing interest in digital currencies and blockchain technology.

A second Trump administration could potentially see a huge rise in crypto use and adoption not only in the U.S. but globally as a result of American popularity.

It is hard to say exactly what his plan would be and how Trump would go about implementing it into day-to-day use, but as he has proclaimed to make America the Crypto capital of the planet, it can only mean that he has big plans for digital currency.

![]()

Crypto Legislation: What Could Happen After the Election?

Several important crypto-related bills are currently being reviewed by Congress:

The Digital Commodities Consumer Protection Act (DCCPA) is a major one, that could give the CFTC more control over cryptocurrencies classified as commodities.

The Stablecoin Transparency and Security Act is another important bill that aims to regulate stablecoin issuers by enforcing strict reserve and transparency requirements.

The 2024 election outcome could determine the future of these bills. A win for a particular candidate who favors stricter regulation might fast-track these bills. This would imply a more regulated market.

On the other hand, a more crypto-friendly administration could modify these bills, potentially maintaining the self-custody aspect of cryptocurrencies.

Regardless of the outcome, eventually, if more countries and governments accept and adopt crypto, they will need to become centralized and more controlled. This, of course, goes against the fundamental belief of crypto.

We could see changes in innovation due to compliance costs. Exchanges might need to alter their charges and services, leading to higher costs. Changes in crypto taxation could also impact how investors buy and sell crypto.

Key Crypto Laws Being Debated in Congress

One of the most significant debates in Congress is whether cryptocurrencies should be classified as securities or commodities.

The Securities and Exchange Commission (SEC) has argued that many cryptocurrencies meet the definition of security, which would make them need to follow the same laws and regulations as stocks and bonds.

In contrast, the Commodity Futures Trading Commission (CFTC) has claimed that certain cryptocurrencies, like Bitcoin, should be classified as commodities, which would place them under a different regulatory category.

This would have major impacts on exchanges and how investors interact with crypto.

Taxation of cryptocurrencies is another area where many changes could happen quickly. Currently, the IRS treats cryptocurrencies as property, meaning that every transaction is a taxable event, subject to capital gains tax.

Some proposed bills are aiming to simplify the taxation of cryptocurrencies.

How SEC and CFTC Regulations Could Shift

As of now, the regulation of cryptocurrencies in the U.S. is split between the SEC and the CFTC.

➡️The SEC has primarily focused on cryptos that it considers to be securities.

➡️The CFTC oversees cryptocurrencies that are classified as commodities, such as Bitcoin and Ethereum. The agency has also taken enforcement actions, particularly against exchanges that offer derivatives trading without proper registration.

Regardless of the outcome of the election, storing your crypto in a cold hardware wallet is crucial for ensuring your crypto’s safety and security — especially during times of uncertainty.

Never leave your crypto assets on an exchange or in an online hot wallet where they are vulnerable to hacks. Instead, keep them in your custody with one of the best hard wallets available: Material Wallets.

Take full control and have peace of mind.

Crypto Lobbies in the Presidential Elections

Crypto lobbyists are becoming very important in shaping and influencing candidates and their policies.

Some major groups, like the Blockchain Association and Coin Center, are actively involved with Congress and both groups to push for “lighter and more favorable regulations”.

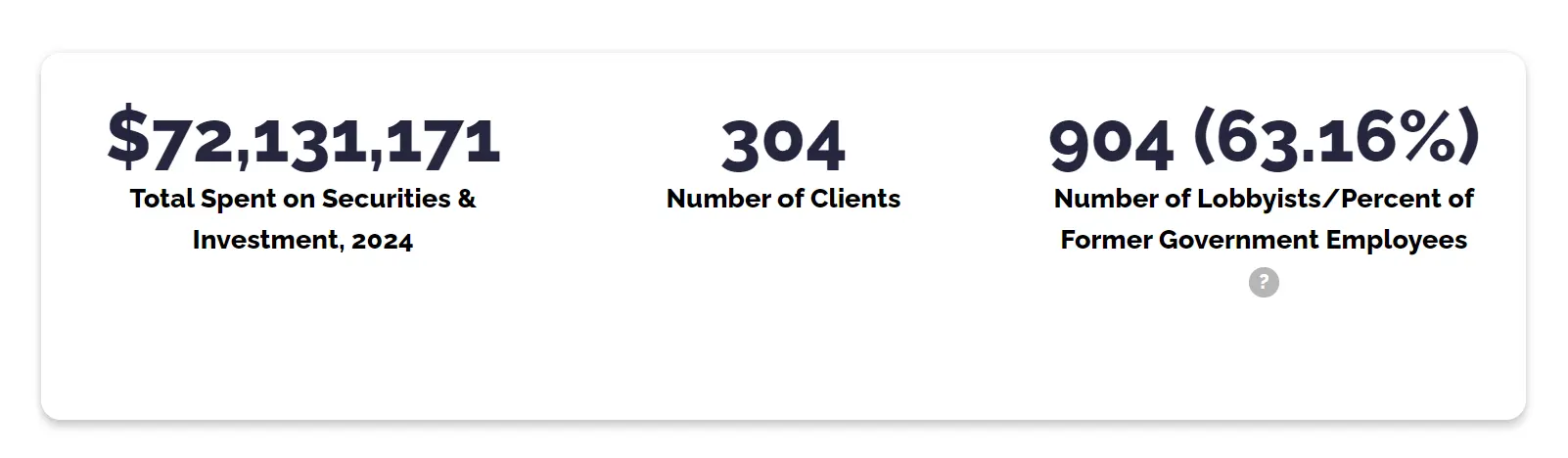

The amount of money spent on Securities and Investment in 2024, along with the groups of lobbyists is only increasing.

Crypto Voters: How Are the Elections Affecting the Crypto Community?

There is no doubt that younger Millennials and Gen Z voters will have an impact on these elections.

As younger generations are more open to using and have already adopted crypto, any potential changes or impacts to their financial future are something worth fighting for.

A candidate’s stance on crypto could greatly influence voting behavior, especially for the tech-savvy citizen who has grown their portfolio over the years. Candidates who are clear about their stance on crypto and plans for regulations are more likely to attract this demographic.

What Does the Future Hold for Cryptocurrencies in the U.S.?

The fate of crypto after the 2024 presidential elections can go either way.

We can either be left with a president who adopts it fully and implements it as a normal currency or commodity for all U.S. citizens, or we could be faced with a president who will be pushed back by government agencies, traditional banking institutions, and others who will try their best to suppress the adoption of crypto.

One thing that we can bank on, is to expect market volatility during this time. In turn, if investors and traders react to the fears of the future of crypto in the U.S. it could cause even further short-term price drops.

Overall, based on what the two main candidates are expressing, it seems that the new administration will need to take a stance on crypto and how America will use it moving forward.

Luckily, we know that certain cryptos like Bitcoin can hedge against inflation rates and should be a vital asset to hold onto.

Towards Greater Adoption or Tighter Restrictions?

Adoption Trends

- Balanced approach = more businesses accepting crypto, increased financial products, and broader public acceptance.

Potential Restrictions

- Possible tighter regulations on AML (Anti-Money Laundering) and KYC (Know Your Customer).

- This could hinder anonymous transactions and slow adoption, especially among privacy-conscious users.

Future Possibilities (Two Outcomes)

- Supportive regulations = mainstream adoption and widespread use.

- Overly restrictive = increased laws and regulations, a potential decline in U.S. market activity as users invest in other jurisdictions.

The Final Round-Up on the 2024 Elections

As the 2024 U.S. elections approach, the cryptocurrency market is set up for potential volatility due to uncertainty, policy shifts, and regulatory changes.

The outcome of the election could lead to either increased regulation or more crypto-friendly policies. Each with its own set of long-term implications for investors and the market.

You should be prepared for market fluctuations as the election evolves.

It’s essential to stay informed about these political developments and candidate policies.

But please, don’t be afraid.

Take into consideration the risks and opportunities that the new election might bring. Make informed decisions to protect and grow your assets during this time.

0 Comments