Investing money is a concept that is ingrained in many of us from an early age. Whether it’s opening a college fund or getting a 401k for our retirement, starting to invest can cause stress for some.

We are here to explain and give you the tools to know how to start investing money for the first time, no matter your future goals.

Starting to invest early is a key element so that you can take advantage of compound interest. This is where your returns on an investment generate their own returns, gradually increasing the amount you make.

We know what you might be thinking, and no, it’s never too late to start. Even if you start investing at 30, all you need is to understand the basics of investing and then dive in!

We hope that by the end of this post, you will know what options you have, how to invest money for the first time, and set your plan to begin.

💰Investing is when you allocate money to an asset with the expectation of it generating profit.

Your Check-List When Starting to Invest Money for the First Time

Before you allocate your money anywhere, there are a few important steps that you need to take. You must educate yourself on investment assets, learn about your risk tolerance, and understand market trends.

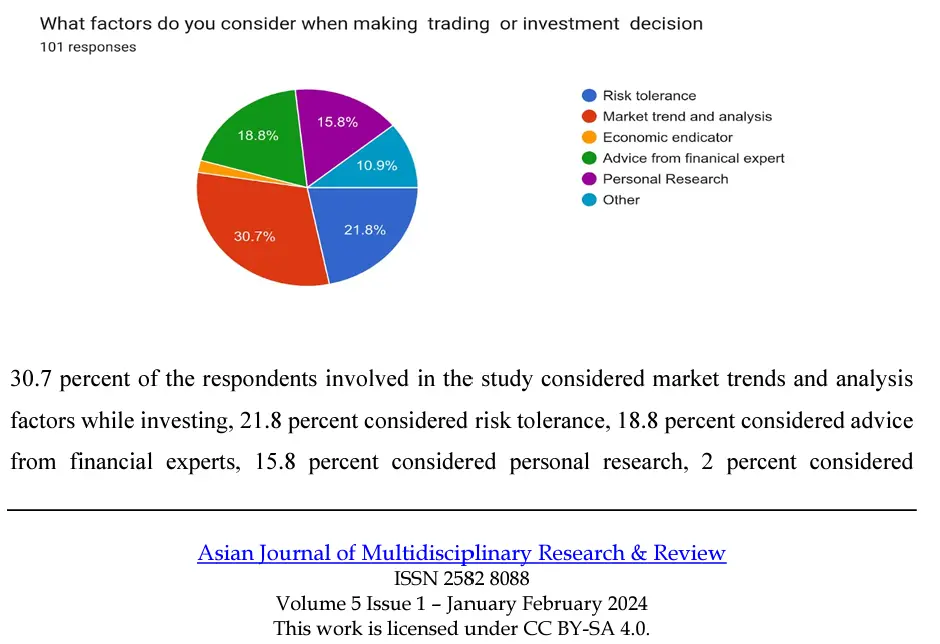

A study conducted earlier this year on the youth in Asia (ages ranging from 18-35+) found that multiple factors affected how they invest their money.

To help guide you on how to start investing money for the first time, we have compiled an easy-to-follow checklist considering the most crucial factors for investing.

🔲 What is your goal?

The very first thing you need to do is define your investment goals. It is a vital step because it’s what will guide your investment strategy. You must determine what are your short-term goals and long-term goals.

Use the SMART approach when setting your investment objectives: specific, measurable, achievable, relevant, and time-bound. This will help to make your goals more clear and therefore easier to decide which investment assets are the most appropriate for you.

🔲 What is the time frame for your investment?

Short-term investments (1-5 years) often place liquidity and lower risk as a top priority. Long-term investments (10+ years) are when you can afford to invest in higher risk for greater future returns.

🔲 Will you be investing periodically?

Also known as dollar-cost averaging, means that you make regular contributions to investing in assets no matter the market. The idea here is that this helps to lower the negative impact that market volatility can have on your portfolio and helps to build wealth over a longer period.

☝️Pro Tip: Set up an automatic investment to guarantee your consistency.

🔲 Do you want to do it yourself?

Are you someone who likes to have control or do you prefer to pay someone else for that service?

There are plenty of platforms and services that offer aid in managing your investment portfolio, which can be useful to beginner investors.

🔲 What is your risk tolerance?

This is a question of how much are you willing to lose or endure during difficult market volatility. This can be influenced by your personality which might sway you to make emotional decisions.

Your risk tolerance can also be influenced by your age, future goals, and financial situation.

Even if you have a high-risk tolerance, it isn’t recommended that someone close to retirement puts a large amount of their savings into a high-risk stock. There is a logical strategy that is involved and needs to be reviewed before making any investments.

🔲 Have you researched the investment options available to you?

Education and research are the most vital tools you can have and can make the biggest difference in your investing strategy. Each option, from stocks and bonds to ETFs and cryptocurrencies, has its own risk and return profile. Understanding how each asset works is highly necessary before putting a dollar into an investment.

4 Ways to Start Investing Money

Now that you’ve reviewed and assessed your goals and tolerances, you are ready to begin to invest to achieve financial independence.

Here are our suggestions for when you are starting to invest your money:

1. Material Bitcoin for Bitcoin Investment

We’ve all been hearing about cryptocurrencies and how volatile the market can be. But did you know that Bitcoin has had one of the best returns over the past 10 years than many other investments?

In the last decade, BTC has had a 60.29% compound annual return!

What Material Bitcoin provides is an easy way to start investing in Bitcoin. It’s a crypto cold wallet that was designed for long-term storage.

To invest in BTC with Material Bitcoin, all you need to do is:

➡️Buy the wallet from the online store.

➡️Use the Material Bitcoin website to buy BTC directly.

➡️Safely store your Bitcoin in the cold wallet for long-term growth.

The benefits of Bitcoin have been impressive with its overall high returns, decentralization, and self-custody features and therefore its natural ability to hedge against inflation.

2. ETFs

Exchange-traded funds are investment funds that can be made up of one or a collection of stocks, bonds, crypto, or other assets and commodities. ETFs trade on the stock exchange and are highly recommendable for beginner investors.

The benefit of investing in an ETF is that it gives you diversification of many different asset classes without needing to know which ones to buy. If you decide to move forward with a broker, there are many great options available for newcomers looking for extra guidance. You simply need to choose a reputable broker and open an account.

Some popular ETFs for first-timers include Vanguard Total Stock Market ETF, iShares Core S&P 500 ETF, and iShares Core MSCI World UCITS ETF.

To help explain how ETFs are a great way to start investing, take this example: the S&P 500 index is tracked by 19 different ETFs. The S&P 500 has an average of 10.75% annual return. In contrast, inflation in the US increases by 3.8% per year. This is a positive asset to have for the long term and a sure way to make your money grow.

3. Stocks for Long Term Hold

Investing in individual stocks is another way how to start investing money for the first time as it can provide substantial returns over the long term. Stocks give you portions of ownership of companies. It’s a good way to diversify your portfolio and add a good means of gaining high returns. Historically speaking, stocks have outperformed other asset classes when bought and kept with the HODL strategy.

Using a broker who is knowledgeable in the American and international stock markets is a great tool to have when you are starting to invest. Just make sure that the broker is regulated by financial authorities (FINRA).

4. Investing Through Your Own Bank’s Investment Service

There are many banks across the US and globally that offer investment services. This is a convenient way to invest when you don’t know how to start investing money for the first time.

✅Pros: Easy access and integration with your existing accounts.

❌Con: Bank investment services usually have much higher fees when compared to some brokers.

Although there are commissions and management fees that you need to pay, it might be worth it to you for the benefit of the services, including the advisory aspect.

Other Honorable Mentions:

🧾Treasury Bonds

📈Mutual Funds

🪙Commodities

Investing for Your Future

Luckily, there are so many options available for beginners. The most important aspect is to learn as much as possible about the different types of assets available, know their limitations and growth possibilities, and indicate your personal risk tolerances.

Starting to invest for the first time shouldn’t be scary, but rather an exciting key to help build your future.

FAQs

What are the key objectives for starting to invest?

- The main objective should be to build your wealth and gain financial independence.

What time horizon should I consider for my investments?

- Your time horizon depends on your goals. Whether you are investing for the short-term or long-term, try to align your investments with your ideal time frames.

Is $200 enough to start investing?

- Yes, $200 is a great start! You can invest in low-cost ETFs, and buy cryptocurrencies and other assets.

Should I invest periodically or all at once?

- It’s been historically proven that periodic investing, also called dollar-cost averaging, reduces risk compared to investing all at once.

Is self-directed investing right for me?

- It’s suitable if you want to control your investments and are willing to research, learn, and manage your portfolio.

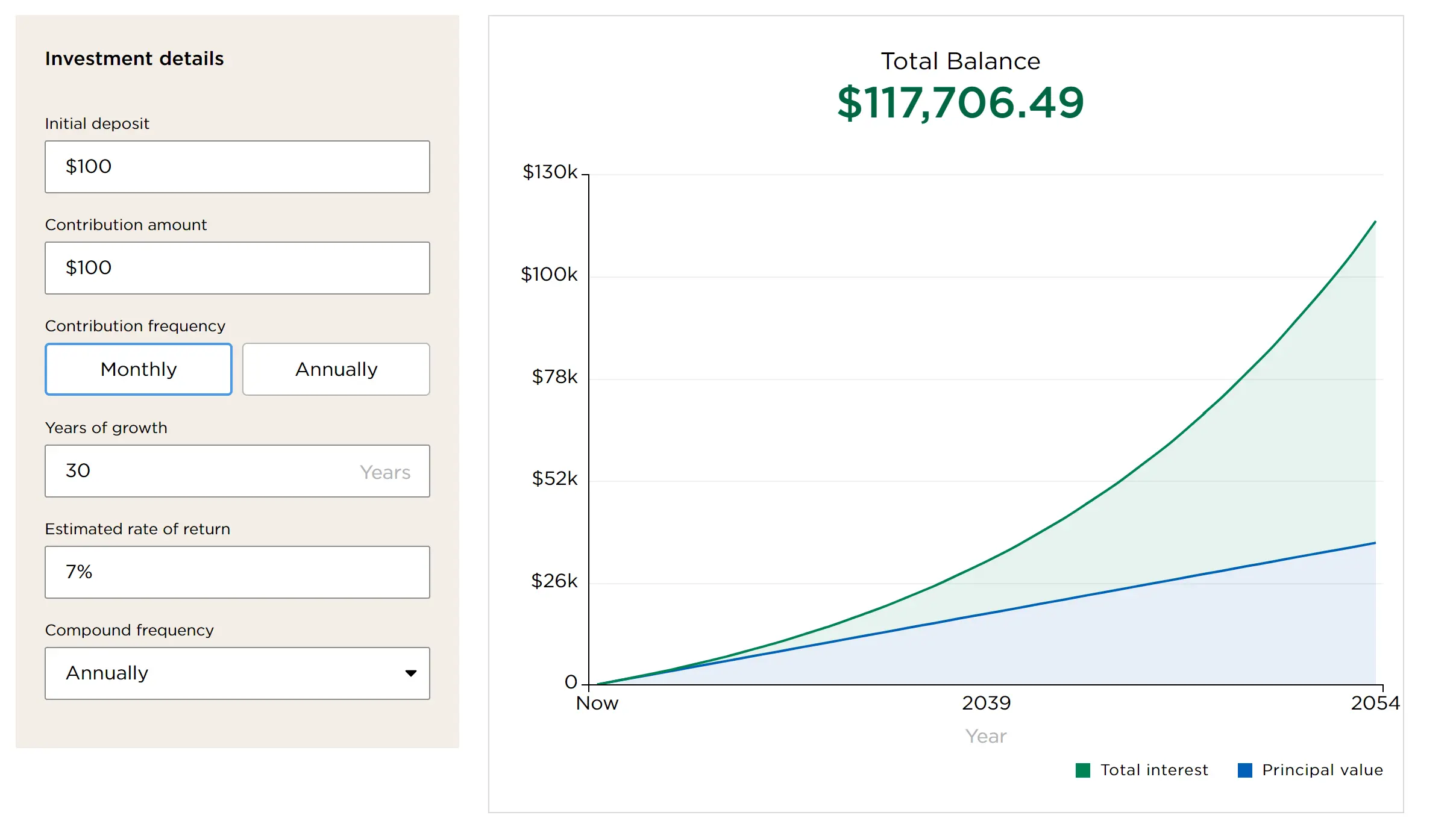

How much is $100 a month for 30 years?

- Investing $100 a month for 30 years at an average annual return of 7% will give you about $117,000. This calculation demonstrates the power of compound interest over time. In contrast, if you saved that same amount in cash at home, you would only have $36,000. You can use a compound interest calculator for your investments.

0 Comments