When you start investing at 30, you are taking action to prepare for your future. Usually, by this age, most people are more financially stable compared to their 20s and have a clearer outlook on their long-term goals.

Investing, regardless of age is crucial for your future financial security. It helps to plan for your retirement and hedge against inflation. Getting started at 30, if you haven’t already, is a great time to start.

There are plenty of misconceptions and concerns, with many people asking themselves “Is it too late to start investing at 30?” – but the short answer is no.

In this post, we are going to guide you step-by-step on how and why you should start investing at 30.

Why 30 Is a Great Age to Start Investing

When you start investing at 30, you can take advantage of many benefits.

At 30 you have a clearer concept of your future objectives and what you desire in the next 10 years to retirement.

During your 30s, you also have a steadier job, higher income, and a better understanding of finance. You usually have begun to buy property or at least started planning your next steps on how to achieve it and therefore have a more disciplined approach to budgeting.

But the key point to start investing at 30 is that you can take advantage of compound interest.

This is a very useful tool to utilize to your financial advantage, and the sooner you begin investing, the better off you are. Compound interest is when the gains from an investment start to earn its gains.

This causes a snowball effect over time, that leads to more and more growth.

To help explain, let’s look at this example provided by the Consumer Protection Financial Bureau from the US Government:

It might seem like a small amount at first glance, but you have to consider that each year, the amount of compound interest that you gain will increase.

Consider it “free money” that you wouldn’t be earning otherwise!

So, is 30 too late to start investing? NO!

Imagine the growth you can gain by the time you are ready for retirement.

To help you calculate your potential, you can use this free compound interest tool.

Steps to Start Investing at 30

Ready to start investing at 30, but not sure how? Here’s our step-by-step guide to help you get started:

1. Assess Your Financial Situation

Before you put your hard-earned money anywhere, your first step is to look over your current financial situation. This includes reviewing your debts, credits, and any savings that you might have.

- List your income, monthly expenses, and debts.

- Make it a priority to pay off your high-interest debt first, like credit card bills or student loans.

- Have an emergency fund set aside. It’s recommended to have between 3-6 months worth saved up.

These steps might seem overwhelming at first, and even unattainable. But the trick here is to get started. Even if it’s little by little, having the knowledge of every cent and where it’s going will help you in the long run.

2. Set Clear Financial Goals

Your next step is to define what you want from your investments. We suggest setting short-term and long-term goals. These can range from creating an emergency fund to buying a house and planning your retirement.

3. Educate Yourself About Investment Options

It’s vital that you understand what investments are and the different asset classes that are available. Some common options include stocks, bonds, ETFs and Index funds, cryptocurrencies, and commodities.

Do your research to understand the risks of each investment and assess what your risk tolerance is.

In general, younger investors can afford to invest in more volatile assets such as stocks and crypto, since the long-term rewards have historically paid off. In your 30s, you have time to build and wait out the ups and downs of markets.

4. How to Start Investing at 30?

Once you have reviewed your options and know what your tolerances are, begin by setting up investment accounts. If you are afraid of putting money into more volatile markets, start slow.

We recommend beginning with index funds or ETFs. But remember to diversify your portfolio.

You can add small amounts of Bitcoin, which has had a high return over the past decade. Remember to always store your BTC in a crypto cold wallet for safe long-term storage offline. Later, invest in other assets like Treasury Bonds or gold.

When you feel more secure and confident in your investing strategy, you can begin to buy other types of cryptocurrencies, such as Ethereum or individual stocks. Always do your research and use the aid of a broker if you feel the need to.

Common Mistakes to Avoid When Starting to Invest at 30

Although starting to invest at 30 is an ideal choice, there are some important mistakes to avoid.

Jumping onto a bandwagon investment because you hear about it on social media is a big no-no.

You want to have a clear strategy for your investment portfolio, which means knowing exactly what an asset is, how it works, and feeling comfortable with the possible outcomes.

Making an impulse decision can lead to big potential losses. So stick to your short-term and long-term objectives.

If we had to pinpoint the single most dangerous move anyone can make when investing, it is not diversifying your investment portfolio.

Putting all of your money into a single type of asset is extremely risky. To protect your money during a recession or downward fall in the market, you want to have other types of investments to help offset the losses you are temporarily facing.

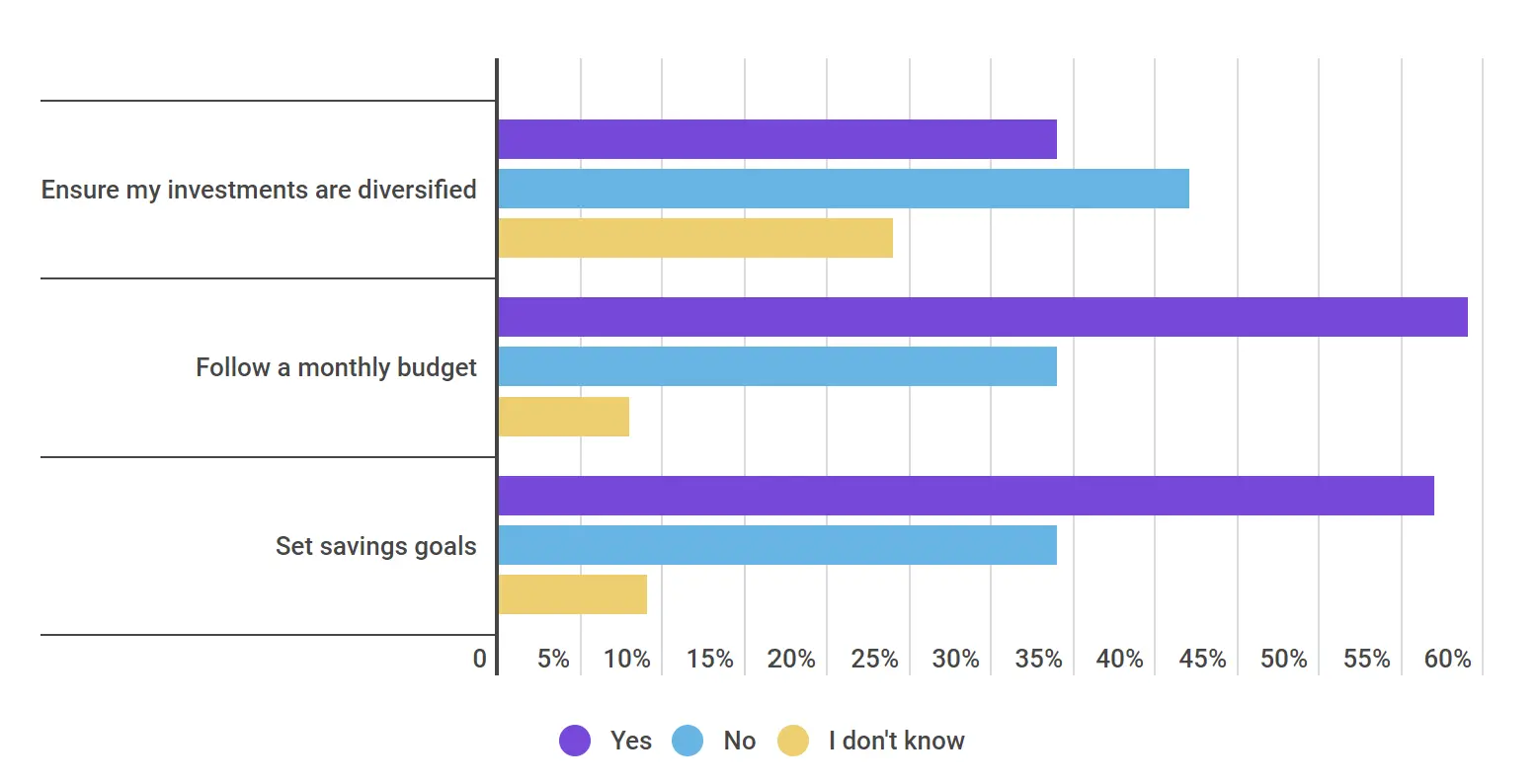

For example, an alarming amount of Americans are NOT diversifying their investment portfolios.

A study conducted by CNBC News found that 42% of investors do not diversify their assets while almost 40% of Americans don’t even have or follow a budget. These are some alarming stats that reflect the lack of education and know-how by US investors.

To minimize your risk and ensure a steady return on your investments, spread out your investments across different asset classes like ETFs, stocks, bonds, real estate, crypto, and commodities.

Investment Success Stories

Investing for the first time can be a bit scary, but hearing from real-life success stories can be motivational to help give you the boost you need.

By no means are we saying that investing will always guarantee that you become a multimillionaire by the time you are 60, but these cases help to demonstrate the power of starting to invest at 30 and how you too can benefit.

One success story that jumps out is of Rachel Siegel. At the age of 29, she was working as a substitute teacher living paycheck to paycheck, when she went to a crypto conference afterparty in New York.

From that moment, she decided to begin investing and bought $25 worth of Bitcoin from the leftovers of her weekly paycheck.

Today, she is a multimillionaire, who has her own company called Crypto Finally.

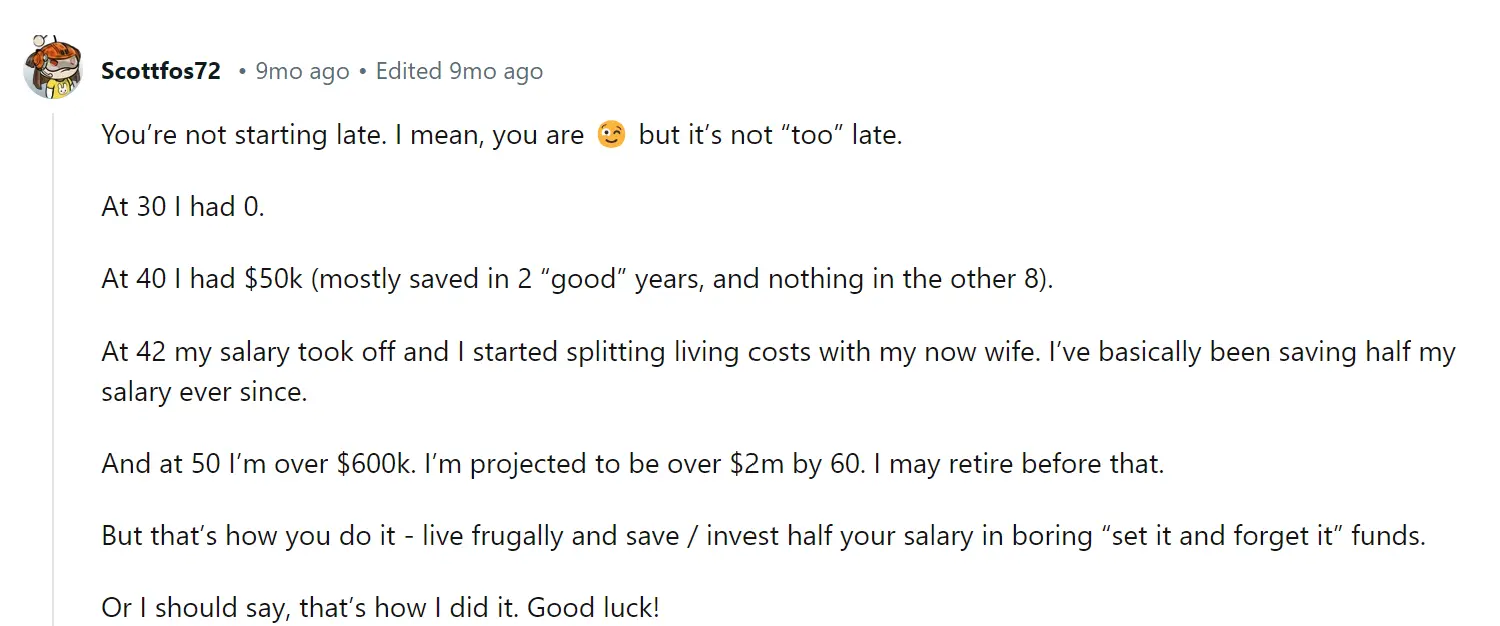

Let’s have a look at another example here of how starting to save at 30 in multiple long-term “set it and forget it” investments has set this Reddit user for early retirement.

If you’re hesitating about starting your investment journey at 30, thinking that it’s too late, we hope that these examples teach you otherwise.

Frequently Asked Questions

Is it too late to start investing at 30?

- Absolutely not! Starting at 30 gives you plenty of time to benefit from compound interest and market growth.

What are the best investment options for someone starting at 30?

- If you are just beginning, start slowly with a diverse plan. Including ETFs, index funds, Bitcoin, and bonds. You can work your way up to stocks, real estate properties, and other commodities as your funds grow.

How much should I invest when starting at 30?

- From some of the success stories we shared in this post, you can see that you don’t need much to get started. You just need to be consistent. Start budgeting and allocate an amount you’re comfortable investing in each week or each month.

It’s Never Too Late to Begin Building a Secure Financial Future

Starting to invest at 30 gives you significant benefits and the potential for long-term gains.

The sooner you start, the more you’ll benefit from the power of compound interest and market growth.

So, if you’re wondering, “Is it too late to start investing at 30?” the answer is NO!

0 Comments