Now in 2024, crypto security has never been more important. As the value of many digital assets, like Bitcoin and Ethereum are on the rise, hacking attempts become more frequent and even more sophisticated.

Knowing how to securely hold and store your cryptocurrencies can make the difference in protecting your assets or losing them all in an instant.

In this post, we’ll review the 3 safest ways to store crypto. We will discuss different wallet options and types, and best practices for using them, and also explore the future of cryptocurrency storage.

By the end, you will have a solid understanding of just how to safeguard your digital assets.

Understanding Cryptocurrency Wallets

Crypto wallets function as a way to store, send, and receive cryptocurrencies.

Similar to a traditional wallet that would hold physical cash, a crypto wallet stores your crypto…metaphorically speaking that is.

Instead of holding the physical coins, a crypto wallet stores your private keys, which is what gives you access to your crypto on the blockchain.

Public vs. Private Keys

There is a difference between the types of keys associated with a crypto wallet.

Your public key is needed for making transactions, just like a bank account number, it is what you would share to receive crypto from another person or exchange.

On the other hand, your private key is considered your password and is what gives you access to your crypto.

You must never share your private key with anyone because it can result in losing access to your digital assets.

Types of Crypto Wallets

Generally, there are two categories of cryptocurrency wallets: hot wallets and cold wallets.

Each has its own set of pros and cons, appealing to how you plan on using your crypto.

Hot Wallets

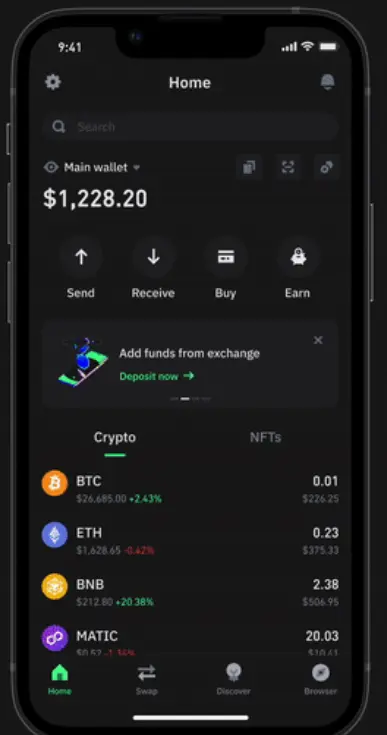

Also referred to as software wallets, Hot wallets are always connected to the internet, making them easily accessible for users. Hot wallets can be mobile apps, desktop software, or web-based platforms.

✅Pro: Easy accessibility is especially valuable for investors and traders who make day-to-day transactions.

❌Con: Since they are always connected online, they are more easily hackable. Not ideal for long-term storage of crypto.

Cold Wallets

Cold wallets are not connected to the internet. Rather, your private keys are stored on a physical object or device.

✅Pro: Higher security and protection.

❌Con: Less convenient for daily access.

Within the cold wallet category, there are hardware wallets, which are the most popular form of cold storage.

Hardware wallets come in two forms: electronic and non-electronic.

Electronic hardware wallets, like Ledger or Trezor, are devices that store your private keys.

However, to be truly considered cold storage, a crypto wallet should have no electronic components, ensuring that it is always offline, therefore preventing cyber-attacks and threats.

An example of a non-electronic hardware wallet is a metal crypto wallet, which is a plate engraved with your seed phrase. A popular option is Material Bitcoin.

Another form of cold storage is a paper wallet.

This is a physical piece of paper that has your public and private keys printed on it. It is secure in the sense of self-custody, but paper is highly susceptible to physical damage and loss.

Step-by-Step Guide to Using Hot Wallets

If you have decided to store your crypto on a hot wallet, there are some important steps that you need to take to help improve the security of your stored crypto on the platform.

Step 1: Select a Reputable Platform

If you’ve decided to go this route and not protect your crypto fully in a cold wallet, then please make sure to use a reliable provider. Popular options include MetaMask and Trust Wallet. They are commonly used and are known for having user-friendly interfaces with good customer support teams.

Step 2: Set Up Your Software Wallet

Once you’ve selected a wallet, the next step is setting it up:

- Create an Account: Download the wallet app or software, and follow the prompts to create a new account.

- Use a Strong Password: Make sure to use a unique and complex password that you haven’t used anywhere else.

- Enable Two-Factor Authentication (2FA): If your wallet offers it, enabling 2FA provides an extra layer of security.

Step 3: Store Your Keys and Backup Seed Phrases

When you set up your wallet, you’ll be given your private key and a backup seed phrase (a list of random words that can recover your wallet if you lose access). You must store your recovery phrase securely.

Step 4: Update Software and Be Aware of Current Hacking Scams

This step is essential for keeping the security of your hot wallet. Make sure to check for updates, and also keep up with any current hacks in the media. Check your account frequently to spot any suspicious activity.

Best Practices for Using Exchange Wallets

Exchange wallets are hot wallets provided by cryptocurrency exchanges, giving you the ability to store and trade crypto directly on one platform. It is extremely convenient for frequent trading but comes with risks.

The biggest risk with exchange wallets is like with any other software wallet: hacking.

However, you run another risk of the platform being compromised or going bankrupt…this means that your crypto and funds can be lost forever.

The most shocking example was the hacking and bankruptcy of the FTX exchange in 2022, which resulted in over $600 million being stolen.

When Using an Exchange Wallet, Remember To:

➡️Use reputable exchanges.

➡️Limit funds in the exchange wallet. Store the rest in a cold wallet.

➡️Enable security features like 2FA.

Cold Storage Solutions for Maximum Security

For top security and peace of mind, using cold storage for your crypto is the best option. It keeps your assets offline, making them immune to hacking attempts and fake crypto wallet scams.

Especially if you are using the HODL strategy for investing in crypto, cold storage gives you the peace of mind to “set it and forget it”.

Types of Cold Storage

1️⃣Material Wallets

When it comes to cold storage, Material Wallets stand out as a top choice. Different from other hardware wallets, Material Wallets are completely non-electronic. They are made of durable stainless steel that is fireproof, shockproof, and water-resistant. They are the ideal choice for anyone who wants to ensure that their Bitcoin, Ethereum, and USDT remain safe for decades to come.

2️⃣Hardware Wallets

If you prefer an electronic component to your wallet, then there are plenty of options available. These devices, which usually have a digital screen, store your private keys and connect to the internet when you plug them into a computer to make a transaction. Yes, the connectivity time is limited, but it’s all it takes for your private keys to be compromised.

3️⃣Paper Wallets

A paper wallet is another form of cold storage. You need to generate your keys using an online website and then print or write them down. While a paper option is secure from cyber-attacks and digital threats, it is highly susceptible to damage. Ink can fade or get smudged, while wear and tear of the paper is bound to happen over the years.

Multi-Signature and Multi-Factor Authentication

It’s important to protect your crypto beyond basic security measures. Advanced steps like Multisig wallets and Multi-Factor Authentication (MFA) add an extra layer of security.

Multi-Signature Wallets:

- These are wallets that require more than one private key to access. This means that if one key is compromised, the transaction cannot move forward. These types of wallets are best suited for businesses, joint accounts, or when transactions must be pre-approved.

Multi-Factor Authentication (MFA):

- MFA requires multiple steps of verification to access your wallet. This could range from a password or PIN to a code sent through an app. You can easily implement this by syncing your hot wallet to an authentication app, like Google Authenticator.

Wallet Backup and Recovery

As a crypto holder, having a backup is vital. It is the only way to regain access in the case that your device gets stolen, lost, or damaged.

The main part of a backup is a seed phrase, also referred to as a recovery phrase. These are a series of words that are generated by your wallet that can be used to recover your crypto in case you lose access to your wallet.

Material DIY

Instead of using easily damaged paper storage or hackable digital solutions, Material DIY involves engraving your seed phrase onto the steel card. It keeps your recovery phase offline and is also damage-proof.

Crypto owners have lost over $140 billion worth of Bitcoin due to forgotten passwords and lost seed phrases.

Security Tips

- Never store your seed phrase digitally.

- Do not share your seed phrase, not even with someone you trust.

- Guarantee its physical security and safety. Using Material DIY guarantees that it is fireproof and water-resistant.

Future Trends in Crypto Storage Technologies

| Future Crypto Storage | Description |

|---|---|

| Decentralized Finance (DeFi) and Storage | DeFi is driving innovation in crypto storage solutions, providing decentralized alternatives to traditional storage methods. |

| Quantum-Resistant Wallets | Developers are creating quantum-resistant wallets to withstand potential threats from future quantum computing advancements. |

| AI in Wallet Management | Artificial Intelligence is being integrated into wallet management, enhancing security and automating routine tasks. |

Key Takeaways

After reviewing the different wallet options and ways to store your cryptocurrencies, along with innovations and backup protocols, we take that you have a clearer idea of how to store your crypto.

Making sure that you have selected the right storage solution for you is important. While hot wallets provide ease and convenience, keep in mind that they come with their risks.

The best option for the security of your crypto is a cold hardware wallet, like Material Wallets. They are durable and keep your private keys offline.

FAQs

What’s the difference between hot and cold wallets?

- Hot wallets are connected to the internet, while cold wallets are offline, offering better security for long-term storage.

How safe are exchange wallets?

- Exchange wallets are convenient for trading but come with risks like potential hacks or exchange insolvency. It’s always best to keep some crypto on the exchange for easy trading but store the rest in a cold hardware wallet.

Can I lose my crypto if I forget my seed phrase?

- Yes, your seed phrase is the key to recovering your wallet. If you lose it, you will lose access to your cryptocurrency permanently.

Will new technologies make my current wallet obsolete?

- While new technologies like quantum-resistant wallets are emerging, your current wallet will remain secure as long as you follow best practices.

0 Comments