Inflation is something we can never get away from. In some years the inflation percentage has risen by a small percentage amount, while in other years, we’ve seen increases of up to 8%.

What inflation does to our economy and our savings is devaluing what we once had.

As prices rise, the real value of each dollar diminishes. This is why knowing how to protect your savings from inflation is crucial.

What is Inflation?

It’s a word we hear a lot in the news and financial headlines. Especially in recent months, as international conflicts continue and an upcoming US election approaches, the financial state of the world is changing, and inflation keeps rising.

But, what does inflation mean exactly? Simply put, when inflation rates go up, prices of goods and commodities therefore rise, resulting in a decrease in your purchasing power since the value of currency is now lower.

What causes inflation?

➡️ Increased demand for goods and services

➡️ Higher costs of production

➡️ Supply chain disruptions

➡️ Excessive monetary supply

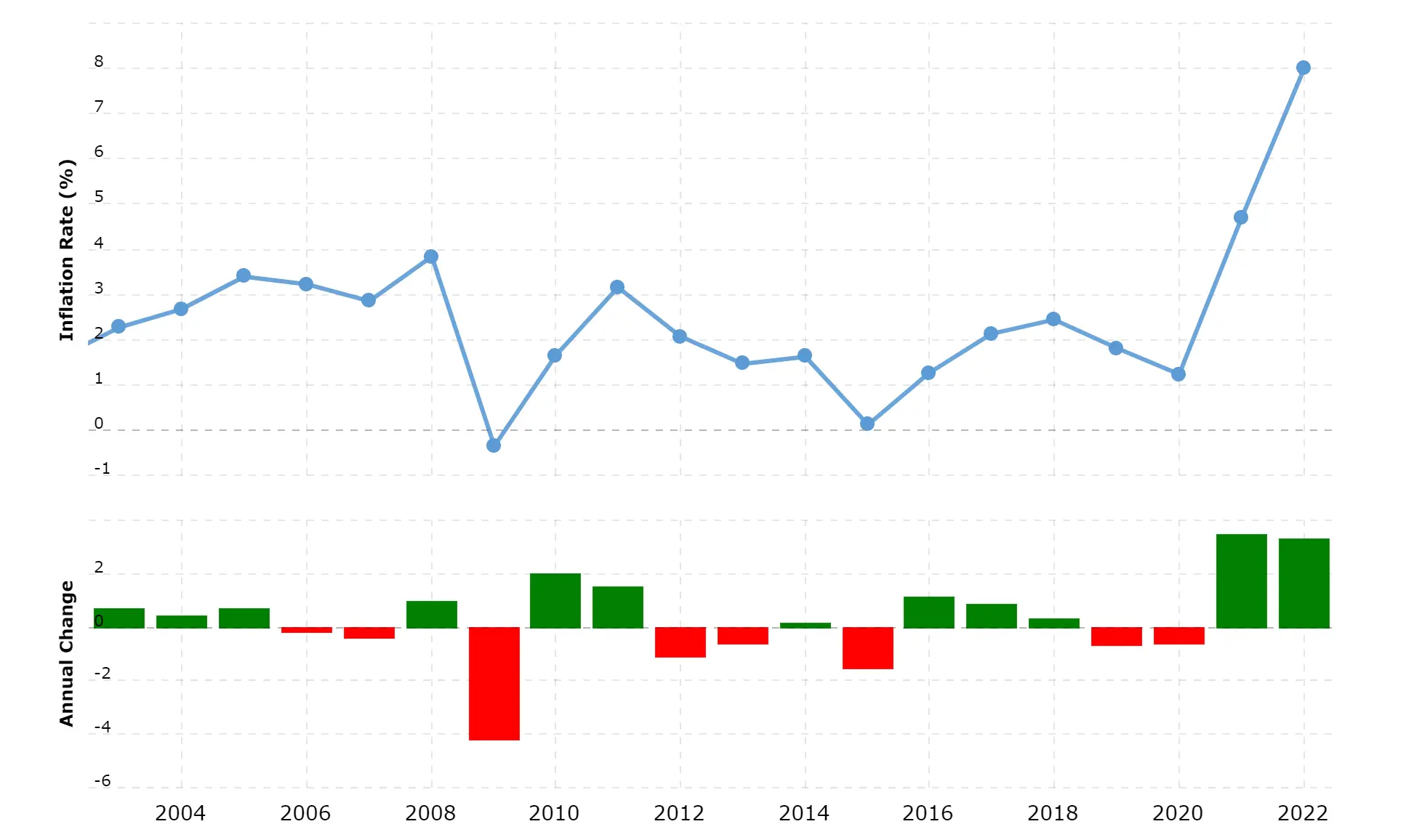

Inflation is usually calculated by the Consumer Price Index (CPI) or the Producer Price Index (PPI). Here is a chart depicting inflation rates in the last 10 years in the US. You can see that the years post-COVID have seen a large increase in percentage rates.

Ways to Protect Your Savings from Inflation

As the cost of goods rises not only in the US but around the world, our purchasing power decreases, making it vital to adopt strategies that protect our savings and investments.

One of the most effective ways to protect your savings from inflation is by diversifying your investment portfolio.

Diversification means that you spread your investments across different types of assets. It can include cryptocurrencies, bonds, ETFs, index funds, real estate, and stocks. When you invest money to make it grow, you want to make sure that it is safe.

Diversifying your investments protects you against inflation by reducing the risk of one single investment impacting negatively on your entire portfolio. When you balance your investments across asset types, you can resist some inflation pressures.

Popular Inflation-Resistant Investments

- Bitcoin and Cryptocurrencies

- Bonds & Treasury Inflation-Protected Securities (TIPS)

- ETFs and Index Funds

- Real Estate

- Stocks

Bitcoin and Other Cryptocurrencies

Over the past decade, Bitcoin has gained the nickname of “digital gold”. It has risen in popularity as a hedge against inflation because of its limited supply (21 million total exist) and decentralization.

In contrast to fiat currencies that are printed by central banks, BTC is finite, meaning that its limitation makes it resistant to inflation pressures that we see with fiat money.

✅Pros

- Potential for high returns: Bitcoin has historically grown immensely and provided a high return for its early investors.

- Protected against devaluation: Since BTC is a decentralized digital currency, it doesn’t run the same risks as government-issued currencies.

❌Cons

- Not widely adopted (yet): Although BTC is growing in popularity, Bitcoin and other cryptocurrencies have not yet become accepted in the mainstream for everyday use.

✴️Pro Tip

When investing in Bitcoin to protect your savings from inflation, rely on Material Bitcoin as a secure and user-friendly option for buying and safeguarding your crypto.

Material Wallets are ranked as one of the best hardware wallets available as you can safely buy and store Bitcoin directly from the wallet. It stores your private keys offline and is made of stainless steel to safeguard against water and fire damage.

Bonds

Known as a conservative investment strategy, bonds give a more “predictable” return and run a lower risk compared to stocks or cryptocurrencies. Bonds, especially government-issued ones, pay regular interest payments, which is a stable return.

✅ Pros

- Predictable returns: Bonds offer fixed interest payments, perfect for investors who have a low-risk tolerance.

- Lower risk: Compared to other investment strategies, bonds are generally less volatile.

❌ Cons

- Lower returns: Historically speaking, bonds have lower returns compared to stocks and Bitcoin, which may not keep up with inflation over the long term.

✴️ Pro Tip

When investing in bonds to protect your savings from inflation, consider including Treasury Inflation-Protected Securities (TIPS) in your portfolio.

TIPS are government bonds designed to protect investors from the effects of inflation. It works by increasing with inflation so that your investment maintains its purchasing power.

ETFs and Index Funds

ETFs (Exchange-Traded Funds) and index funds have become popular investments. They are perfect for beginners and for those looking to diversify their portfolio. They track the performance of specific indices, like the S&P 500.

✅ Pros

- Diversification: ETFs and index funds diversify your assets by spreading investments across different sectors and asset classes. Commodities, like gold or crypto, can be part of it, and so can companies and entities.

- Inflation protection: Since ETFs and Index funds can include different assets like stocks, commodities, and real estate, they can give better protection against inflation than traditional fixed-income investments.

❌ Cons

- Limited control: As an investor, you have no control over the individual securities of the ETF or index fund.

✴️ Pro Tip

When investing in ETFs and index funds to protect your savings from inflation, look for funds that track commodities, real estate, or specific sectors that have historically performed well during high inflation periods.

It requires a bit of research on your end, but it’s a helpful asset when understood correctly.

Real Estate

Real estate is a reliable investment for those looking to protect their savings from inflation because it can produce income through rentals and appreciate over time.

Property values and rents typically increase with inflation, making real estate an ultimate hedge against rising prices.

✅ Pros

- Potential for appreciation: Real estate values normally increase over time, especially in high-demand areas.

- Generates income: Rental properties provide a steady income for owners. With growing inflations, landlords can raise prices to reflect those changes.

- Tangible asset: Real estate is a physical asset, which gives a sense of security for owners.

❌ Cons

- High upfront cost: Purchasing real estate requires a larger upfront investment.

- Maintenance and upkeep: As the owner of the property, you are responsible for updating and fixing any issues, which can be costly.

- Illiquidity: Depending on the market and demand, real estate is not as liquid as stocks or crypto. It can take a lot of time to prepare and sell a property.

✴️ Pro Tip

If you have the disposable income to make larger investments, we suggest diversifying your real estate portfolio.

This means buying residential properties, commercial properties, and even Real Estate Investment Trusts (REITs).

Stocks

The stock market has proven to be a powerful investment tool over the past century. A stock represents ownership in companies or entities that can adjust their prices and revenue to keep up with inflation. This makes the stock market adaptable.

This is not to say that your money will always grow with stocks, of course, there are risks involved and markets rise and fall. But, the adaptability of the shares makes them good options during periods of rising prices.

✅ Pros

- Possible high returns: Historically, stocks have provided a high long-term return and some years, even outperformed inflation.

- Resistant to devaluation: When inflation rises, companies are quick to adjust their prices to reflect the higher costs. This means that the value of stocks can increase also.

❌ Cons

- Volatility: Stocks can be highly volatile in the short term. Fluctuations in the market can cause significant changes to your portfolio, which might negatively impact your savings depending on your risk tolerance and investment strategies.

- Economic sensitivity: How well stocks perform is closely related to the economy. Meaning, that if there is a big economic downturn, it will negatively impact stock prices.

✴️ Pro Tip

When buying stocks, diversifying across sectors is vital to your success.

Try investing in stocks of small businesses, larger companies, and within different fields such as tech, healthcare, logistics, and more.

Protect Your Savings From Inflation

Protecting your savings from inflation has never been more important. Diversifying your investments is the best strategy to safeguard your money and hopefully grow your wealth during periods of rising prices.

Stocks and ETFs offer growth opportunities and help keep up with inflation since they diversify your shares.

Bonds, particularly Treasury Inflation-Protected Securities (TIPS), give you stability and inflation-adjusted returns.

Real estate can generate rental income and can appreciate over time, serving as a solid hedge against inflation.

Including Bitcoin as a long-term investment strategy will add to your portfolio’s strengths.

Bitcoin’s limited supply gives it a unique protection against currency devaluation and inflationary pressures and as demonstrated over the past decade, its return on initial investment is spectacular.

By mixing traditional assets and modern investment options like crypto, you can maintain and potentially grow the value of your savings, giving you financial stability and peace of mind through inflation and economic changes.

FAQs

How does inflation impact your savings?

- It reduces the purchasing power of your savings. This means that your money buys less goods than before due to prices rising.

Why are people with savings hurt by inflation?

- People with savings who have not invested properly can get hurt by inflation because the real value of their saved money decreases.

Are savings accounts safe from inflation?

- No, traditional savings accounts are not safe from inflation because their interest rates normally don’t keep up to match with inflation.

Is it good to save money during inflation?

- Consider investing in assets that offer returns that are higher than the inflation rate to maintain the value of your savings.

Can I lose money in a savings account?

- Yes, if the interest earned on your savings is less than the inflation rate, you are losing.

Am I losing money because of inflation?

- Yes, if your savings do not grow at the same rate or more than the inflation rate, then you are losing purchasing power over time.

0 Comments