The MEXC Exchange is a platform that’s been making waves in the crypto world since 2018. Some good, some bad, but it’s been growing since then and making a name for itself.

Originating in Singapore, MEXC has grown rapidly and has created a reputation for being a dynamic exchange, with a wide range of cryptocurrencies for trading.

Now, when we talk about trading crypto, one thing we can’t skim over is security — it’s absolutely crucial, right?

Exchanges, like MEXC, play a critical role here when it comes to buying and trading crypto. In this post, we’ll take a thorough look at the MEXC Exchange, exploring its features, fee structure, international controversy, and how it stacks up against other trading platforms. We will even expose some user comments and finally give our final thoughts on MEXC and where to keep your crypto off the exchange.

MEXC Exchange Features and User Experience

MEXC Exchange has become popular as a trading tool for its user-friendly design. No matter if you are new to online crypto exchanges or have been doing it for a while, the MEXC platform is pretty intuitive and easy to navigate.

Top Features: You can spot trade, futures, margin trade, buy ETFs, and over 2,050 cryptocurrencies that can be bought as an individual, retailer, or even at an institutional level.

Mobile App: For anyone trading crypto, having the ability to do it on the go is a must, which is why a highly functional app is a necessity. This means you can manage trades and check your portfolio without needing to be at your desktop.

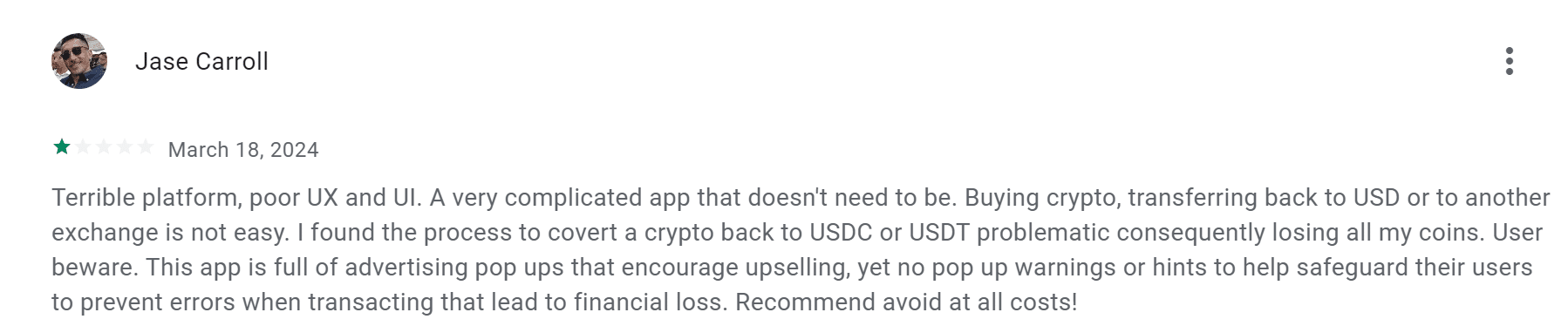

User Feedback: This is where things can get tricky since up until now, things have been looking pretty good for MEXC. The app is available for both iOS and Android—a ranking of 3.7 on the App Store and 3.8 on the Play Store.

Not bad, but not great either.

The biggest concern from the app users is that it doesn’t work correctly or respond, which can be the most frustrating thing when you need to access your crypto, now!

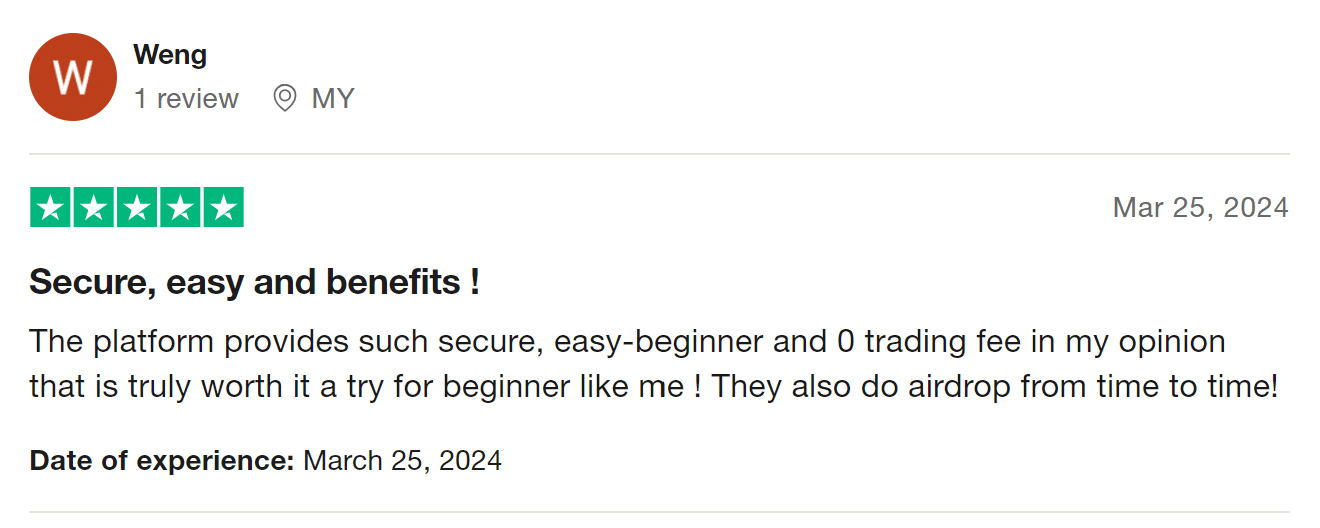

However, for the desktop version and exchange itself, the feedback is a bit better, praising the MEXC Exchange on its easy-to-use interface…

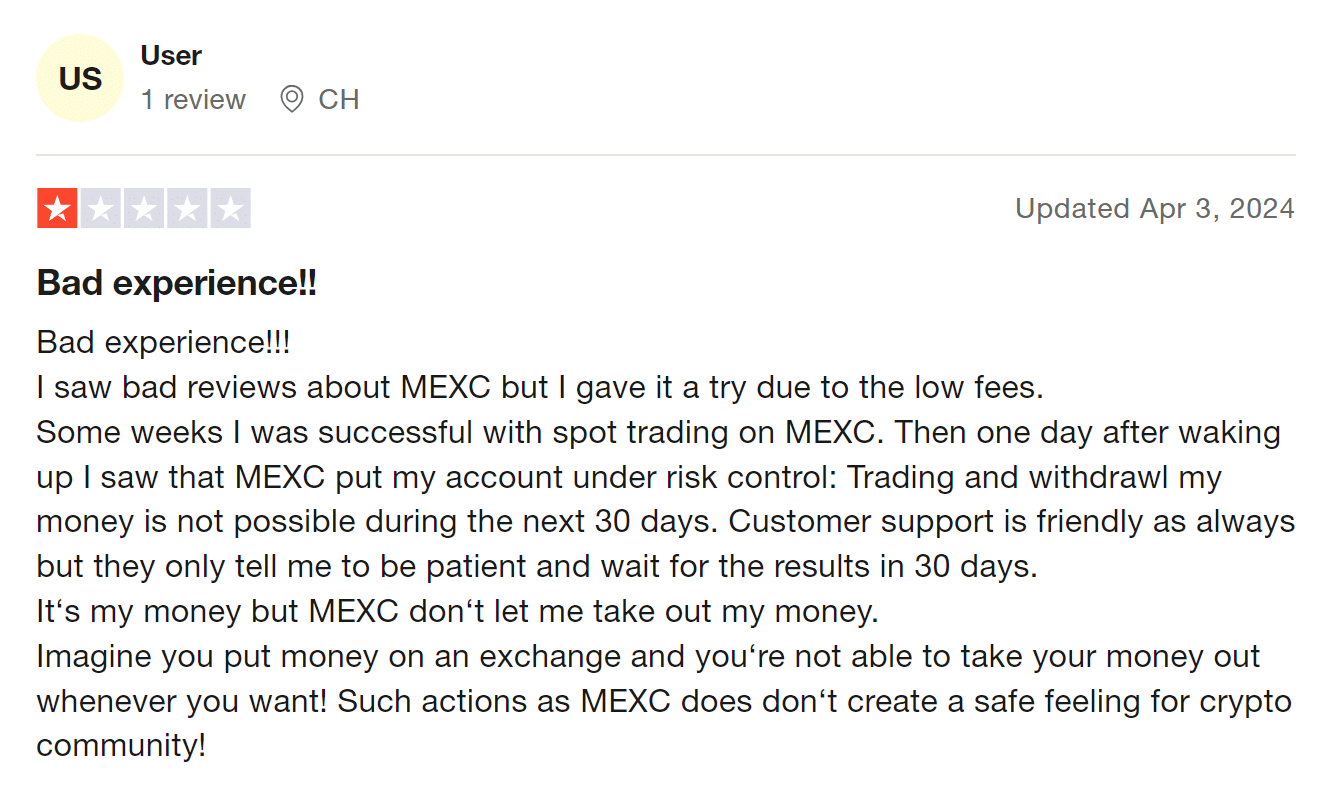

While others complain about horrible experiences and assets being held and frozen.

Managing Your Account and MEXC KYC Procedures

Having a strong emphasis on security in the crypto world is a big issue and that’s where Know Your Customer (KYC) processes come into play, especially on online exchanges like MEXC.

Depending on your view, KYC can be seen as a positive or negative aspect in the world of finance.

On one hand, KYC helps prevent financial crimes such as money laundering and fraud, but on the other hand, when it comes to crypto, being anonymous and private is a top priority for many users who look for no-KYC crypto exchanges and anonymous crypto wallets.

MEXC Exchange has 3 types of accounts: unverified, primary KYC, and verified plus. If you have an unverified account, you do not need to adhere to KYC, but you have limitations to crypto MEXC withdrawals.

MEXC Location & Regulatory Controversy

MEXC Exchange is registered in Seychelles, with other registered offices around the world (allowing them to license the exchange in that country or region), but recently, MEXC’s journey with regulatory compliance has had its ups and downs.

In 2023, The British Columbia Securities Commission (BCSC) in Canada, the Austrian Financial Market Authority (FMA), and Germany’s Federal Financial Supervisory Authority (BaFin) each issued warnings to MEXC Global for non-compliance issues. Later, in November 2023, the Estonian FIU (which is where MEXC was registered within the EU) revoked the license of MEXC Estonia OÜ due to allegations of money laundering scams on the platform.

There is also a list of countries that have prohibited the use of MEXC Exchange, which include Mainland China, Canada, the US, and ironically enough, Singapore, where the Exchange was first created.

LOOPHOLE FOR PROHIBITED COUNTRIES: Many US citizens still want to use MEXC, especially since KuCoin was recently banned as well. But how can you do this if it isn’t licensed in the US?

Use a VPN to alter your IP address.

⚠️We do not condone prohibited activities, but there are legal loopholes available to grant US residents access to MEXC Exchange.

Understanding MEXC Fees

Here’s a breakdown of MEXC fees you can expect and how they stack up against industry standards.

Trading Fees:

MEXC works as a maker-taker fee model, which is common in the crypto exchange world. The fees are tiered based on your trading volume over the last 30 days, with higher volumes attracting lower fees. Typically, fees start at 0.20%.

Withdrawal Fees:

MEXC withdrawal fees can vary depending on the cryptocurrency that you want to withdraw. They are not fixed fees but rather adjusted based on the blockchain. For example, withdrawing BTC might be more expensive than other cryptocurrencies because mining fees could be higher for Bitcoin.

Our Take:

Overall, MEXC’s fees are competitive, but it can be difficult for new crypto investors and traders to understand. Make sure you familiarize yourself with fee structures and consider the volume that you want to buy, trade, and withdraw since it can impact your fees.

Community Feedback – MEXC on Reddit

When it comes to understanding how MEXC stands with its users, Reddit is the place to go.

Like other user reviews and comments we saw earlier, there are some good and some bad, but the Reddit community can also be SAVAGE.

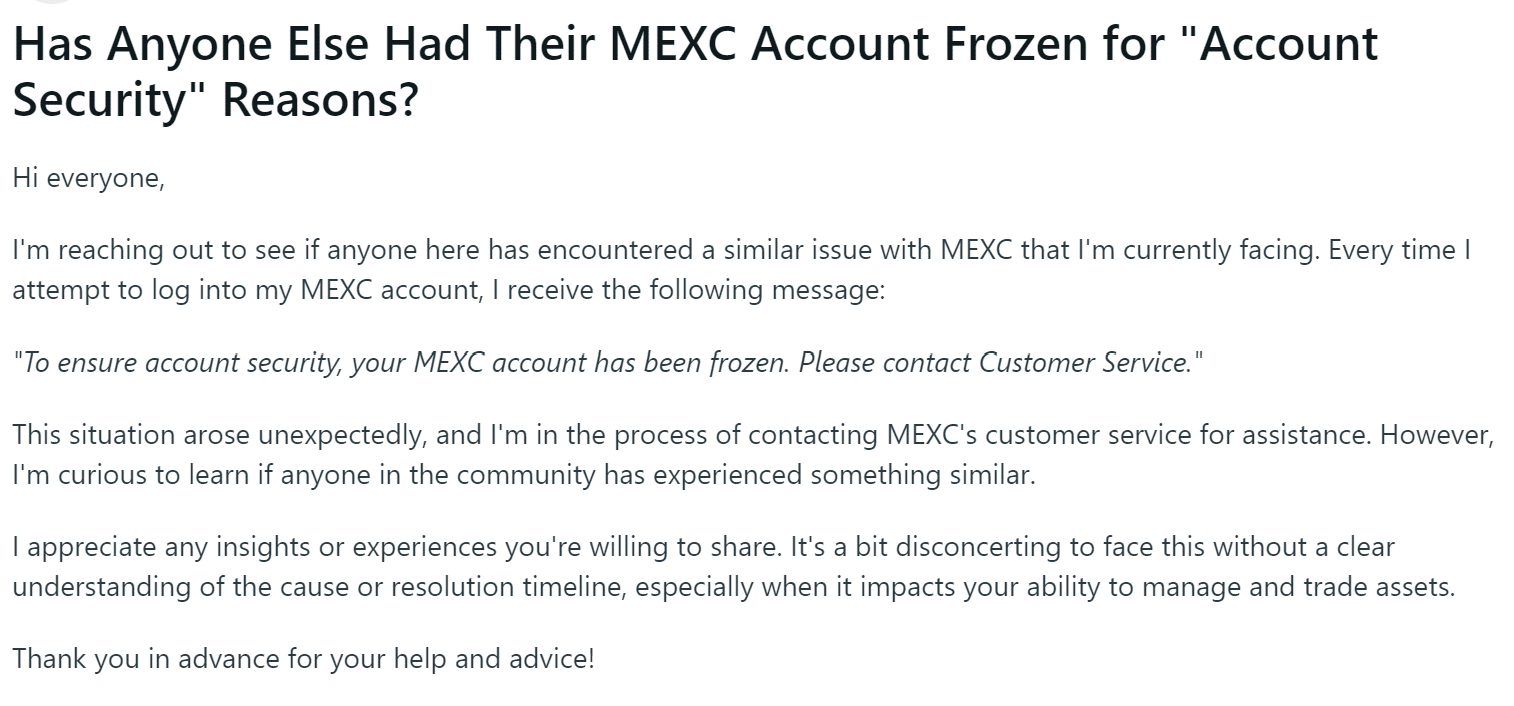

Even on MEXC’s official Reddit, they are being flooded by user complaints, inquiries, and frustration. It can get a bit scary to see how many people are being locked out of the exchange with assets frozen or unable to withdraw.

Storing Your Crypto in a Safe Place

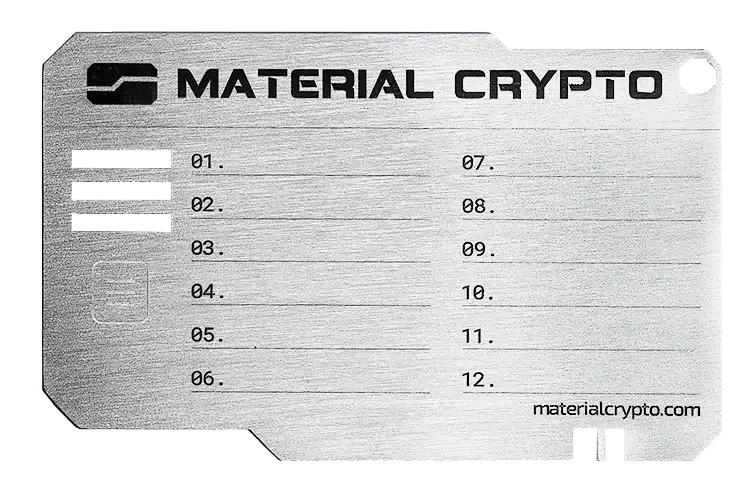

Regardless of which exchange you decide to use, when it comes to managing cryptocurrencies, keeping it safe and secure is a top priority. As digital currencies continue to gain mainstream acceptance, exchanges, and software wallets are becoming easy targets for scammers and hackers. One of the most secure methods for storing cryptocurrencies is using cold wallets, such as Material.

How Cold Wallets Work

Cold wallets, which usually are also hardware wallets, are used to keep your crypto offline. Unlike the MEXC Exchange and wallet option, they are not connected to the internet, making them less hackable. An important feature of a cold wallet is the seed phrase storage. They are a series of words that you use to protect your assets.

Material Bitcoin’s wallets for BTC, ETH, and USDT emphasize security with the set-up of unique seed phrases. This guarantees the self-custody of your crypto.

Alternative Options to MEXC

Although MEXC has so many tools and options on its platform, the overall roundup has been mixed. Depending on your needs and what suits you best, MEXC Exchange can either be the best or worst option for you.

As a good alternative, with similar features to MEXC, here are some suggestions:

Binance: Can exchange similarly to MEXC, including spot trading, margin and futures, and decentralized services. Fees are also considerably lower than MEXC’s.

Coinbase: Great for newcomers to the crypto world. Super easy-to-use interface with the ability to buy and sell a wide variety of cryptocurrencies.

Changelly Exchange: Offers a complete suite of tools, perfect for the advanced user. Has features for individuals and businesses.

FAQ Section

Is MEXC available in the US?

No, not anymore. The US, along with Canada, Mainland China, Singapore, Indonesia, Venezuela, and a few others have revoked its license.

Is MEXC a trusted exchange?

MEXC has built a reputation for offering a wide range of trading options, but it’s faced regulatory warnings in some regions, putting its trustworthiness into question.

Does MEXC require KYC to withdraw?

If you are an unverified user, then no. But to gain access to the PRO account, then yes, the exchange requires users to complete a Know Your Customer process to withdraw funds, enhancing security and compliance with anti-money laundering regulations.

How do I open a MEXC account in the USA?

To open a MEXC account in the USA, you need to install a VPN and work your way around US regulations. It is important to note that MEXC itself states on its terms that the US is a prohibited country of use, so ease with caution and at your own risk!

How do I buy on MEXC in the US?

As mentioned, since MEXC is not available in the US, you will need to use other crypto or P2P trading to make exchanges.

Final Thoughts

The MEXC Exchange has made a name for itself in the world of crypto. However, ongoing questions about its security and regulatory compliance continue to cast a shadow over the platform.

In the end, no matter where you choose to buy and trade your cryptocurrencies, the safest practice is to transfer your crypto into a cold wallet for long-term storage. This guarantees that your digital investments are secure from online threats.

Thanks, Maral!