The tradition of saving money in a bank account is ingrained in our system. Most parents open a savings account or start a college fund when a baby is born.

However, the concept of investing isn’t so widely received even though it’s one of the main ways to grow assets over time.

Concepts of compounding interests, investment strategies, and trading are all proven ways of growing your finances, yet there are many skeptics and people who are afraid to begin investing.

In this post, we will help to answer the question: “How can I invest my money to make it grow?”

We will guide you through five ways to invest your money to make it grow by exploring different investing strategies.

From traditional stocks and bonds to modern assets like cryptocurrencies, we will review risk tolerances and share different ways that you can manage your investments.

Understanding Your Financial Goals

Before you put your hard-earned money into anything, you must think about your personal financial goals and understand the difference between short-term and long-term objectives.

Short-term Goals

With a cap length of the next five years, short-term goals refer to money you want to save or grow “quickly”.

Reasons to want to grow your money in the short term can include going on a holiday, paying for a wedding, or creating an emergency fund. Typically, these types of investments are better suited for low-risk investments that you can easily access when needed.

Most people look into high-yield savings accounts and bonds for these types of investments because they can offer a higher APY (annual percentage yield) within the US.

Prior knowledge of basic economics and investing is ideal. Knowing how to read charts, understand price movements, and interpret trading strategies is a vital tool before investing.

Long-term Goals

In contrast, long-term goals, therefore, span five years or more. Usually, the main objectives for these types of investments are buying a home, children’s education funds, and retirement.

On average, most investors will go with options that offer a higher return potential in the future, despite volatility or the unknown outcome of these investments.

Examples include Stocks, crypto, and real-estate purchases, applying the HODL strategy.

For example, Bitcoin in the last 10 years has provided a return of 13,408.3%. In comparison, SPDR Gold shares had a 61.67% return over the same period, but we’ll get into BTC later on in this post.

Bitcoin Returns

| Period | Annualized Average Return | Total Return |

|---|---|---|

|

Last year |

107.4% |

107.4% |

|

Last 5 years |

63.0% |

1050.7% |

|

Last 10 years |

63.3% |

13,408.3% |

Understanding your financial goals is crucial because it influences your investment strategy.

When you clearly define your objectives, you can then move on to the next step of buying assets accordingly and managing risks to help maximize the potential growth of your investments.

Assessing Your Risk Tolerance

One of the most important things to ask yourself before you invest in anything is “How much am I willing to lose?”

Are there many people in the world making a lot of money off of their investments? Yes, but are there people who have made poor choices and lost everything as a result of their investment? Yes. Therefore, understanding your comfort levels for risk tolerance is a big part of aligning your goals.

There are three main types of risk profiles:

1. Conservative

2. Moderate

3. Aggressive

Conservative investors prefer low-risk, so it’s better to stick to bonds and higher-interest savings accounts.

Moderate investors like to balance the comfort of low-risk with the potential reward from stocks and crypto.

Aggressive investors pursue higher-risk options for a high-reward potential by only investing and trading in stocks, cryptocurrencies, and NFTs, waiting out short-term volatilities for long-term gains.

DIY Investing vs. Professional Help

DIY Investing

✅Pros:

- Complete control over your investment choices and strategy

- Lower fees

❌Cons:

- Requires time and effort to research and manage investments

- Knowledge required

Professional Help

✅Pros:

- Access to personalized strategies and expert guidance

❌Cons:

- Higher costs

- Higher fees can eat into your overall investment returns

Due to the lower fees, higher potential for returns, and control of assets, DIY investing is recommended for most people.

Creating a Diversified Investment Portfolio

The strategy of diversification means that you spread your investments across various types of assets to reduce risks. The basic idea is that if you make one poor decision, you don’t lose everything.

The old saying Don’t put all your eggs in one basket is the foundation of this concept.

A diverse portfolio might include a mix of crypto, ETFs, real estate, and stocks. Each one of these assets represents the 3 types of investors, ensuring that your growth potential is there but that the chance of losing it all is minimal.

Stocks allow you to grow your wealth, property gives you a more secure monthly return and potential appreciation, while crypto can provide a big return as proven over the past decade.

Owning portions of different investments gives you a balanced portfolio that manages risk but also aims for growth and gains.

5 Types of Investments

Here’s a closer look at five common types of investments that will make your money grow:

1. Bonds

These are considered “fixed-income” investments where you essentially lend money to either a corporate or government entity. You are loaning your money in exchange for interest payments and a return of principle.

Best For: Conservative investors who want a guaranteed and steady return with low risks.

2. ETFs (Exchange-Traded Funds)

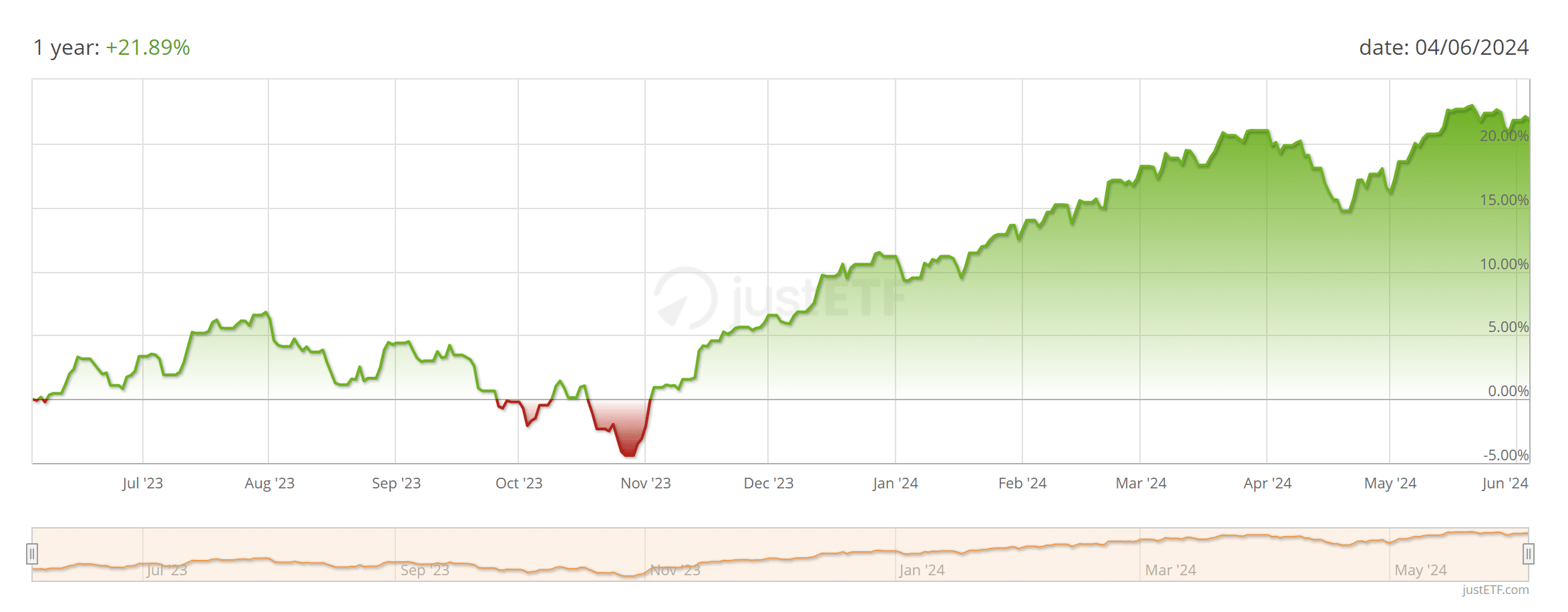

ETFs are investment funds that track the price performance of assets, and trade on exchanges, typically aligned with an index.

ETFs can either track the price of a single commodity or a collection of them and/or indexes such as the S&P 500 and MSCI World. Cryptocurrencies, like Bitcoin and Ethereum, were recently approved by the SEC to be part of ETFs in early 2024. They have quickly become a favorite investment for many.

Best For: Investors looking for moderate risk with diversification benefits. Since you own multiple portions of a commodity and not one specific item, it lowers the risk of owning one asset.

3. Real Estate

Owning and renting real estate as an investment involves purchasing property that generates income or grows in appreciation. These properties can be residential, commercial, or rental properties.

Best For: Investors who want a tangible asset. You need to be willing to manage the property or pay for a service to do so. It’s seen as a moderate risk since it does provide the option to sell and have quick liquidity but market turns and fluctuations can also be unpredictable, along with the added costs of maintaining the property and additional taxes.

4. Cryptocurrency

Cryptocurrencies are digital currencies with Bitcoin being the most well-known and most stable of them. Bitcoin and other crypto can be purchased from online exchanges, some crypto wallets, or earned by mining.

Best For: Forward-thinking investors who understand the potential risks and are looking for high returns. Although there is high volatility associated with cryptocurrencies, Bitcoin’s annual returns are impressive, with last year’s return average at 107.4%

5. Stocks

Stocks represent shares of ownership in a company. When you buy stocks, you essentially buy a portion of that company, therefore gaining part of its assets and earnings. You buy and trade stocks on stock exchanges and they can be bought and sold through brokers.

Best For: Investors looking for the possibility of high growth potential. Not for those who have a low risk tolerance as markets can be volatile.

How to Start Investing

Luckily nowadays it is easy to start investing. With many aids online and low-cost services available, beginning to invest and diversify your portfolio has never been more straightforward.

Here is a step-by-step guide to help you begin:

Training & Education

Before jumping into investing, you must educate yourself. There are many books, online courses, education blogs, and websites that are specifically tailored to beginners. Organizations and clubs like the Trading and Investing Society and the Crimson Global Academy are some good places to start.

Familiarize yourself with key concepts like stocks, bonds, decentralized finance, mutual funds, and ETFs. This will help you understand and navigate market trends and make informed choices.

Define Your Financial Goals

Identify what you are saving for. Is it for retirement, buying a house, or building an emergency fund? Knowing what your financial goals are will help determine your investment strategy.

Understand Your Risk Profile

Assess your risk tolerance and decide what your limits are. Determine how much risk you are willing to take based on your financial situation, comfort level, and investment goals about market volatility. Are you able to handle market fluctuations?

It’s generally considered that younger investors can afford to take higher risks, while investors near retirement should take a more conservative approach. Use your sense of judgment or contact a financial advisor for further guidance in assessing your profile.

Come Up With an Invest Plan

Pick how you will invest and through which platform. You can use brokers, online exchanges, or traditional banks. Brokers and exchanges typically offer a wider range of investment options and can provide you with more control over your portfolio. While institutional banks typically offer fewer options but might give you more sense of security.

We suggest always researching fees and comparing services before giving your money to anyone!

Choose the Type of Asset

Identify the types of assets you want to invest in, such as stocks, bonds, real estate, or crypto.

Remember that diversification is key to managing risk, so make sure to spread your investments across different investment classes.

Start Small

Begin with small investments at first to gain experience and build your confidence. This will give you the ability to learn without risking large amounts of money. As you become more knowledgeable and experienced, you can eventually increase your investment amounts.

Analyze and Adjust Your Portfolio

Regularly review your investments. Monitor their performance and assess them with your goals. Stay up-to-date and informed about market conditions and regulations. Make the necessary adjustments to your portfolio to match your goals and risk tolerances.

Long-Term Investment Plans

A great way to start on your investing journey is to look for user-friendly tools that will help you grow your money for the future.

For a new investor looking towards digital finance, Material Bitcoin is an easy aid to buy, and HODL Bitcoin for the long term.

With Material Bitcoin Wallets, you can rest assured that your crypto is stored safely since it keeps your private keys offline, protecting your Bitcoin from hacking threats. It is simple to set up, and you can either buy BTC directly from the app or send it from an exchange.

Investing in ETFs with the help of a reputable broker is another good option for long-term investment plans. An example of a stable long-term ETF is the iShares MSCI World ETF, which has a strong growth potential. Consistently investing with a bullish strategy in ETFs is one way to gain a significant return over time.

Advanced Investment Strategies

If you’re not new to the world of investing and have confidence in your skills, there are some advanced strategies that you can use for possible higher returns and gains. Keep in mind that with higher returns, they also come with an increased risk!

➡️ Short-Term Trading: Includes swing trading and trend following. This method involves a high knowledge and understanding of market trends, the ability to predict prices, and relies on short-term buying and selling. This is definitely not meant for beginner investors.

➡️ Options Trading: Meant for fully versed financial traders, options trading means that you buy and sell an asset for a pre-negotiated value at a certain time in the future. This is a very high-risk method and is not meant for inexperienced traders.

Other options include real-estate syndicates, forex trading, and hedge funds.

Monitoring and Adjusting Your Investments

We suggest you review your investment portfolio to make sure that it stays aligned with your financial goals and reflects current market conditions.

Of course, if you are buying and HODLing your investments, we by no means suggest that you sell and trade consistently based on market ups and downs. But rather that your risk tolerance and objectives don’t get pushed aside when waiting out the volatility.

If you feel overwhelmed by all the information on market trends and predictions, some tools and apps can guide you, such as the Bitcoin rainbow chart that indicates when is a good time to buy, HODL, and sell your digital investments.

Common Mistakes to Avoid

When thinking about “How can I invest my money to make it grow?”, it’s easy to see why some investors fall into the trap of emotional investing. They see markets crashing and panic sell or markets rise and buy beyond their means in some new token or product that is trending without thinking it through.

We all want to grow our money, but having a clear plan and understanding all prices, fees, and risks is always the first thing you should examine before making any rash decisions.

Frequently Asked Questions

What is the minimum amount to start investing?

- You can start investing with as little as $10. The important thing is that you start!

How do I choose the right investments for me?

- Always consider your financial goals and your risk tolerance.

What should I do during a market downturn?

- Stay calm and avoid making emotional decisions like panic selling. Go over your long-term strategy and future goals.

How often should I review my investments?

- For those just getting started and looking for a long-term investing strategy, we don’t recommend reviewing your investments daily. This can overwhelm you and create unnecessary stress. Try reviewing your portfolio every 6 months to a year and readjust to market conditions.

Start Investing and Make Your Money Grow

For financial growth, investing is a sure way to reach your future goals. Make sure to set clear objectives and pick the right strategies that match your risk tolerances and interests.

By starting your investment journey with Material Bitcoin, along with other methods and investment platforms you are sure to successfully grow your wealth.

0 Comments