When you have a large amount of money, such as $300,000 to invest, finding the right place to put your cash can be exciting but also worrisome.

You have the possibility of securing your financial future and obtaining long-term goals. But it also puts a lot of pressure on you to make the right decisions and have a solid investing strategy.

In this post, we will guide you through the essential steps needed for investing $300k. We’ll review how to maximize your investments, minimize your risks, and give you tips so that your money is working for you!

Personal Investment Evaluation

Before investing your money, there are some important questions to ask yourself. This self-evaluation will make it easier to know which types of investments are best suited for you and your situation.

1. Know Your Financial Goals

- Ask yourself if you are looking for long-term growth or a quick turnaround.

Building long-term growth by using the HODL strategy, focuses on investing in long-term high-growth assets such as stocks, ETFs and Index funds, real estate, and cryptocurrencies.

Comparison of Bitcoin and S&P 500 Returns

S&P 500 Index:

- Annual Return: 12.9% (last 10 years)

- Total Return: 235.2%

Bitcoin:

- Annual Return: 58.1% (last 10 years)

- Total Return: 9676.2%

If you require immediate income, with a monthly payout, then you should consider dividend stocks or invest in a rental property that will give you a payout from your tenants.

2. Understand Your Risk Tolerance

- Question just how much you are willing to lose in a worst-case scenario. This will help determine what kind of investments you should make.

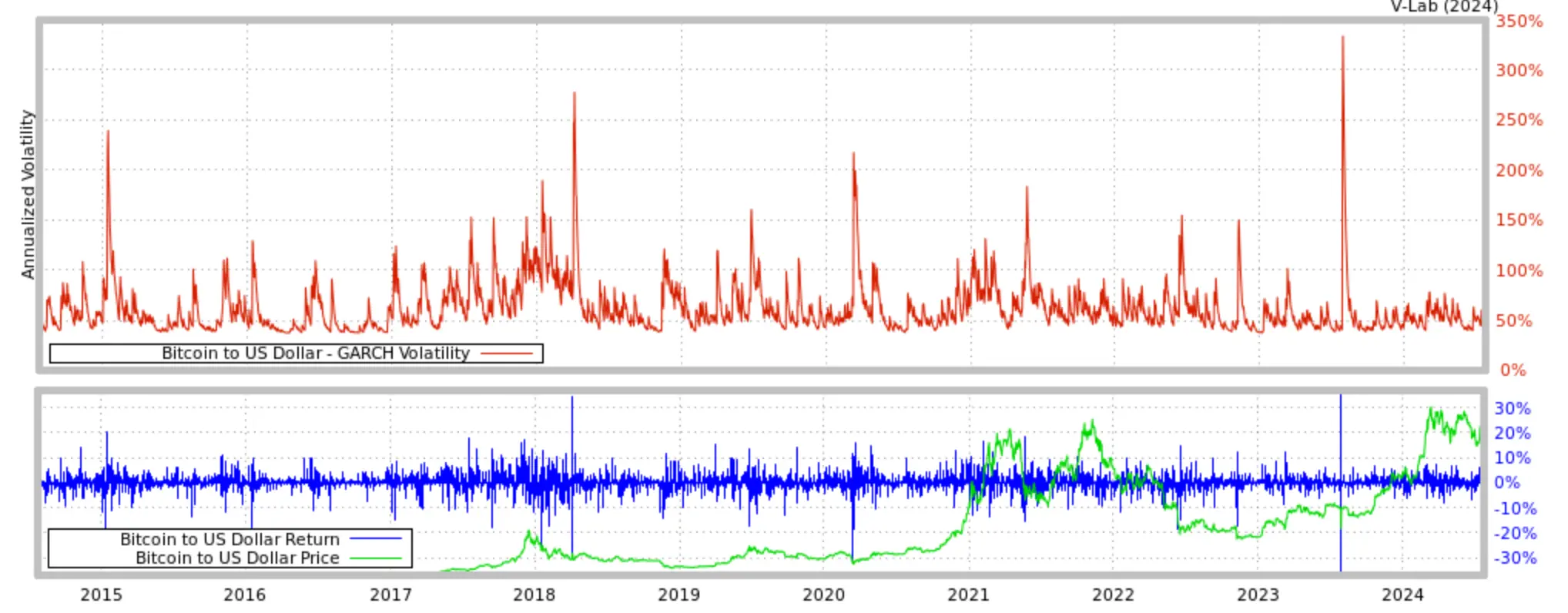

High-Risk Tolerance: You can invest more in volatile assets like stocks and cryptocurrencies. For instance, Bitcoin has an average volatility of 81.89%.

Low-Risk Tolerance: If you prefer stability, then investments like bonds or money market funds are best for you.

U.S. Treasury bonds, for example, have lower risk but keep in mind that your return potential is also significantly lower. 10-year Treasuries yield an average of 1.5% as of 2023.

3. Set a Timeline

Determine how long you want to invest for and when you would want to pull out of your investment assets.

Short-term (1-3 years): Invest in high-yield savings accounts or short-term bonds. They give liquidity and capital preservation.

Medium-term (3-10 years): Mixing bonds, ETFs, Bitcoin, and stocks can balance risk and return.

Long-term (10+ years): Invest in growth investments like stocks, real estate, cryptocurrencies, and alternative assets (NFTs, art, commodities, collectibles, and more).

Principles of Diversification

The smartest thing you can do when investing your money is to spread out your assets and invest in different asset classes to make your money grow. This is called diversification.

What is Diversification and Why is it Crucial?

When you diversify your investment portfolio, you are spreading out your investments across different assets which helps to minimize risk. This helps to protect your portfolio from big losses in the event of a big market turn.

Investing in highly volatile assets can bring you a big return, but holding some stable stocks, ETFs & Index funds, and commodities like gold will help to balance and cushion your portfolio.

According to a study by Vanguard, a diversified portfolio can reduce risk by up to 30% compared to holding individual stocks alone.

Types of Assets for a Diversified Portfolio

Having a balanced portfolio means that you have a balanced mix of class assets in correlation to your risk tolerances and goals. Dividing your $300k between these assets is ideal.

Here are some assets worth investing in:

1️⃣Bitcoin and other Crypto

2️⃣Stocks and ETFs

3️⃣Bonds

4️⃣Real Estate

5️⃣Alternative Investments – art, NFTs, farmland, natural energy sources, etc.

By including a mix of these assets in your portfolio, you will better manage risk and enhance your chances of hedging against inflation, protecting your assets during a recession, and achieving financial growth.

Traditional Versus Alternative Investments

Knowing which types of investments to mix and match for a diversified portfolio can be tough.

Here is a look at some traditional and alternative asset classes for you to consider:

Traditional Investments

Stocks and ETFs

Investing in individual stocks and exchange-traded funds (ETFs) can provide substantial growth. However, diversification within the stocks and ETFs category is also needed by investing in different sectors and industries. For this reason, many new investors stick with ETFs and Index funds as they usually mix a variety of different industries.

Bonds and Bond Funds

Bonds are known to be safer investments that provide a regular interest income (monthly or quarterly). Bond funds, which pool money from many investors to buy a diversified portfolio of bonds, offer more diversification and also help to reduce risk.

Direct Property Purchase

Real estate can give you a large return, but it also involves a larger investment upfront. You can benefit from real estate on a short-term monthly rental return or long-term appreciation once you sell the property.

Real Estate Investments

This entails buying stakes in a specific property development. You can do this by either debt or equity investment, where you lend part of the capital that is needed for developing the property, or you have part ownership of the property and therefore share the profits (from dividends).

Indirect Real Estate Investments

This involves buying shares in a fund or stocks in a company that invests in real estate. This is usually done through REITs.

Alternative Investments

Art and Collectibles

This can be a very lucrative asset to invest in and can be very enjoyable for those who have a genuine interest in the world of art and antiques. But, it requires an advanced knowledge base to invest smartly.

Agriculture and Farmland

This asset has been making a lot of noise in the news recently. It involves property and agricultural biology, so there are many different avenues within this industry to explore.

Business and Startup Investments

Investing in startups and small companies can give you high returns on your initial investment, but it involves a much higher risk. Platforms like AngelList can help you get started.

Cryptocurrencies and Digital Assets

Cryptocurrencies, such as Bitcoin, have become a highly popular investment, producing high returns for long-term investors.

For new Bitcoin investors, Material Bitcoin is the easiest and safest way to invest in BTC and store it for the long term.

Made of stainless steel and built to last, you never need to worry about the security of your crypto.

Just scan the QR code, follow the indications, and buy BTC directly from Material Bitcoin, then forget about it as it stays safe in the cold hardware wallet for many years to come.

Things to Remember When Investing $300k

➡️Pay Off Your Debts: Paying off high-interest debt is the first thing you should do to improve your financial health. When you eliminate high-interest payments, you increase your income and your savings for investments. It should be your top priority.

➡️Tax Considerations: Understanding the tax implications of your investments is crucial, especially for alternative investments like crypto taxes. You can consult with a tax advisor, and contact the IRS for further guidance.

Investment Management Apps & Tools

Using technology to your advantage to help manage your investments efficiently can help to reduce costs, and save time.

Robo-advisors are great tools to use to your advantage. They are an automated financial planning service that uses mathematical algorithms to outline the best assets for you.

They offer easy accessibility and low service fees to help beginners manage their portfolios.

Many platforms, such as Betterment and Wealthfront, include a self-rebalancing feature that automatically rebalances your portfolio to keep you invested in your desired assets.

Financial Education Platforms

Being up-to-date and educated about investing and different asset classes is vital for anyone who wants to make smart financial choices. Many free and paid platforms offer courses online to help you up your game.

Coursera is a well-known educational platform that offers a wide range of courses on finance, financial management, and investing strategies.

BMO offers online investing courses that review trading, options trading, creating a diverse portfolio, and some alternative investment assets.

The Blockchain Council provides a certified cryptocurrency trading program, where you will learn all about Bitcoin and other coins and tokens.

Expert Tips

- Diversify Your Portfolio: As Warren Buffett famously said, “Do not put all your eggs in one basket.” Diversification will help to protect your assets from market volatility and recessions.

- Stay Informed and Educated: Keep up with market trends and financial news. Use resources to your advantage.

- Focus on Long-Term Growth: The most successful investors use the HODL strategy when buying stocks, ETFs, crypto, and other assets.

Case Study on Bitcoin Investing: Kingsley Advani’s All-In Bet on Crypto

“I think at no point in human history have people in their twenties had such an opportunity to invest in such high-growth assets.” — Kingsley Advani.

In mid-2017, Kingsley Advani saw a chance in the up-and-coming world of cryptocurrencies. It was at this moment that Kingsley decided to go all in, he sold everything he possibly could and made a bold choice to invest in Bitcoin.

He managed to put $34,000 into Bitcoin, right when a bull market was about to hit. Within a few short months, the value of his BTC shot up, turning his initial investment into millions.

Yes, this is an example of a high-risk investment, but it’s a profound example of how doing your research, understanding investing techniques, and taking a chance can pay off in the long run.

Remember, Bitcoin was worth $1,000 back in 2017. It is now worth over $63,000.

Investing $300,000 wisely involves knowing your financial situation.

You must diversify your portfolio, stay informed of new trends, and take opportunities if the market points in that direction.

Don’t forget to use reliable resources and expert advice when making your financial decisions.

Our favorite Books on Investment:

- The Intelligent Investor by Benjamin Graham

- Rich Dad Poor Dad by Robert Kiyosaki

- Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond by Chris Burniske and Jack Tatar

Useful Websites and Blogs:

0 Comments