Regarding crypto, there is always the question of “How long should I hold Bitcoin?”

Given the volatility of the market and its potential to cause emotional stress, it’s understandable why so many people seek an answer.

However, as Bitcoin has continued to soar, with its value up almost 450% in the last 5 years, many investors and crypto financial gurus are looking at long-term holding as a key strategy.

In this post, we will break down everything you need to know about investing in Bitcoin and what strategies can help you to make an informed decision about keeping or selling your BTC.

What Does Long-Term Bitcoin Holding Mean?

Long-term holding refers to a method of investing where you keep your Bitcoin assets for several years, no matter what the market is indicating.

This investing strategy is not unique to Bitcoin and has been widely viewed as a smart investment method for stocks and other commodities.

The objective is to not sell your Bitcoin regardless of price fluctuations, in the hope that in the long run, your initial investment will grow.

HODL Strategy: What It Is and Why It Works

The term “HODL” has become widely popular in the crypto world, standing for “Hold On for Dear Life”. It was a typo made by a well-known crypto blogger on a forum where he made a mistake and it has stuck.

It perfectly describes the concept of riding out the wild and volatile swings in Bitcoin’s price.

Why the HODL Method Works

This has been an effectively proven strategy over the years. Since its beginning, Bitcoin has grown significantly, even with its frequent market dips.

If you had purchased BTC 10 years ago, you would have made an impressive return on your initial investment.

Here are some points as to why HODLing Bitcoin works so well:

➡️Scarcity: Bitcoin has a fixed supply, meaning that ownership of it is limited.

➡️Restricted Supply: There are only 21 million Bitcoins in existence.

➡️Growing Demand: As prices go up, the demand rises which in turn increases BTC’s value even more.

➡️Halving Events: Bitcoin’s “halving” events usually take place every four years, reducing the reward for mining new blocks by half.

➡️The Impact of Halving: Halving events restrict Bitcoin’s supply even more, and usually lead to price increases due to new scarcity issues.

Holding Bitcoin vs. Traditional Assets

Stocks and Bonds: Traditional assets like stocks and bonds have provided stable, but modest, returns over the years. As an example, the S&P 500 has delivered an average annual return of about 10% over the past 100 years. Compared to Bitcoin’s average annual return from the past decade at 63.6%, the difference is astronomical.

Gold: Bitcoin is frequently compared to the precious metal, often referred to as “digital gold”, offering a to protect your money during a recession. For example, during the 2020 pandemic, Bitcoin outperformed gold by rising over 300%, while gold gained around 25%.

What to Consider When Determining Holding Time

When deciding how long to hold Bitcoin, there are several factors to consider. Each strategy will affect the potential success of your Bitcoin investment.

1️⃣Market Volatility & Risk Tolerance

Consider price swings and volatility of crypto in the short term. For example, in April of 2021, BTC dropped from $65,000 to $30,000 in two months. Luckily, within the year, it gained its value back.

These fluctuations might scare many investors who don’t have a clear understanding of their risk tolerance to make emotional decisions and sell. If you were to have sold your BTC during that time, rather than waiting it out, you would have lost a significant amount.

2️⃣Global Economic Cycles

Historically, Bitcoin has outperformed other investments during times of recession and even has hedged against inflation. Understanding these cycles in the economy can help guide you on whether to hold or sell your Bitcoin.

Reviewing Bitcoin monthly returns and analysis is another tool that you can use to help you predict BTC’s movements.

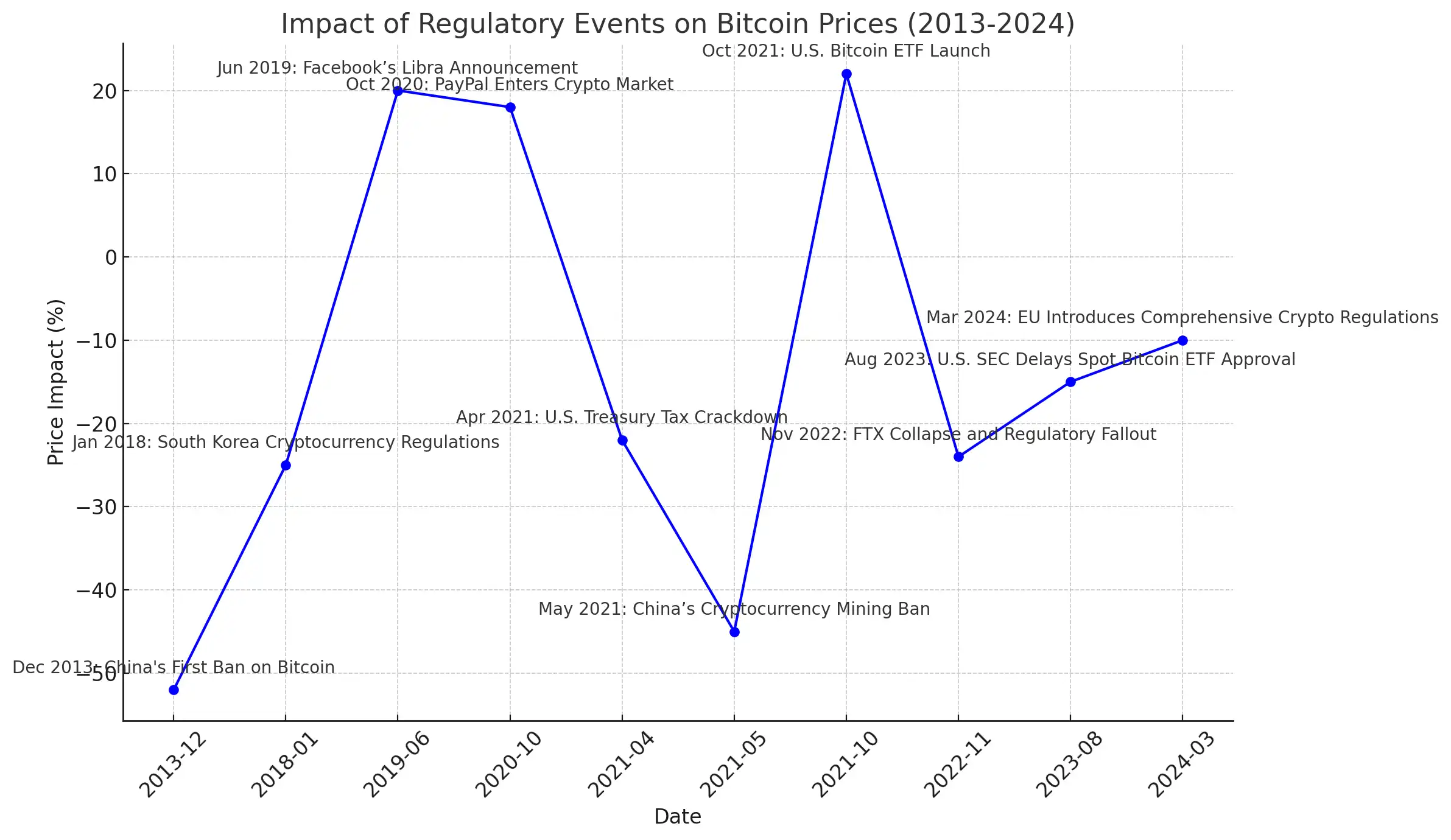

3️⃣Crypto Regulations and Their Effect on Bitcoin’s Price

Government regulations can play a critical role in Bitcoin’s price. It can either be positive or negative and lead to quick changes. Some countries have accepted cryptocurrencies like El Salvador, while other countries like China have cracked down on its mining and use.

Understanding how global regulations function can help you anticipate potential price movements.

Bitcoin Investment Strategies

When looking to buy and invest in BTC, there are a few different ways of strategically building your portfolio. Here are some proven methods that many investors and professional consultants recommend:

Dollar-cost averaging (DCA)

This strategy involves buying Bitcoin at regular intervals, regardless of the price. Usually, you would set a fixed amount, and buy consistently.

Diversification

Diversifying your investment portfolio, whether crypto or mixed asset types, is an ideal strategy for all. This helps to reduce risk by spreading your assets across different classes and not putting all of your eggs in one basket.

Identify Your Exit Strategy

Knowing when and how to buy BTC is important, but so is knowing when to sell your Bitcoin. You want to make sure to have a well-thought-out exit strategy that aligns with your risk tolerances to avoid making last-minute emotional decisions.

Some exit methods include: selling at market peaks, phased selling (gradual liquidation of assets), selling once you reach a target profit, and dollar-cost averaging for exiting.

Pros & Cons of Long-Term Bitcoin Holding

✅Pros:

- Historically Profitable

- HODL Proven Success: Holding can avoid emotional reactions to short-term volatility.

- Hedge Against Inflation

- Tax Advantages (Depending on Jurisdiction): In certain countries, like the US, long-term holding may provide you with a lower capital gains tax when you sell your Bitcoin.

❌Cons:

- Control of Emotions With Market Volatility: It might be difficult for some not to panic during market drops.

- Regulatory Changes: New laws and regulations can quickly change the market or even the investment asset of crypto.

- Technological Risks: Hacking and security of Bitcoin in the long-term if not protected correctly.

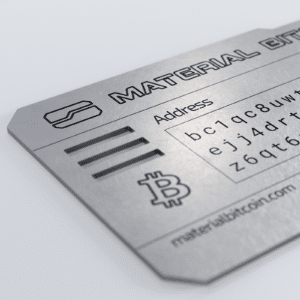

The Safest Option for Long-Term Crypto Holding – Material Bitcoin

When it comes to safeguarding your cryptocurrency for the long term, Material Bitcoin stands out as the most secure and reliable cold wallet solution.

It offers physical, tamper-proof security that stores your Bitcoin offline. This means that your assets are immune to hacking, phishing attacks, or technical failures common with online hot wallets.

Material Bitcoin provides peace of mind for HODLers who want to protect their investment for years to come.

Short-Term VS. Long-Term Investor: Which One Are You?

Deciding “How Long Should I Hold Bitcoin?”

In the end, the decision of how long to hold Bitcoin comes down to your personal investment goals, risk tolerance, and market outlook.

Regardless of your choice, the key is to stay informed and on top of your strategy.

FAQs About Holding Bitcoin

Is It Better to Sell at Market Peaks?

- Timing the market can be tricky and risky. While selling at a peak can return high profits, it’s hard to predict exactly when that will happen.

How Are Bitcoin Gains Taxed?

- In the US Bitcoin is usually taxed as property, with long-term holdings taxed at a lower rate. These regulations differ from country to country.

What Should I Do if Bitcoin Crashes?

- If Bitcoin does crash, reassess your goals. Long-term holders ride out dips and lows, while short-term investors may want to sell. No matter what, stay calm and avoid panic selling.

Can I Lose My Bitcoin by Holding Too Long?

- While Bitcoin itself doesn’t expire, long-term holders face risks like hacking or security breaches if not stored correctly. Use a secure cold hardware wallet like Material Bitcoin for peace of mind.

Is Diversification Important?

- Yes, diversifying your portfolio with other assets can reduce risk.

0 Comments