Are you ready to finally begin your crypto journey, but not sure where to begin?

You’re not alone.

With Bitcoin prices reaching new highs, ETFs finally being adopted, and thousands of coins flooding the market, it’s normal to feel overwhelmed.

The truth is, you don’t need to be a trader or tech expert to invest in crypto successfully.

What you do need is a thought-out crypto strategy.

This guide breaks down the best crypto investment strategies for beginners in 2025.

Straightforward, practical, and beginner-friendly.

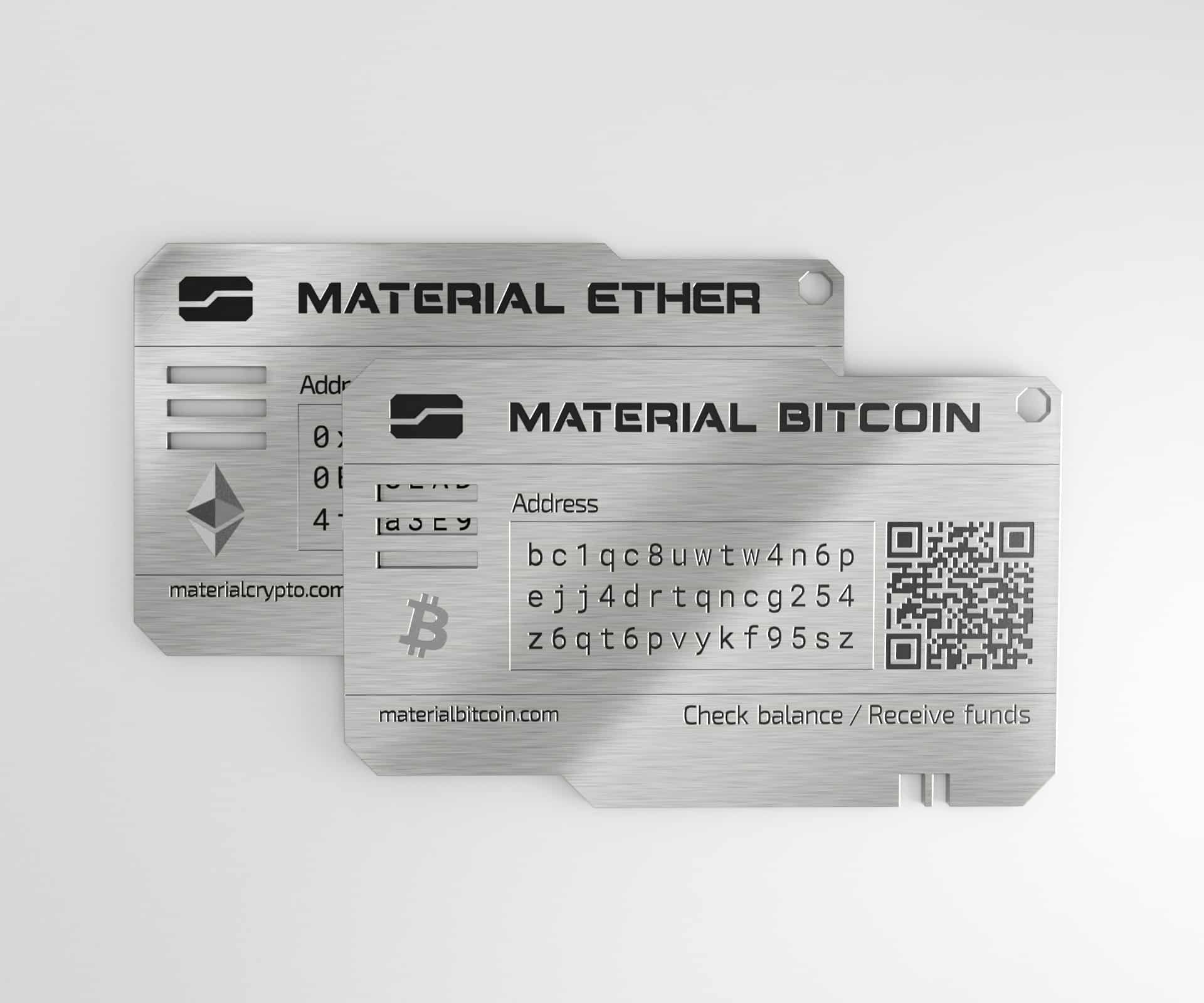

Material Bitcoin: Secure. Trusted. Educational.

Material Bitcoin is more than a cold wallet; it’s your gateway to crypto security and confidence. Trusted by thousands, our steel wallets keep your assets safe while our blog helps you stay informed. Whether you’re storing Bitcoin or just starting out, we’ve got you covered.

Why You Need a Crypto Investment Strategy in 2025

Investing in crypto as a beginner might seem to have its challenges.

With so many influencers and “crypto experts” on TikTok and Reddit, we can see why some beginners might feel confused or unfortunately go down the wrong path.

Common Pitfalls for First-Time Investors

⛔Believing the Hype (FOMO)

Jumping into trending tokens without doing your due diligence can cause big losses, especially with the rise of “rug pull” schemes targeting inexperienced investors.

🔄Overtrading

Frequent buying and selling in response to market fluctuations can eat away at your profits through fees and taxes.

📊No Portfolio Management

Failing to diversify across different assets and sectors (even within crypto) or knowing techniques like buying the dip or selling high and buying low.

💸Ignoring Taxes and Fees

Overlooking transaction fees and tax obligations can cause legal complications and additional fees and fines.

How to Avoid Common Mistakes

| Mistake | How to Avoid It |

|---|---|

| Chasing hype (FOMO) |

|

| Overtrading |

|

| Lack of portfolio management |

|

| Ignoring taxes and fees |

|

How the Crypto Market Has Evolved

Crypto has had a HUGE transformation.

Growth of Bitcoin ETFs in 2024: The approval of spot Bitcoin and Ethereum ETFs has attracted big institutional investment. BlackRock’s iShares Bitcoin Trust has massive inflows…and this from a traditional financial institution!

More Regulation (MiCA, SEC Rulings): The European Union’s Markets in Crypto-Assets (MiCA) regulation, effective since December 2024, puts strict rules on exchanges, wallets, and investors. The SEC and other US organizations have varying rules on crypto and its use.

New Retail Investor Protections: As crypto is becoming more adopted, regulations are now being implemented to safeguard retail investors. This is creating more compliance regulations for crypto exchanges and wallets.

Institutional Interest: Major financial institutions, from financial organizations to the US government, are increasing their exposure to cryptocurrencies.

Need a Secure Way to Store Your Crypto?

Cold storage is always the safest way to protect your crypto.

Check out Material Bitcoin for trusted cold storage wallets that keep your BTC, ETH, and USDT offline and safe from hackers!

7 Best Crypto Investing Strategies for Beginners

1️⃣Diversify Your Crypto Portfolio

One of the most important crypto investment strategies for beginners in 2025 is diversification.

Putting all your money into a single asset is risky, especially in such a volatile market.

Instead, spread your investment across different types of crypto assets to reduce risk and improve long-term gains.

Top Coins and Tokens for 2025

Here are some of the most recommended cryptocurrencies for beginners this year:

| Coin | Use Case | Risk Level | Growth Potential | Notes |

|---|---|---|---|---|

| BTC | Digital Store of Value | Low | Moderate | Most stable; widely adopted |

| ETH | Smart Contracts Platform | Medium | High | Strong developer ecosystem |

| SOL | High-Speed DeFi Platform | High | High | Fast and scalable, but riskier |

| LINK | Data Oracle for Blockchains | Medium | Medium | Powers smart contract data connections |

| ARB | Ethereum Layer 2 Scaling | High | High | Gaining traction in DeFi |

| RNDR | AI/3D Rendering Network | High | Very High | Growing with AI sector |

| TAO | Decentralized Machine Learning | High | Very High | Popular in the AI narrative |

2️⃣Long-Term Holding

HODLing means keeping your assets for the long haul and ignoring short-term price swings.

This is the most effective and stress-free crypto investment strategy for beginners.

HODLing vs. Short-Term Trading

| Strategy | Pros | Cons |

|---|---|---|

| HODLing | Lower stress, fewer fees, long-term tax advantages | Needs patience, may miss short-term gains |

| Trading | Potential for quick profits, active market engagement | Higher fees, tax complexity, and emotional stress |

Bitcoin Case Study:

If you bought $1,000 worth of Bitcoin at around $300 per coin in early 2015, you would have owned roughly 3.33 BTC.

As of May 22, 2025, with Bitcoin’s value above $90,000, that investment would now be valued at approximately $350,000. That’s a 366-fold increase over 10 years.

This example shows why long-term holding as a crypto investment strategy should not be overlooked.

3️⃣Apply DCA

Dollar-cost averaging (DCA) means investing a fixed amount into crypto regularly.

It can be every week or every month.

The idea is to smooth out volatility, avoid emotional decisions, and build your position over time without needing to time the market.

Start with a monthly budget you’re comfortable with, for example, $50 or $100.

@cnbcShould you buy the dip? CFP Lee Baker weighs in with CNBC’s Greg Iacurci.♬ original sound – cnbc

4️⃣Buy the Dip

“Buy the dip” is a popular phrase in crypto.

Trying to time the exact bottom is nearly impossible, so as a beginner, buy low (when the market dips), but set a limit for yourself.

Remember, the point of investing is to grow your wealth.

Do not accumulate debt!

5️⃣Stay Informed on Market Trends

Staying updated is crucial for making informed decisions.

At Material Bitcoin, we regularly publish insights on market movements, security best practices, tips on buying Bitcoin, and long-term investment strategies.

Don’t forget to follow official X and Reddit communities for key research and user experiences for follow-up research.

Understanding Regulatory Changes

| Country/Region | Regulation Overview |

|---|---|

| 🌍 Global | Regulations are evolving quickly. |

| European Union | The Markets in Crypto-Assets Regulation (MiCA) provides a unified framework for crypto assets across EU member states. |

| United States | Regulatory organizations like the SEC and CFTC are increasing oversight, impacting how cryptocurrencies are classified and traded. |

| Canada | The Canada Revenue Agency (CRA) continues to refine tax guidelines for crypto transactions. |

6️⃣Control Your Emotions

Crypto is very volatile.

Your emotions can easily affect your choices, like panic selling during dips or buying during hype (FOMO).

Stay calm and stick to your investment plan.

Set clear goals, trust your process, and remind yourself that short-term highs or lows don’t determine your long-term success.

7️⃣Learn from Other Investors’ Mistakes

One of the smartest ways to grow when you first begin is to know what NOT to do.

Many experienced investors recommend starting small, being patient, and buying crypto that you understand.

What Not to Do When Starting Out

❌Don’t buy crypto based on hype or influencers

💰Never invest more than you can afford to lose

🔐Don’t ignore security! Use a non-custodial cold wallet, like Material Bitcoin, for large amounts

✴️Bonus Strategy: Explore Bitcoin ETFs and Index Funds

If you don’t yet feel comfortable buying a direct asset, consider Bitcoin ETFs and crypto index funds.

This gives you exposure to BTC, ETH, and other altcoins.

It’s ideal for passive investors who want broad market exposure without the fuss.

Start Investing as a Beginner Today

Getting started with crypto doesn’t have to be complicated.

By following simple, proven strategies, you will learn to build a solid portfolio.

Stay informed, avoid emotional decisions, and always prioritize security.

Ready to invest? Protect your assets with Material Bitcoin.

FAQs

What’s the easiest crypto strategy for beginners?

- Buy BTC and HODL. It’s simple, low-risk, and stress-free. Alternatively, you can explore crypto ETFs for more diversity.

How much should I invest in crypto in 2025?

- Start with 1–5% of your total portfolio.

Which cryptocurrency is best to start with?

- Bitcoin and Ethereum.

Should I use a cold wallet?

- Yes! It’s the safest way to store crypto long-term.

0 Comments