With over 560 million crypto users worldwide and thousands of exchanges available, it is normal to feel overwhelmed when first investing in Bitcoin.

Choosing the right exchange to buy Bitcoin in 2024 has never been more important. With over 80% of crypto theft occurring on unsecured exchanges, choosing the best exchange to buy Bitcoin can either make or break your crypto investing experience.

In this guide, we’ll help you pinpoint some of the most trustworthy Bitcoin exchanges, review their features, and give you step-by-step instructions on how to buy Bitcoin.

What to Look for When Choosing a Bitcoin Exchange

As the value of Bitcoin rises, more investors from around the world are looking to buy Bitcoin.

However, one stand-out question is whether or not buying Bitcoin is safe.

To choose the right Bitcoin exchange for you, it is vital to look at a few key features that can impact your experience.

1. Reputation

First things first, it is best to always investigate exchanges that are well-known and already established. Look at user reviews, and expert opinions and check how long they’ve been in business.

2. Security Features

Security should always be the top priority. Check for exchanges that offer more than just a username and password entrance such as two-factor authentification, and insurance policies.

3. Fees and Pricing

Trading fees are another important factor when choosing the right exchange. Especially if you are a frequent trader, this can affect your bottom line and profitability.

For example, Binance typically charges 0.10% per trade while Coinbase has fees ranging from 0.5% to 4.5%, depending on the region you are in and the payment method (credit card/debit card).

4. Liquidity

Liquidity refers to how quickly and easily you can buy or sell Bitcoin on an exchange without affecting the price. Therefore, high liquidity means you can make faster trades, even during market volatility. If you are going to be trading daily, it’s best to use an exchange with a high liquidity ranking.

5. User Interface and Ease

The ease of use of an exchange platform is what can make or break your experience. It all depends if you are a beginner or an experienced user and what you are looking for.

As a new investor, look for exchanges that are simple, and that allow you to purchase Bitcoin without too many steps. However, if you are an experienced user looking for more advanced options like staking, then it’s best to use an exchange with a more complex interface to meet your needs.

6. Regulatory Compliance and Availability

Select an exchange that is available in your country and complies with local regulations. For example in Canada, exchanges like Kraken are available without restrictions, however, in the U.S. it doesn’t offer services to Washington State, New York State, or Maine.

Top Bitcoin Exchanges in 2024

Coinbase

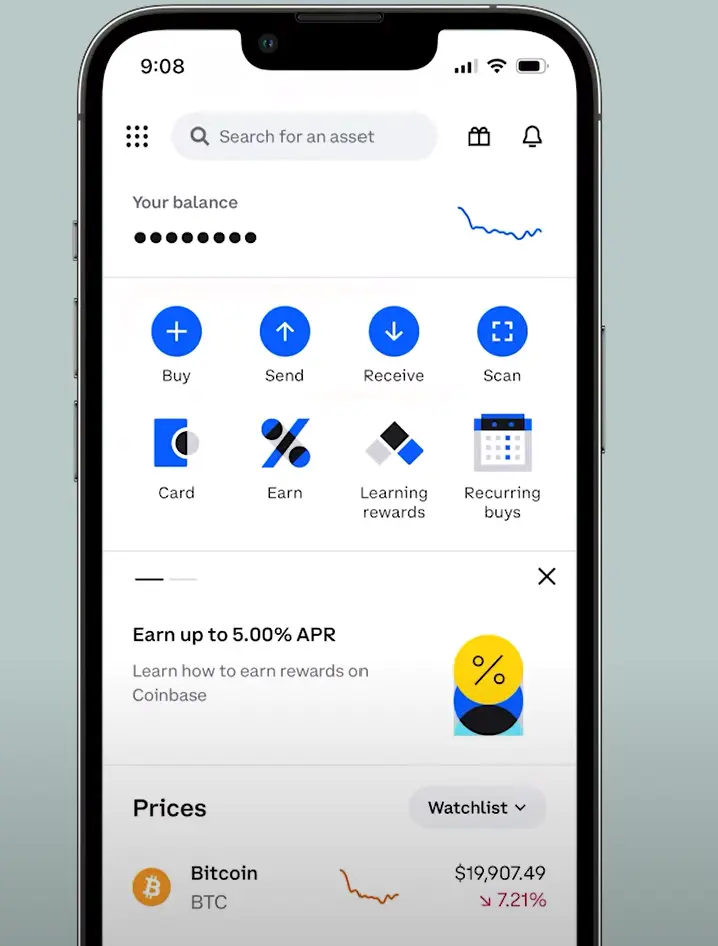

Coinbase is one of the most popular platforms. It offers a user-friendly interface and has many educational resources that make it easy for crypto investors to navigate the Coinbase platform.

🔐Security: 2-factor authentication (with security key support), password protection, multi-approval withdrawals, and insurance coverage for digital assets.

🧑⚖️Regulations: Fully regulated in the US by FINCEN.

🎖️Best For: Beginners or US-based users who need a simple platform with strong educational support.

Binance

Binance is the go-to platform for advanced traders. It has a wide range of cryptocurrencies and many trading tools. Fees and liquidity are low, which makes it an appealing option for frequent traders.

🔐Security: Binance has a backup emergency SAFU fund, which can protect user assets in case of hacking.

🧑⚖️Regulations: It has regulatory challenges in some countries, so you should be aware of your local restrictions.

🎖️Best For: Advanced traders looking for low fees, high liquidity, and a high selection of cryptocurrencies.

Kraken

Kraken is a well-established exchange. It is suitable for all levels of investors and offers advanced trading tools. It is highly regarded in the margin trading community.

🔐Security: Kraken offers two-factor authentication and cold storage for assets. This means that Kraken uses servers that are offline to store your private keys and crypto.

🧑⚖️Regulations: Regulated in both the US, Canada, and Europe.

🎖️Best For: Traders of all levels who want access to advanced features like margin and futures trading.

KuCoin

KuCoin is known for its large selection of cryptocurrencies, including many altcoins. But, it operates with fewer regulations. This might be concerning for some users.

🔐Security: KuCoin has standard security features like two-factor authentication, but it’s less strict in comparison to other fully regulated exchanges.

🧑⚖️Regulations: Not fully regulated, so users need to be cautious.

🎖️Best For: Altcoin enthusiasts and traders who want a wide range of “lesser-known” cryptocurrencies at low fees.

Gemini

Gemini uses strong security features and regulatory compliance. This is reassuring to many users, making it a trustworthy platform for both beginners and advanced users. You even have staking options for earning rewards with this platform.

🔐Security: Gemini proudly has SOC 2 certification and has insurance for digital assets stored online.

🧑⚖️Regulations: Fully regulated in the US and UK.

🎖️Best For: Security-conscious users who want a regulated platform.

Why Choose One Exchange Over Another?

When selecting a Bitcoin exchange, you must consider your individual needs and trading goals. Each platform offers distinct advantages based on factors like experience level, trading features, fees, and security.

If you’re new to cryptocurrency: Coinbase is a great choice as it has a beginner-friendly design and plenty of educational resources. Its simple interface makes it easy to buy, sell, and store Bitcoin, even if you’re just getting started.

☝️TIP: If you are certain that you only want to invest in Bitcoin and not other cryptos or tokens, Material Bitcoin offers an even simpler way of Buying and securely storing your BTC.

For advanced traders: Binance is a great option due to its lower fees and wide range of advanced features like futures and margin trading. If you want a large number of cryptocurrencies (over 500) and are looking for liquidity for high-volume trades, Binance is the best option. But, please keep in mind the availability of it in certain regions.

If you want regulatory assurance: Kraken has a good balance between being affordable and offering compliance. It’s suitable for beginners through to advanced traders.

For altcoin users: KuCoin is a great choice due to its vast range of altcoins and tokens (over 700), many of which you can’t get on other platforms. But please, be mindful of its lesser regulatory status.

If you want a security option: Gemini is the platform for you. It’s fully regulated in the US and UK and provides strong security features like SOC 2 certification and insurance for your assets held online.

Your Bitcoin’s Security

When it comes to Bitcoin security, there is one golden rule: NEVER LEAVE YOUR BITCOIN ON AN EXCHANGE.

Although exchanges offer convenience and quick accessibility for trading and buying Bitcoin, they are also the #1 target for hackers and phishing scammers.

Research suggests that $1.38 billion in crypto has been stolen from exchanges in the first half of 2024 alone!

To safeguard your Bitcoin, it is essential to transfer your Bitcoin to a secure cold storage hardware wallet.

Material Bitcoin is one of the best hardware wallets available on the market.

It offers an ideal solution for new investors, as it isn’t only a secure offline storage solution, but also allows you to buy BTC directly from the wallet.

You simply scan the QR code on the steel card, enter the amount of BTC you want to purchase and that’s it!

It is an all-in-one solution.

How to Choose the Right Bitcoin Exchange for You

To find the best exchange to buy Bitcoin, you must identify your needs first.

➡️Define Your Priorities: are you looking for top security or affordability? Is access to multiple platforms important to you?

➡️User Experience: Are you a beginner or an advanced trader? What features are you looking for in an exchange?

➡️Additional Services Offered: Are you looking simply to buy and sell BTC or do you also want integrated cold storage solutions, like with Material Bitcoin?

Step-by-Step Guide to Buying Bitcoin on Different Exchanges

Buying Bitcoin on an exchange might seem overwhelming, especially when you need to register, and complete KYC and other verifications. But it doesn’t have to be!

Here’s a step-by-step guide for some of the most popular exchanges to help you get started:

How to Buy Bitcoin on Coinbase

1. Create an Account: Visit the official website and register.

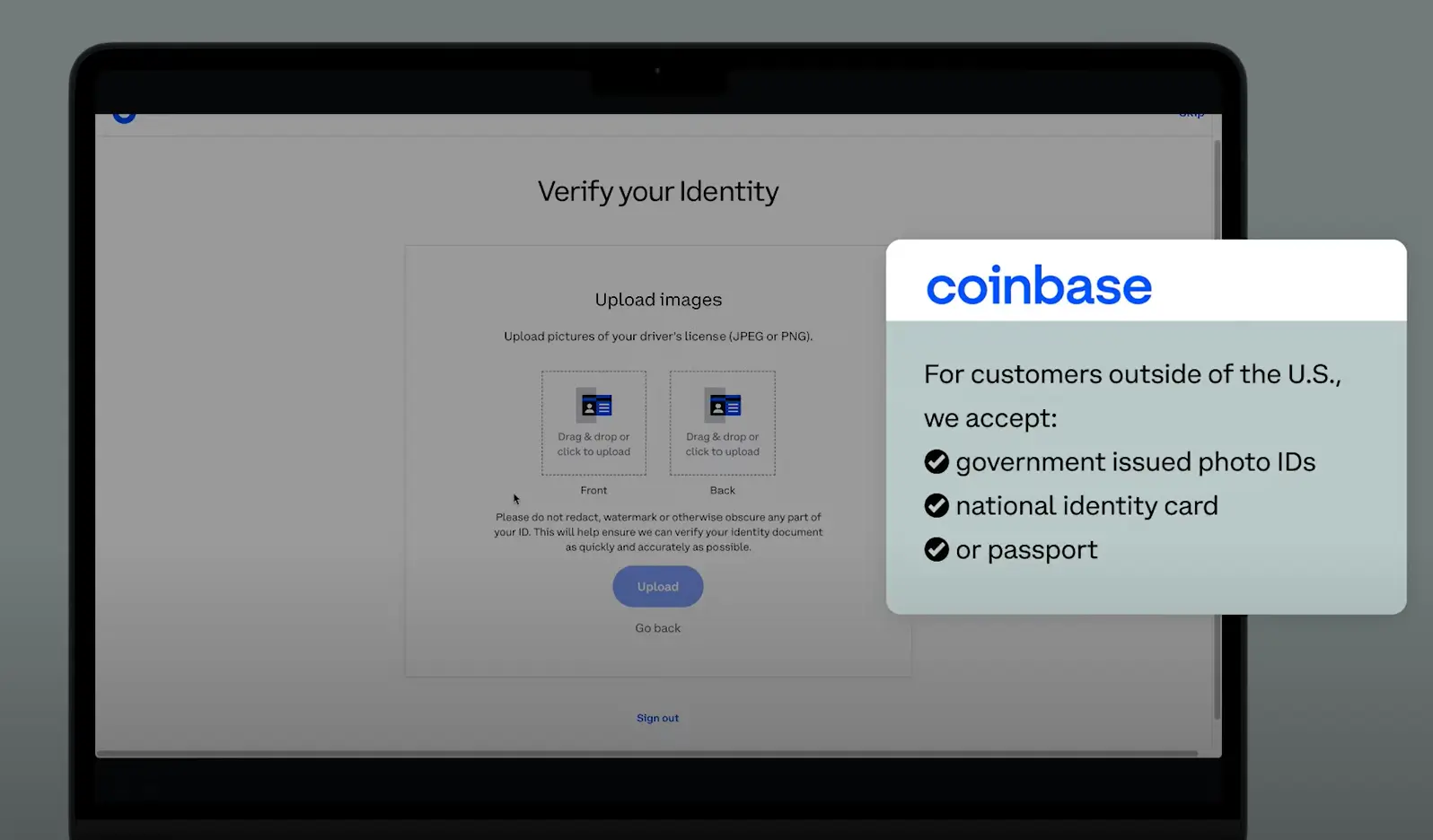

2. Verify Your Identity: Follow the prompts to upload your ID and complete the KYC (Know Your Customer) process.

3. Connect a Payment Method: Link your bank account, debit card, or other payment methods.

4. Buy Bitcoin: Once your payment method is linked, go to the “Buy/Sell” tab, select Bitcoin, and enter the amount you wish to purchase.

5. Secure Your Bitcoin: Coinbase allows you to transfer your Bitcoin to a cold storage wallet for added security.

How to Buy Bitcoin on Binance

1. Sign Up: Go to the official website and click on “Register.” Provide your email and set a secure password.

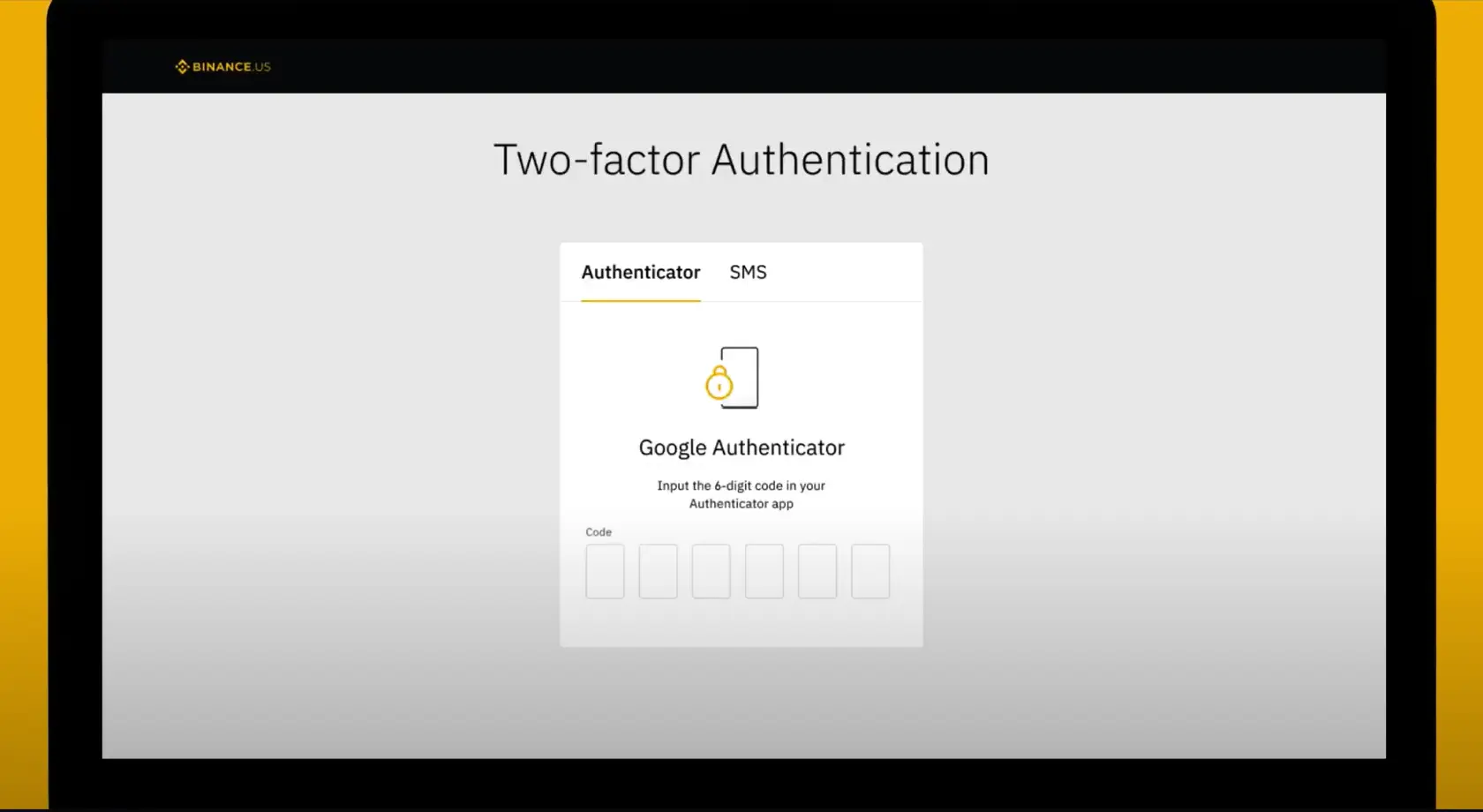

2. Enable Two-Factor Authentication (2FA): To secure your account, set up 2FA through your phone or email. This step is highly recommended by the exchange to protect your account from unauthorized access.

3. Complete Identity Verification: In the “User Center” section, complete KYC verification by uploading your ID and other necessary documents.

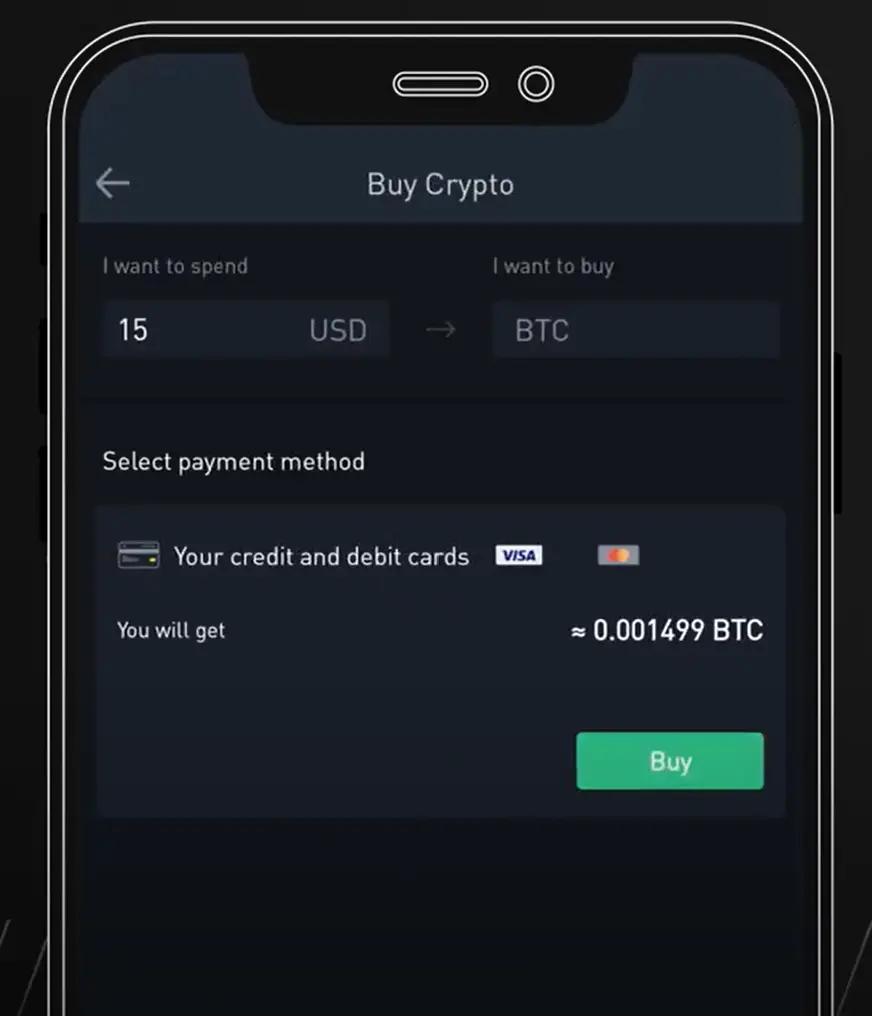

4. Deposit Funds: Go to the “Wallet” section and choose “Deposit.” You can fund your account using bank transfers, credit/debit cards, or crypto.

5. Buy Bitcoin: Select the “Buy Crypto” tab, select your payment method, choose Bitcoin (BTC), and input the amount.

6. Transfer to Cold Storage: For top security, move your crypto to cold storage.

Additional Tutorials for KuCoin and Changelly can be found on our blog.

Security Tips for Storing Your Bitcoin After Purchase

As the value of Bitcoin is only expected to rise in the next year, it is always a good time to buy Bitcoin.

But, as we’ve mentioned, using an exchange to buy BTC is one thing, but securing it is another.

Here are a few tips for crypto best practices to protect your exchange account and long-term storage.

Use of Cold Storage:

✅ Store your Bitcoin in a cold storage wallet, which keeps your assets offline and safe from online threats.

✅ Consider using Material Bitcoin for a reliable cold storage solution designed to keep your Bitcoin secure long-term.

Two-Factor Authentication (2FA):

✅ Enable 2FA on all your exchange and wallet accounts to add an extra layer of security and prevent unauthorized access.

Regular Backups:

✅ Make regular backups of your wallet data and store these backups securely offline.

Purchasing BTC Directly from Material Bitcoin:

✅ Take advantage of Material Bitcoin’s all-in-one solution, where you can buy Bitcoin directly and securely store it in one integrated platform for an enhanced user experience.

Making the Right Choice for Your Bitcoin

Choosing the right Bitcoin exchange and securing your assets are crucial steps.

Understanding what your needs and wants are from an exchange and then learning about each exchange’s features will help you to make the right choice on which exchange to buy Bitcoin from.

Remember, the key here is to be up-to-date on new regulations, understand what requirements exchanges need from you, and be smart enough to store your crypto securely offline.

FAQs

What is the safest way to buy Bitcoin?

- The safest way is to use a reputable, regulated exchange like Coinbase or Gemini and then transfer your Bitcoin to a secure cold storage wallet. Alternatively, you can purchase BTC directly from cold wallet Material Bitcoin for a one-stop shop.

Can I buy Bitcoin without ID verification?

- Some exchanges offer limited purchases without ID, but most regulated platforms require identity verification for security and compliance. There are a few no-KYC exchanges available, but be aware that they might not be permitted in your country.

How much should I invest in Bitcoin initially?

- It depends on your financial situation and risk tolerance. Usually, most new investors start small and gradually increase their investment.

What are the risks of buying Bitcoin on exchanges?

- Exchanges can be hacked, and funds left online are vulnerable. Always move your Bitcoin to secure storage after purchase.

How do I transfer Bitcoin from an exchange to a wallet like Material Bitcoin?

- Most exchanges have a “Withdraw” or “Send” option. Enter your wallet’s public address and follow the steps to transfer your funds securely.

Are exchange fees tax-deductible?

- In most cases, trading fees are not tax-deductible, but they can reduce your capital gains when calculating taxes, which can give you a “tax break”.

0 Comments