Since the rise of Ethereum 2.0, staking has become a hot topic in the crypto world.

If you are holding Ethereum, you might have heard about how staking can create income, but what is it exactly and how do you go about it?

In this post, we will break down everything you need to know about staking Ethereum, from the different options of staking and the best exchanges to do so.

Whether you want to participate in staking your Ethereum or are just curious about the process, our guide will help you decide “Should I stake my Ethereum“?

What is Staking?

This is the process where crypto holders take a portion of their assets and “lock” it into the blockchain to earn rewards.

By staking, the blockchain benefits by using your crypto to validate transactions and keep up with maintaining the network. The rewards vary on different factors, such as the amount staked, the length of time you have locked in your asset, and the overall activity on the network.

It’s important to remember that although you are rewarded for lending your coins/tokens to the blockchain, you cannot access your assets during the agreed-upon timeframe.

This is why staking is better suited for long-term holders rather than short-term investors as you may not be able to sell your Ethereum and other assets as you please.

Ethereum 2.0 and Staking

Ethereum’s move from Proof of Work (PoW) to Proof of Stake (PoS) has modified how the blockchain operates. Now, under the PoS, the network doesn’t rely on minors and the energy-intensive validation process, but instead on “stakers”.

This change has made Ethereum so much more efficient.

Why Is Staking Ethereum So Popular?

- Well-known and trusted network.

- Can earn a passive income with ETH while also supporting the network to improve.

- As Ethereum grows, the rewards from staking also rise.

Types of Staking

There are several options when it comes to staking on the Ethereum network. Each one has its pros and cons of doing so, but understanding them can help you choose which method is best suited for you.

Solo Staking

This involves running your own validator node on Ethereum- a fancy way of saying a copy of the Ethereum blockchain is downloaded onto your computer and verifies the validity of every block.

To do this, you must invest in Ethereum and commit to a minimum of 32 ETH. Now, you can activate the validator, which gives you the ability to participate on the blockchain.

✅Pro: This method gives you full control of your asset and the highest rewards, typically around 4-7% in APY.

❌Con: You need technical knowledge and a dedicated computer that can be connected online 24/7.

As the name states in solo staking, since you have all the control and responsibility, you earn all the rewards yourself and do not share them.

Staking Pools

If having all the responsibility of managing your own validator node seems too difficult, or if you don’t have the 32 ETH to stake, using the staking pool method is a great alternative.

In staking pools, you participate with other investors to pool your ETH and create a common validator node.

✅Pro: You can enter staking for as little as 0.01 ETH and don’t have the full responsibility.

❌Con: You don’t earn the same amount of rewards that you would with solo staking.

The main advantage here is convenience and minimized pressure of responsibility.

Staking on Exchanges

Using well-known crypto exchanges like Binance, Coinbase, and others is the easiest way to stake. The exchanges handle all of the technical aspects of staking, which means that you do not need to worry about running a validator node or managing the staking pool.

✅Pro: Rewards are competitive, usually around 3-5% APY.

❌Con: You have less control over the ETH you have given to the exchange to stake, including the security of your crypto as the exchange now holds your private keys.

Staking on an exchange is the best option for newbies to the crypto world, but keep in mind that you give up custodial rights for the locked-in period of your ETH.

Material ETHER: Securing Your Digital Assets

Storing Ethereum on a Cold Hardware Wallet is Vital:

Maximum Security: Cold hardware wallets store your Ethereum offline, reducing the risk of hacking and unauthorized access.

Protection from Phishing Attacks: Cold wallets are immune to phishing attacks that target online wallets and exchanges.

Private Key Safety: Your private keys are stored securely on the hardware wallet and never exposed.

Long-term Storage: Ideal for hodlers, cold wallets are crucial for safely storing Ethereum for the long term.

What Should I Consider When Staking My Ethereum?

Staking your ETH can be very rewarding, but it’s also important to understand several key factors like time commitments, security risks, and regulations on certain platforms.

Time Horizon for Staking

This should be one of the first things you consider before staking. When you commit to stake your Ethereum, you usually lock in your ETH for a certain period. This means that you will have a lack of liquidity for this ETH staked since it cannot be withdrawn or traded.

⚠️It’s essential that you only stake assets that you know you won’t need in the short term.

Cryptocurrency

Ethereum is the best choice and one of the most popular for staking thanks to its ongoing Ethereum 2.0 upgrade. But, it isn’t the only cryptocurrency available for staking. Other cryptocurrencies like Cardano, Polkadot, and Solana also offer staking opportunities.

Make sure you compare the rewards and risks of staking each before committing.

Using an Exchange or Other Platforms

Choosing the right exchange or platform for staking is very important, and you should consider all the factors such as reputation, charges, staking rewards, and security.

Popular exchanges that offer staking services offer varying APYs.

Risks

Like any investment, staking comes with its own risks. Specifically, the risk of “slashing” is possible (a penalty if a validator fails to perform correctly). Slashing can lead to loss of staked funds.

Rewards and Fees

The amount you can be rewarded for staking your ETH varies depending on the platform you choose.

Typically, you can expect to earn between 4-6% APY but this can fluctuate based on the network conditions.

Governance and Voting Rights

Some platforms give additional benefits to “stakers”, like governance tokens and voting rights for future say in the network’s development.

These governance tokens allow you to participate in key decisions and protocols made to upgrades.

Exchanges and Staking Plans

You’ve finally made up your mind on “Should I stake my Ethereum”? So, choosing the right platform is what will make a big difference in the benefits and features you have available.

Directly on the Ethereum Platform

To stake on the Ethereum blockchain directly, you must solo stake. As mentioned before, this gives you the highest reward benefits but also requires a good knowledge base of crypto and blockchain performance.

Binance

This exchange is one of the world’s largest and it offers staking options for ETH.

What is unique to Binance is that it offers flexible staking, which means that you can commit to shorter lock-in periods of your ETH. However, the longer you commit to, the higher you can earn.

Coinbase

Coinbase is well-known for being user-friendly, making it a great choice for beginners who are interested in staking Ethereum. The platform also offers insurance coverage for digital currencies which provides a bit more peace of mind for those not keeping their crypto on a hardware wallet. However, the rewards you can earn on Coinbase are slightly lower compared to other exchanges.

Other Platforms

Many other available platforms offer staking Ethereum that is not so commonly known. Lido and Rocket Pool are two alternative exchanges worth looking into as each offers unique options that are not available on the other more popular exchanges.

Best Cryptocurrencies for Staking

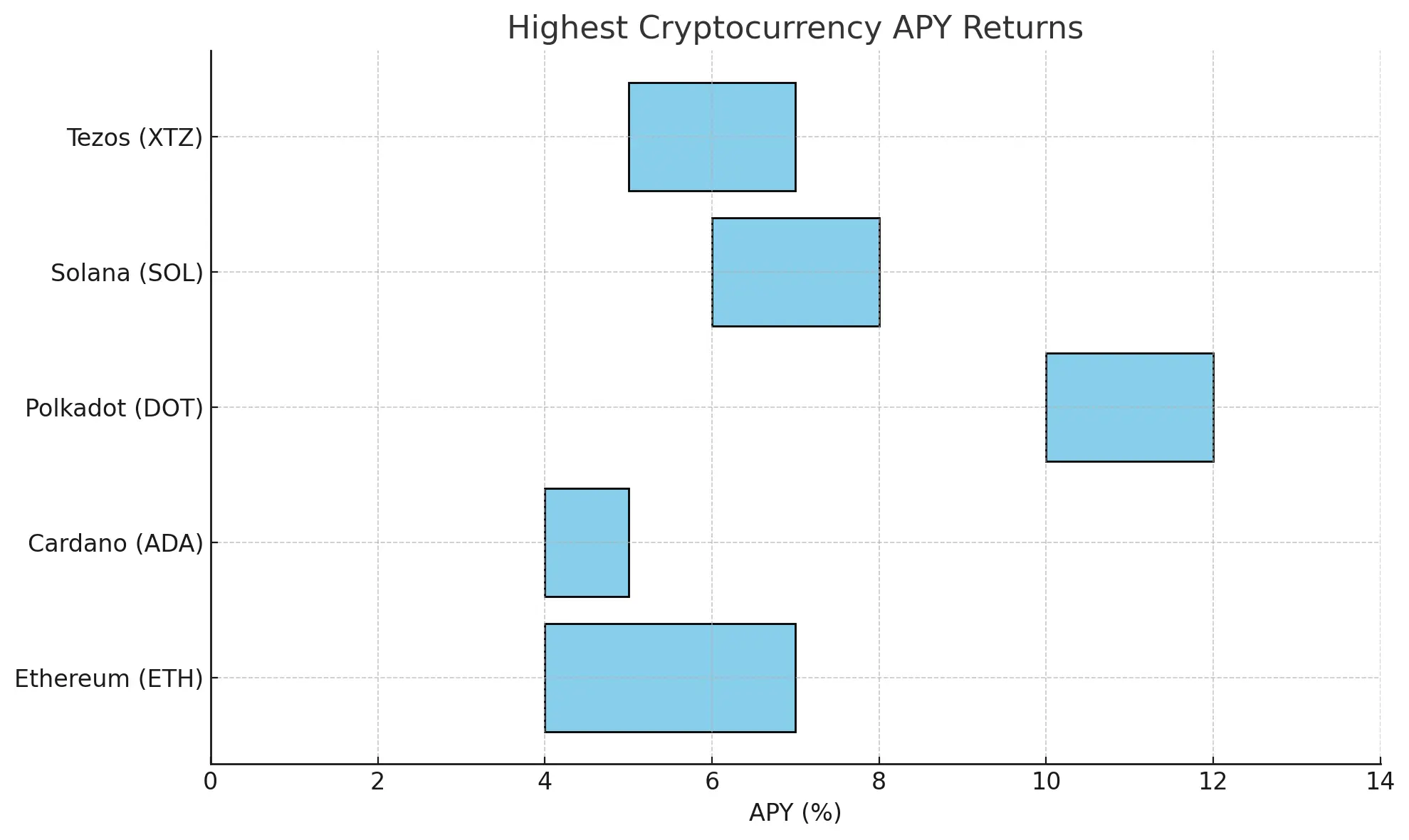

Ethereum (ETH): It’s highly trusted as the second-largest cryptocurrency. Staking helps to secure the network further and improve Ethereum 2.0. Rewards are typically between 4-7% APY.

Cardano (ADA): An easy-to-use and highly accessible crypto that needs minimum maintenance for staking. Rewards are between 4-5% APY.

Polkadot (DOT): Offers high rewards, between 10-12% APY but requires blockchain knowledge and more active management.

Solana (SOL): Has low fees and earning potential of 6-8% APY.

Tezos (XTZ): Offers liquid staking with 5-7% APY.

Staking Ethereum is a great strategy for investors who are using the HODL method to earn a passive income and support the network.

By understanding APY returns, and what your involvement and level of expertise require, choosing the right platform will help to maximize your earning rewards.

Just remember, when you are not staking, secure your crypto on an Ethereum cold wallet and never leave it on an exchange.

FAQs

Is Staking Ethereum Safe?

- Yes, staking Ethereum is generally safe, especially when using reputable platforms. But be aware of slashing risks.

What’s the Difference Between Staking in Pools and on Exchanges?

- Staking in pools combines your ETH with others, making it easier to access staking options. But, it comes with custodial and safety risks.

Can I Lose My ETH When Staking?

- Yes, if your validator is penalized (slashing), you could lose some or all of your staked ETH.

How Much Does Staking Ethereum Pay?

- Staking rewards for Ethereum range from 4-7% APY, depending on the platform and network used.

Where Can Ethereum Be Staked?

- You can stake Ethereum on many different platforms, including Binance, Coinbase, Kraken, and other decentralized platforms like Lido.

How Long Does Ethereum Staking Last?

- Ethereum staking typically locks up your ETH until the next major network upgrade or a specified period, depending on the platform used.

0 Comments